In the past two columns I have discussed spreading time, also known as calendar spreads. There are horizontal time spreads which use the same strike and there are diagonal time spreads which use different strikes.

In the past two columns I have discussed spreading time, also known as calendar spreads. There are horizontal time spreads which use the same strike and there are diagonal time spreads which use different strikes.

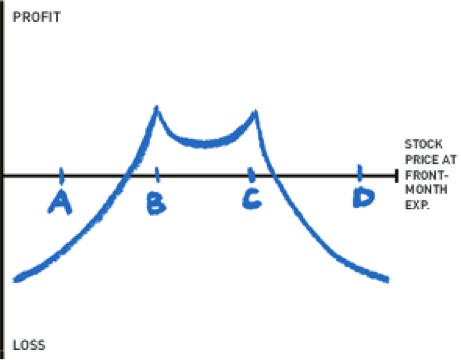

Today I want to talk about a variation of the diagonal time spread, the double diagonal time spread: Buy a farther dated (+/- 60 days until expiration) out of the money (OTM) put, strike A. Sell a near term (+/- 30 days) OTM put, strike B. Buy a far term OTM call, strike D and sell a near term OTM call, strike C.

As you may note, the profit and loss lines are not straight. This is because the far term options are still open when the near term options expire. This makes a P&L graph much less exact as opposed to when all options in the strategy expire simultaneously.

So, we are combining two diagonal calendar spreads, one put and one call. What we are doing is capitalizing on the near term options decaying faster over time than the far term options. This is a particularly good strategy if the market is currently slow or range bound but you expect a move in the future.

When you put this trade on you want the stock to be between strikes B and C. Otherwise you have a bullish or bearish bias. What you want is for both the front month legs to expire worthless, thereby leaving you with a cheap strangle (long OTM call and OTM put).

After the expiration you can sell an additional call and put giving you two inexpensive vertical spreads. You can alternatively sell the at the money (ATM) straddle creating a nice Iron Butterfly. If the options are American style (ie, stock options) you will need to unwind the position just before the front month expiration if either the put or call looks to finish in the money (ITM).

Looking at a real life example (July 23, 10:30 CDT), we’ll use the Russell 2000 (RUT). This is a European style index option thereby negating the risk of both early exercise and physical delivery.

The RUT is at this writing trading at 1052. So, we will sell the August 1100 call at 2 and the August 1000 put at 4 (quite the skew, eh?). We will then buy the September 1150 call at 1.50 and the September 950 put at 5.50 (even greater skew, but that’s material for another column).

If RUT expires in August between 1000 and 1100 we will be left with the September 950/1050 strangle for a net price of 1, or 1 seventh of the price it’s trading at now. We can sell it any price greater than 1 for a profit or sell the September 1000 straddle leaving us with a nice Iron Butterfly.

So, you see that the Double Diagonal time spread, while complex at first glance, is an excellent way of taking advantage of front month time decay and leaving room to take advantage of a future move.

As always, if you have any questions or comments, I can be reached either through this website or my own, www.thelissreport.com.

Twitter: @RandallLiss

No positions in any of the mentioned securities at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.