If you are enormously bullish on a stock, perhaps it’s a takeover candidate, but still want a hedged all options position, then the following options strategy may work for you.

If you are enormously bullish on a stock, perhaps it’s a takeover candidate, but still want a hedged all options position, then the following options strategy may work for you.

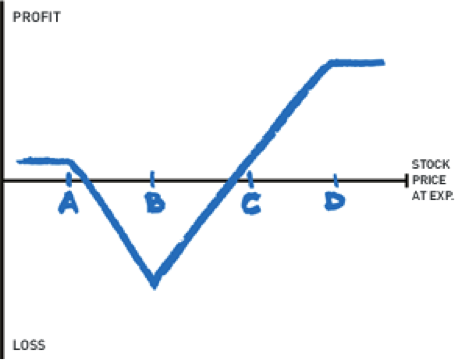

It’s a variation on the broken wing, also known as the split strike butterfly (see my options strategy column dated August 14) using calls. Except that it’s inverted and looks like this:

You are short one at the money call, strike A. You are long two calls at strike B, you skip strike C and sell one call at strike D. Ideally, you’d like to do this spread for a net credit so that if the anticipated move never comes or the stock moves lower you still make a little money. This gives you two break even points: Strike A plus the credit or strike C minus the credit received. Your perfect expiration is right on strike D. That means that your maximum profit is strike D minus strike C plus the net credit.

The further apart the strikes the easier it will be to do this for a credit. But, as in any options strategy, your maximum loss is expiration on your long strike, or in other words strike B minus strike A minus the credit received. The wider the distance between your strikes also means that you need a big move higher to avoid a loss. Actually, even though it’s a bullish play, a small move upside is your worst case scenario. You really don’t want the stock to creep higher and then die right on strike B.

This is also a position that benefits from an increase in implied volatility. You really do want an explosive move higher, to strike D or even beyond.

Selling strike D is what makes this strategy different from a simple 2 by 1 call back spread. It makes the play more affordable but does cap your upside potential.

If the stock stays between strikes A and C time decay hurts you because your profit will erode as the long strike B wastes away. However, if the stock moves above strike B and approaches strike D, time decay begins to work in your favor.

Thank you for reading. For more information, please visit my website: www.thelissreport.com.

Twitter: @RandallLiss

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.