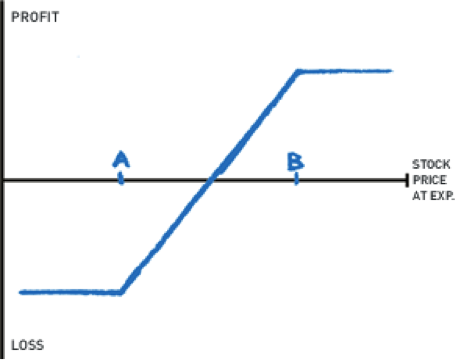

You can sell a call against a stock you own and you can own a protective put under your stock. Well, you can combine the two by owning an out of the money (OTM) put, owning the stock and selling an OTM call. This is commonly referred to as an options collar strategy.

You can sell a call against a stock you own and you can own a protective put under your stock. Well, you can combine the two by owning an out of the money (OTM) put, owning the stock and selling an OTM call. This is commonly referred to as an options collar strategy.

In fact, you are financing your OTM put by selling the OTM call. Yes, it limits your upside potential but it also completely caps your risk. As in all option spreads, limiting your risk always means capping your reward.

Let’s take a real life example of an options collar strategy. AT&T (T) has a dividend yield of 5.03%. Let’s say I want to capture that dividend but I also want downside insurance (a 5% yield is all well and good until the stock drops 6%).

At today’s prices I can buy T at 35.75, buy the January 2014 34 put (5% OTM) at .35 and sell the January 37 call at .30. This reduces my insurance cost to just .05. T will pay a .44 dividend ($1.80 annual dividend) before the January expiration. So, I am protected against a down move greater than 5%, the stock has a 5.03% yield and I have financed my downside protection by selling the call.

My only real risk is being assigned early on the 37 call, giving me only a 3.49% return. Yes, the real risk is only making a little money!

There you have it. A simple and conservative option investment strategy. So, let’s Collar that stock!

Twitter: @RandallLiss

No positions in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.