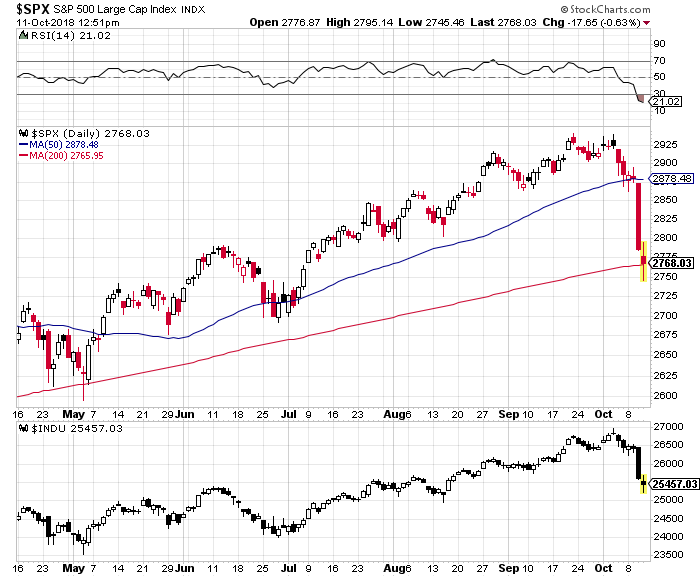

October weakness intensified on Wednesday as volume surged and selling was widespread.

The S&P 500 closed down over 3% (95 points), its first daily change of 1% or more since June.

It was also the first 2% price move since the market experienced five of them in the span of 11 trading days in late March/early April. And the selling carried over into last night and this morning.

It’s amazing to think that just last week the Dow Jones Industrial Average closed at a new all-time high and the S&P 500 was flirting with doing likewise.

Now both have closed below their 50-day moving averages for the first time in three months. And taking on 200-day averages.

See chart below (as of 12:51pm ET Thursday).

The small-cap Russell 2000, which has been losing ground versus the S&P 500 since late June, fared slightly better than its large-cap counterparts today but still closed below its 200-day moving average for the first time in over a year.

The NASDAQ Composite, which has joined small-caps in providing downside leadership this month, is as close to its 200-day average as it has been since mid-2016, which corresponds to the last time the percent of NASDAQ stocks trading above their own 200-day averages has been this low.

While the S&P 500 had been showing some index-level resilience coming into October, momentum was waning and the market internals had been steadily deteriorating. The new high list had narrowed significantly and the percentage of industry groups in up-trends was faltering. Now, the number of stocks making new lows is expanding and the percentage of stocks and industry groups in up-trends is contracting.

As the NASDAQ data above suggests, it appears that the indexes are catching down to the breadth indicators. As such, we may need to see evidence of exhaustive selling, increased investor pessimism and a healthier breadth back-drop to suggest that near-term risks are ebbing.

In previous periods of stock market weakness, bond yields have been quick to move lower and provide relief for equities. For reasons we outlined in this week’s Macro Update (Bond Yields Could Sustain Upward Momentum), that may not be the case in the current episode. This likely puts more reliance on an improving technical backdrop to stem selling.

The Bottom Line: While seasonal tendencies become increasingly favorable moving toward year-end, we have yet to see evidence that overall selling has reached downside exhaustion. For now, caution remains warranted.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.