PayPal Holdings (NASDAQ: PYPL) traded 10% higher on Friday morning, after posting earnings that beat Wall Street expectations.

The online payments company reported earnings per share of $0.58 and total revenue of $3.68 billion, compared to analyst estimates of $0.54 and $3.66 billion.

PayPal also raised its quarterly and full year guidance to $2.38-2.40 versus analyst estimates of $2.34.

“We drove a record 9.1 million new active accounts surpassing 254 million customers by the end of the quarter,” explained CEO Dan Schulman. As well, payment volume for PayPal’s peer-to-peer payments app Venmo rose by 78%.

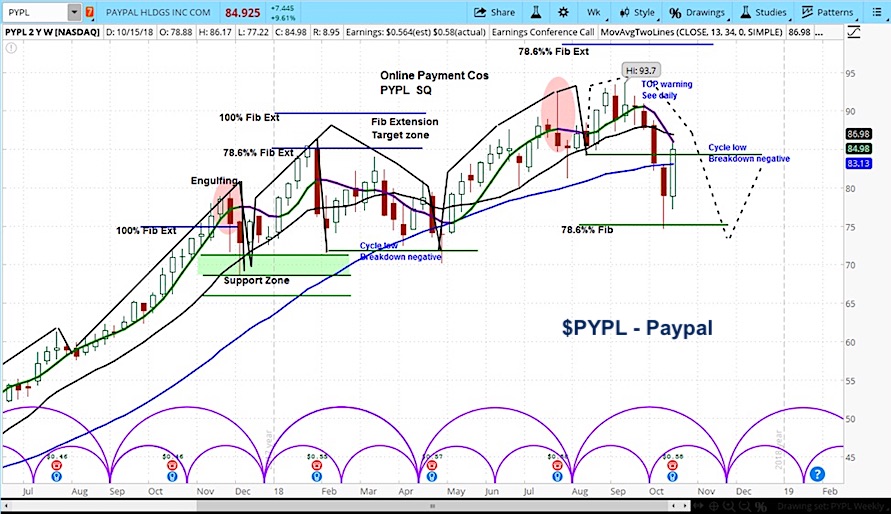

In analyzing the market cycles for PYPL, it has likely begun the rising phase of its current minor cycle.

However, we are skeptical of this rally, as the stock has broken the cycle low for its current intermediate cycle. As such, we are looking for a decline to test recent lows near $74 into November.

PayPal Holdings (PYPL) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.