After the first three week losing streak for the $&P 500 (SPX) since January and the first six week losing streak for the Russell 2000 (RUT) in more than nine years, bulls are looking for any reason a bounce might happen. Well, this could be the ticket: October OpEx.

After the first three week losing streak for the $&P 500 (SPX) since January and the first six week losing streak for the Russell 2000 (RUT) in more than nine years, bulls are looking for any reason a bounce might happen. Well, this could be the ticket: October OpEx.

This week is October options expiration week, otherwise known as October OpEx. Last month, I showed why September OpEx was historically bullish and the SPX gained a solid +1.25% on the week. Now, I’ll dig in on October and show why an oversold bounce is very likely this week.

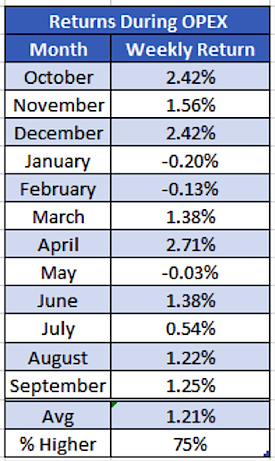

Plain and simple, OpEx week has been very strong over the past year. It has been up four months in a row and nine times out of 12. In fact, those three losers were all very minimal.

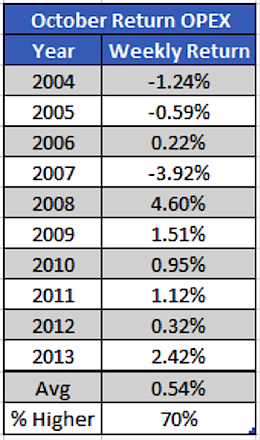

Looking at just October OpEx, the past 10 years has been very impressive. It is up six years in a row and seven of the past 10.

Now my concern is this, OpEx week tends to go with the overall trend, only more magnified. Given the recent trend is down, could that mean we see a big delta hedging decline this week? It is possible is my take. If we see heavy selling to start the week, that could waterfall into a huge decline before all is said and done.

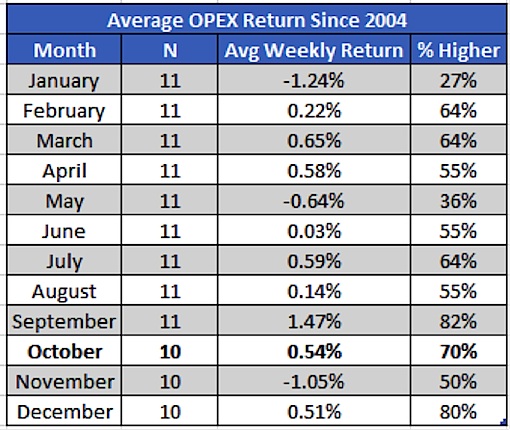

Lastly, going back to 2004, October OpEx week has averaged +0.54% – putting it at the fifth best out of 12.

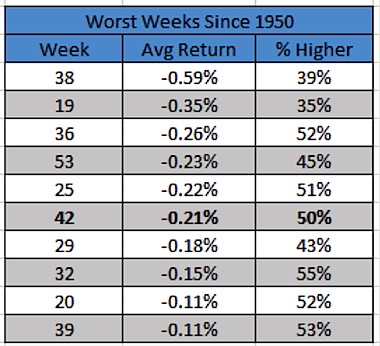

My take is this. The equities markets are extremely oversold and a near-term bounce could happen at any time for any reason. The stats seem to back up the fact that it could happen this week. My final parting shot is don’t get too excited should we bounce this week, as next week is the 42nd week of the year. Historically, it is the 6th worst week of the year. The good news is we usually form a nice late October low after that.

Follow Ryan on Twitter: @RyanDetrick

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.