The stock market has enjoyed a nice rally higher in the fourth quarter. Much of the gains have come since the election in early November. And, if you haven’t noticed, bank stocks have been market leaders.

Banking sector outperformance has come hand in hand with higher interest rates. But the move in banks has also pushed the sector to overbought momentum extremes.

And this is enough to be concerned about future returns from the sector.

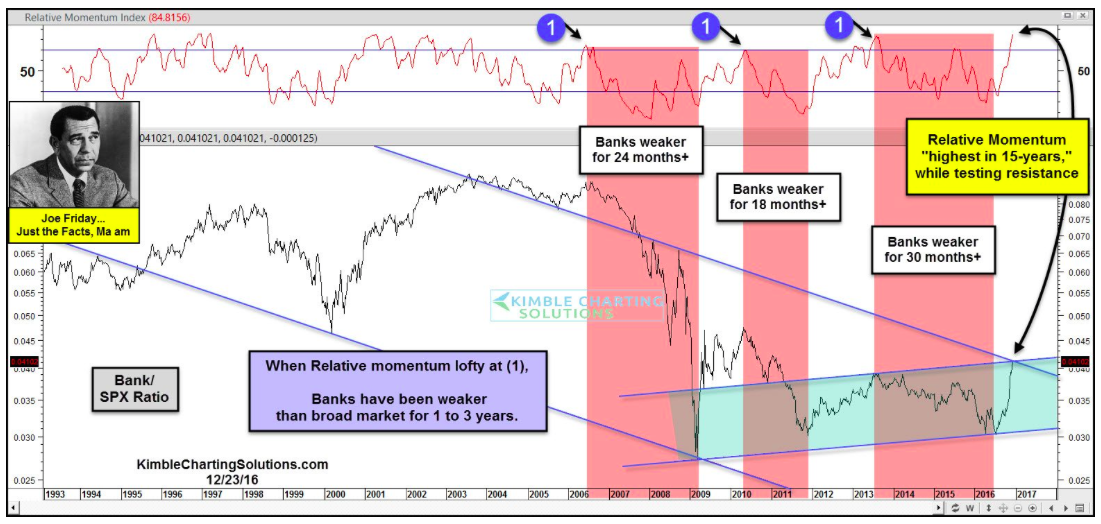

In the chart below, I demonstrate this by looking at the ratio of the Bank Index (INDEXNASDAQ:BKX) to the S&P 500 (INDEXSP:.INX). When the ratio is heading higher, bank stocks are generally stronger than the broader market. And when the ratio is heading lower, bank stocks are generally weaker than the broader market.

The recent breakout and massive rally higher has pushed relative momentum up to levels seldom seen in the past 10 years. If past history is an indicator of future results, then the banking sector could underperform for the next 1 to 3 years.

Lastly, at the same time that momentum is overheated, the Bank Index/S&P 500 ratio is testing “dual” price resistance. Stay tuned!

Thanks for reading and have a safe and happy new year!

Twitter: @KimbleCharting

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.