Crude oil has traded down to an important price support zone and appears to be showing early signs of bottoming.

It’s still early, but should crude oil see a bullish reversal higher for a trade, I think the oil and gas ETF (XOP) will benefit.

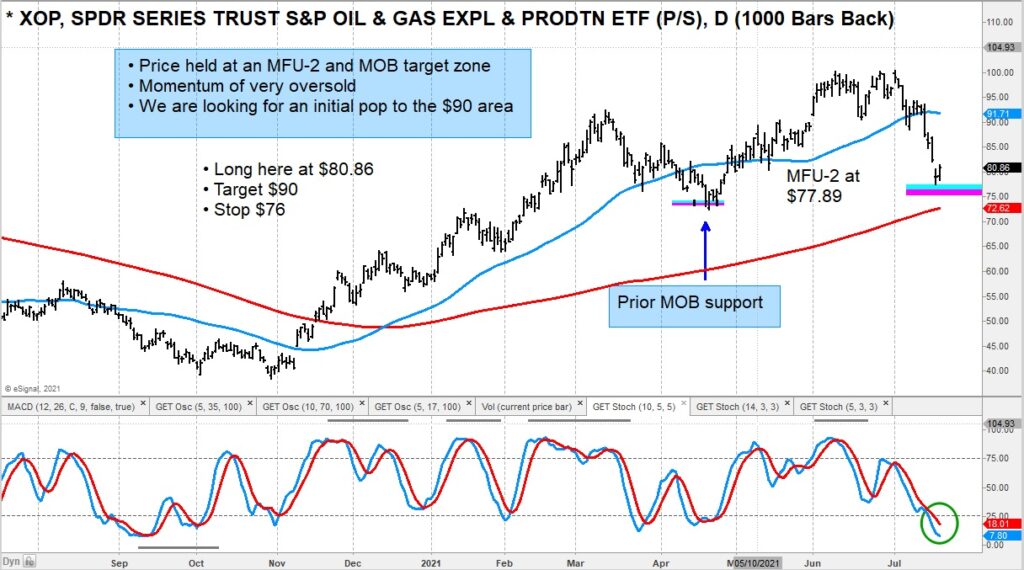

I really like the trading setup on the oil & gas ETF (XOP) as price has come down to a confluence of price support at the MOB band and MFU-2 target zone (Money Flow Unit).

There are several select stocks I like here (for a trade), but it seems the basket of stocks held in XOP should be a good way to trade (and gauge) the initial move.

Traders should keep an eye on crude oil. As long as it holds above its trend line, then $XOP should benefit.

$XOP Oil and Gas Exploration ETF Chart

Crude Oil Futures Chart

The author or his firm have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.