The latest round of 13F holdings were released last week giving us insight into how some of the top investors in the World were positioning their portfolios in a wild trading environment.

Although many talking heads like to chime in that these 13F holdings reports are not useful for the average investor to look at, I find value.

The arguments against paying attention to the 13F filings are arguments that a lazy trader would make, and as with any approach to investing it requires more digging than simply looking at what is presented on the surface. The main argument against following these filings is that it is a snapshot of what these investment firms held 45 days ago, and there is no guarantee it is still a holding. While it is true there can be no guarantee due to the delay, you can eliminate much of this “risk” by simply screening out firms with a historically high quarterly turnover rate.

The other argument is that most hedge funds do not outperform the market, so why bother following their trades. This is also a true statement on the whole, but once again if you are willing to put in the time you can screen for hedge funds with historically strong performance, and define your 13F holdings analysis to these firms. Lastly, it is not just all about the buys, a lot can be learned from what funds are selling each quarter, and it is unlikely a fund that sold out of a position 45 days ago would start a new position, taking away the risk of the filing delay. Overall, the 13F filings just give you data, and as the case with any data, it requires analysis to take away real value, not just determining what was trading in the quarter, but why funds were moving into/out of certain stocks/sectors.

I have a basket of around 40 firms I have determined to by the smartest of funds, $1B to $10B, and look at what names these funds are moving into and moving out of. I spend less time looking at the massive funds that get all the publicity and also try and target stocks that are not as well known by the general public. I also like to see the filings because a lot of the options positions that I have been tracking show up, so I know which firm is in the open interest I previously tracked, although the filings do not give full disclosure as to the strike/expiration of the contracts, I am usually able to figure it out rather quickly.

After looking through the Q1 filings from my smart money basket:

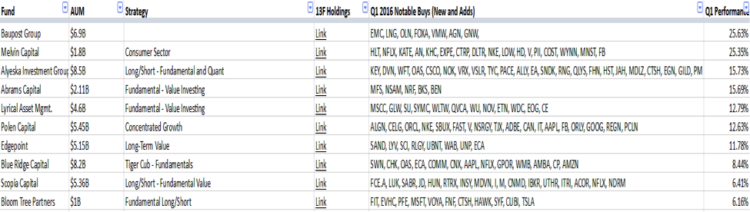

The top 10 Q1 performing funds in my basket with a few notable new buys and additions via 13F holdings reports are:

25 Stocks with Inflows since Q3 2015

EVHC, KEY, FLT, ADSK, ABC, CMCSA, CF, SABR, NKE, DVN, AMH, FEYE, DG, LVS, T, AES, RAI, AR, FTNT, JD, COMM, VMW, SBAC, CTSH, and TAP.

25 Stocks with Outflows since Q3 2015

SIRI, AA, PBR.A, FTR, EBAY, IBN, COH, QCOM, AIG, F, PYPL, BSX, ATVI, PXD, TSN, AMAT, ZTS, FIS, TEL, ABX, SAN, EXC, LBTYK, NOV, and AME.

A brief look at some of the more interesting names the funds were buying in Q1:

Envision Healthcare (EVHC) has a $4.35B market cap and saw nearly a 6% jump in ownership in Q1 from 13F holdings (filings) with 49 funds with new positions, 108 adding to positions, 40 closing positions and 53 reducing positions. Among the notable top buyers were Bloom Tree Partners, Valinor Mgmt., Balyasny, Renaissance Tech, Tobam, Timessquare Capital, and Point-72. EVHC is a provider of medical services and also community based medical transport services. Shares trade 13.5X Earnings, 0.75X Sales, 2.18X Book and 25.2X FCF and targeting 22.5% revenue growth in 2016 and 15%+ EPS growth in both FY16 and FY17. Investors are awaiting EVHC to see accelerated contract signings.

CommScope (COMM) has a $5.65B market cap and saw ownership rise more than 1% with 25 funds taking new positions, 68 adding, 31 closing out and 75 reducing. Notable buyers of COMM in size included Blue Ridge Capital, Criterion Capital, Corvex Mgmt., Line Pine Capital, and Chieftain Capital. COMM is a provider of infrastructure solutions to communication networks. Shares trades 10.4X Earnings, 1.37X Sales, and 15.9X FCF with 31.8% revenue growth projected for 2016 and 33% EPS growth. In early 2015 COMM completed its acquisition of TE Connectivity’s (TEL) Airvana, and the Company is looking to reduce its debt levered balance sheet. COMM recently won a small cell contact that positions it better in a $2-$2.5B market, and a name that is expected to be a beneficiary of the 5G roll out cycle.

Sabre Corp (SABR) has a $7.7B market cap and notable buyers in Q1 included Scopia Capital, Maverick Capital, Hitchwood Capital, and Millennium Mgmt. SABR providers technology solutions to the travel and tourism industries, and shares trade 16X Earnings, 2.47X Sales and growing revenues double digits while targeting 33% EPS growth in 2016 and 18.7% in 2017. SABR recently announced a faster cloud-based flight availability solution built on Amazon Web Services (AWS) Cloud. 2016 is expected to be an inflection year for SABR’s solutions business.

Thanks for reading and have a great week.

Twitter: @OptionsHawk

The author has a position in ADSK and VMW at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.