Crude oil prices have remained in a relatively narrow range for the past year, but we think the oil market offers the potential for a downward break soon.

That said, there are many ways that crude oil could shake traders off their trades regardless of whether they are pointed in the correct direction. This post describes some of the complexities to watch for in future weeks, as well as a review of the bigger picture.

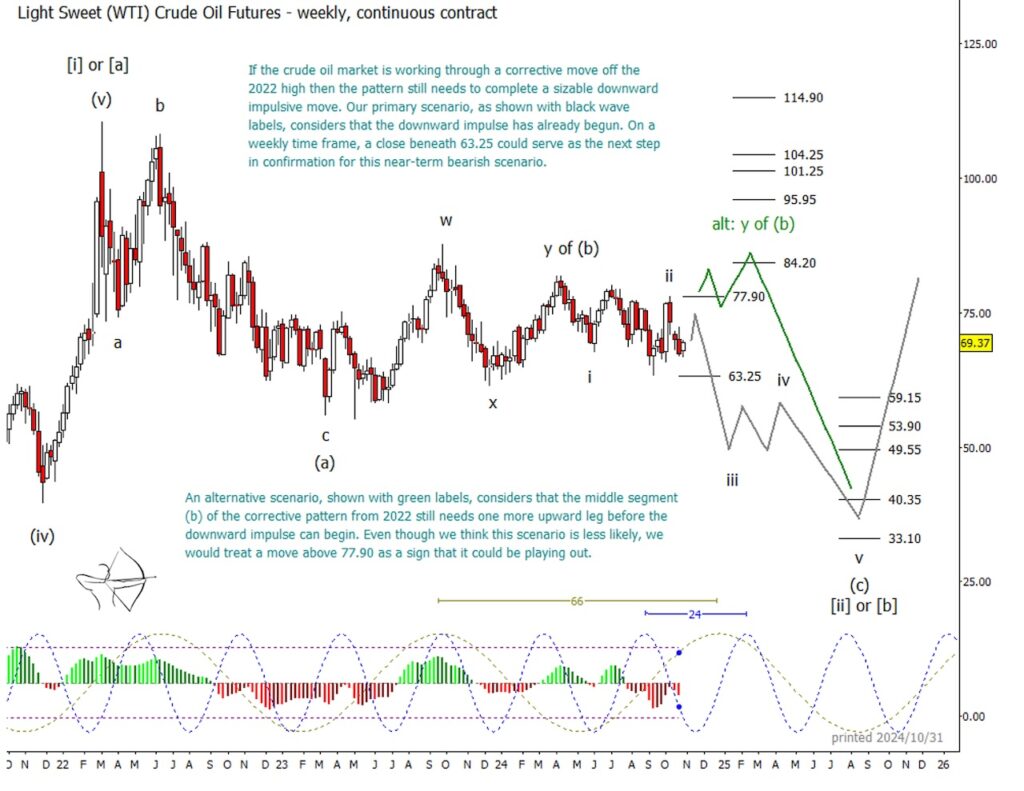

On the weekly chart for crude oil futures we indicate our primary Elliott wave scenario with black wave labels, but we must emphasize that there are multiple ways to assign a wave count to the price action since early 2023.

The black path reflects our preferred bearish scenario, which could start playing out during November.

The alternative green path shows what we believe would be the most likely medium-term bullish scenario if factors such as geopolitical instability intrude to drive the market upward.

There are also possible wave counts that would allow the market to continue in sideways action for several more months before price breaks out in either direction from the 63.25-77.90 zone. Anyone using Elliott wave to trade the anticipated swings in CL will need to monitor wave structures on faster time frames such as the daily and 240-minute charts that we typically write about.

As context for the primary, bearish Elliott wave scenario (black labels), we believe the market has been in a downward/sideways corrective pattern since the 2022 high. Corrective patterns generally have a three-segment structure, and we are assigning the first low in 2023 as the completion of the first segment, or wave (a).

The action following the completion of wave (a) is rather ambiguous and allows for multiple competing wave counts on small time frames. Our primary scenario considers that the middle segment, wave (b), ended in early 2024, and it treats subsequent moves as the initial stages of a strong downward segment, wave (c).

The emergence of the primary, bearish scenario would be marked by a break and weekly close beneath 63.25, but the best entry for the trade might be considerably above that level depending on one’s own trading style. We think there is a strong possibility that price might make a small bounce from nearby and form another little high somewhere beneath 77.90 before continuing downward.

If bears succeed in making a downward break, then we would prefer to see price eventually reach as low as 49.55, although support areas near 59.15 and 53.90 could act like steps on a staircase while the market moves through the middle parts of downward wave (c). The lower support areas near 40.35 and 33.10 could also play a part in the later stages of the move, although the market is not guaranteed to go that low even if our primary scenario plays out.

The alternative medium-term bullish scenario (green path) considers that wave (b), the part of the correction that began early in 2023, might require another upward move before it can be counted as finished. A break above 77.90 would announce the possible emergence of this scenario.

Even if the bullish scenario transpires, we think upward moves beyond the breakout level might be small. The resistance areas near 84.20 and 95.95 are prominent as possible targets for an upward move, but it will be important to monitor wave structures to notice whether the upward impulse gives the appearance of finishing somewhere beneath those levels.

The bullish scenario also has a bearish ending in 2025-2026 that’s essentially the same as for our primary scenario.

The monthly chart shows how we count the price action since the 2008 high. The pattern between 2008 and 2020 appears as a classic three-wave correction. The moves subsequent to the 2020 low represent the first stages of a new pattern which ultimately could take the form of another three-wave (a)-(b)-(c) correction or alternatively a five-wave impulse (i)-(ii)-(iii)-(iv)-(v) that would take the market into a new, considerably higher range.

Elliott wave analysis identifies the places where the market is more likely to turn, as well as the possible target destination of a move. It also shows where price specifically should not go if the main scenario’s thesis is true. For a trader to make use of these “if this, then that” types of scenarios, it’s helpful to have guidance from people who have already integrated Elliott wave into their trading. Our newsletter follows crude oil, major stock indices, currencies, metals, bonds, and related markets on weekly and daily time frames. You can also inquire about our intraday service, which is more customized.

Twitter: @TradingOnMark

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.