I really don’t like being naked short options as a rule. The prospect of potentially unlimited risk would keep me up at night. But then, you, dear readers, are not me. I am a risk adverse and conservative options trader, but that doesn’t mean that you have to be. Anyway, I’m an options educator now and not an advisor and as such see it as my responsibility to talk about all option strategies.

I really don’t like being naked short options as a rule. The prospect of potentially unlimited risk would keep me up at night. But then, you, dear readers, are not me. I am a risk adverse and conservative options trader, but that doesn’t mean that you have to be. Anyway, I’m an options educator now and not an advisor and as such see it as my responsibility to talk about all option strategies.

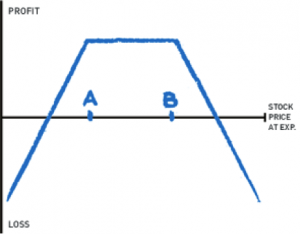

The short strangle options strategy is being short an out of the money call and an OTM put, each equidistant from the at the money option.

Your maximum profit is an expiration between strikes A and B and your risk, is well, unlimited. You probably want to sell the wings at least a one standard deviation move away. And index options are a better bet than stock options for two reasons: One, there is no risk of early exercise. Two: Individual stocks are more prone to Event Risk, ie a takeover rumor or a bad earnings announcement.

Another good tool to use is the measured move target as expressed by the at the money (ATM) straddle (see my previous column on the Iron Condor). The ATM straddle shows where the market, in its supply and demand wisdom, believes the trading range will be.

Let’s look at the Russell 2000 (RUT), currently (August 27, 12:00 CDT) trading at 1021, making the ATM straddle the 1020. The short term September 1020 straddle, expiring on September 6, is trading at 24. This implies a range in the RUT of 1044 and 996 between now and expiration.

So, we can sell the 1040 call at 3.75 and the 990 put at 3.75 for a total of 7.50, or $750 for each strangle sold.

If these RUT option expire on September 6, 2013 with the Russell 2000 between 990 and 1040, a 50 point range, you collect the whole megillah.

Of course, being naked short the options requires putting up a great deal of margin. As well as the potentially unlimited risk. Yes, 80% of OTM options regularly expire worthless. Yes, this strategy will probably work 10 out of 11 times. But it still seems to me to be a sort of Russian Roulette.

But, hey, that’s me. I know people who swear by the short strangle options strategy as a consistent income generator. If you have the stomach for the kind of risk that I do not, then this strategy might be for you.

Thank you for reading. For more information, please visit my website: www.thelissreport.com.

Twitter: @RandallLiss

No positions in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.