Pan American Silver Corporation (NASDAQ: PAAS) is trading sharply lower on Wednesday morning.

The silver mining company announced that it would acquire Tahoe Resources (NYSE: TAHO), which shot 45% higher on the news.

While there may be additional near-term risk, we believe PAAS is setting up for a bounce.

Perhaps this selling will lead to a tradable bottom by the end of November.

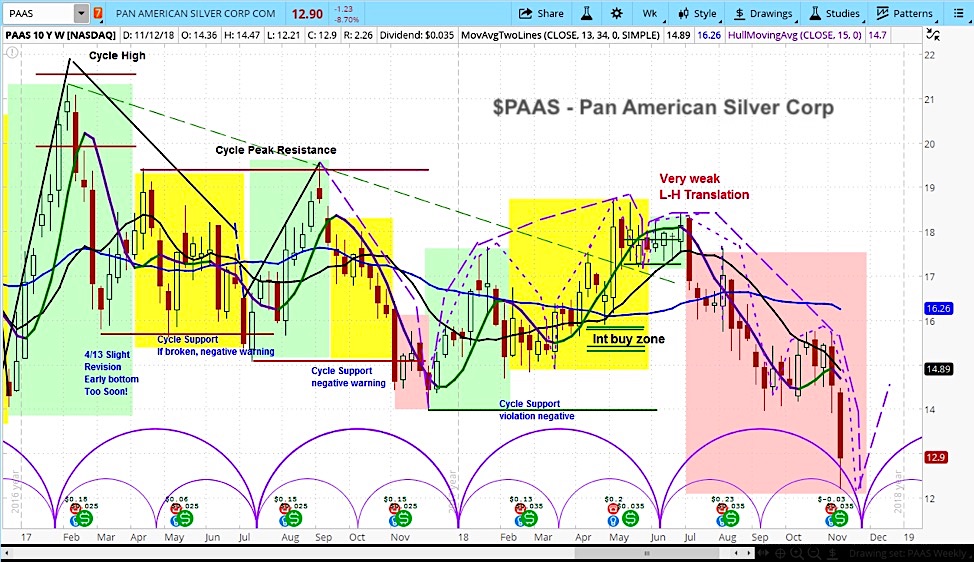

Pan American Silver Corporation (PAAS) Stock Weekly Chart

Pan American agreed to purchase Tahoe for 1.07 billion in a cash and share deal, which will make the combined entity into one of the largest silver miners in the world. The combined entity will benefit from a new cost structure and will have twice the silver reserves.

“This establish the world’s premier silver mining company with an industry-leading portfolio of assets, superior growth opportunities, and attractive operating margins,” explained Pan American CEO Michael Steinmann.

In analyzing the market cycles for PAAS, we can see it is in a declining phase with a near-term bottom due in the coming weeks. As such, the was a good spot for a capitulation. Looking forward, our projection is for the stock to test $12, which will likely be a good spot to form a bottom.

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.