Nowhere to Hide

The following looks at current market “messages” from shifting cross asset and S&P 500 sector correlations.

Why Correlations Matter

Correlation is a statistical measure that quantifies the relationship between two financial assets or securities. A correlation of +1.0 is perfect, meaning the two securities or assets move one-for-one with each other. A correlation of -1.0 means they move exactly opposite of each other. As correlations move away from +/- 1.0 the relationship weakens. A correlation of zero quantitatively implies no relationship in the movement between the two instruments.

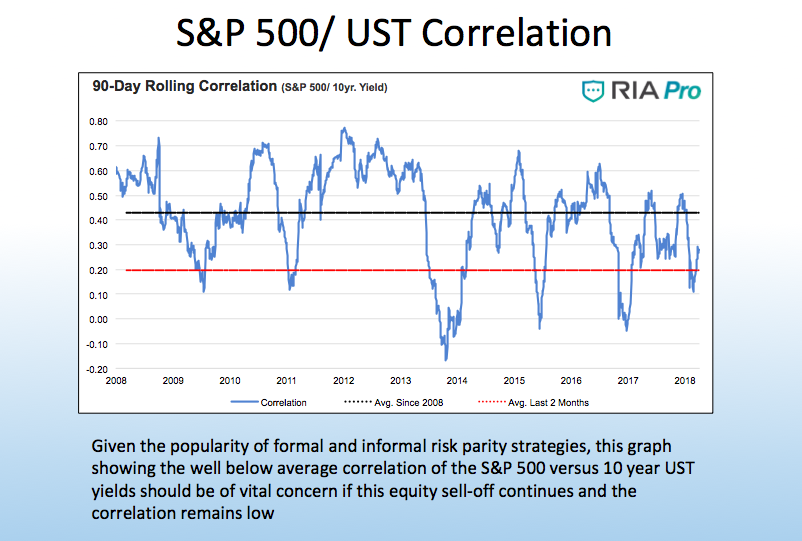

Correlations between and within asset classes plays an integral role in portfolio management. From a big picture perspective, changing correlations can be a signal that broader market trends are changing. Investors may reduce risk during such periods. Also of importance, changing correlations may increase or decrease the value of “hedges” within a portfolio. For instance, investors tend to assume they are taking a more defensive posture moving technology to utility stocks, or from stocks to bonds when they sense a downturn coming. While such trades have been effective in the past, correlations allow us to observe changes and develop opinions about the future.

The following charts and notes provide recent and historical context on how correlations have changed since the equity market turned lower in late January. Whether these changes turn out to be a dependable warning of trend change, or a multi-month anomaly, is unknown. What is known is that the market is not behaving as it has for the last few years and investors should pay close attention to correlations for more market insight.

Underappreciated Price Action

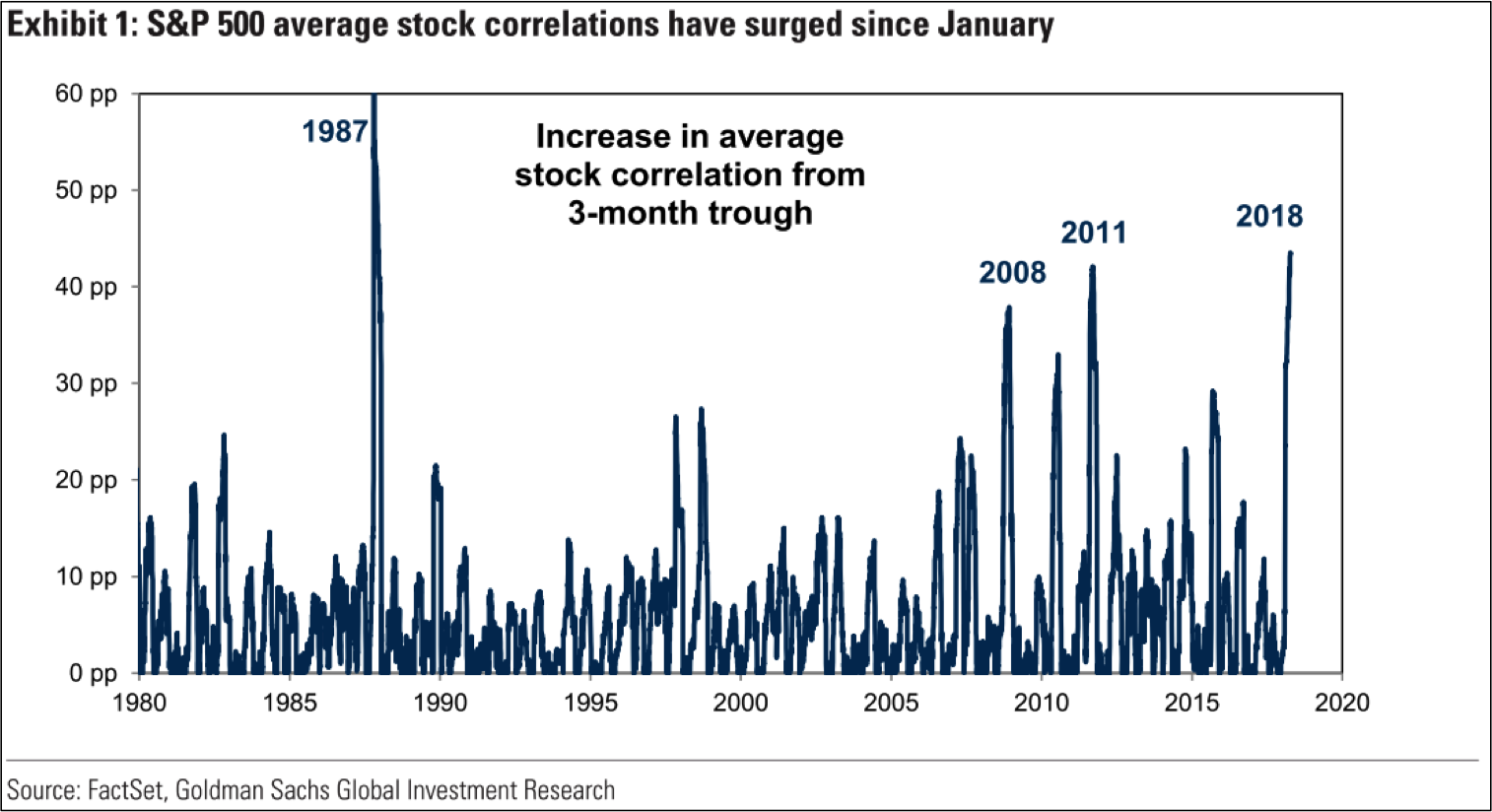

This graph, courtesy of Goldman Sachs, shows how correlations between S&P 500 stocks have increased at a rate greater than anytime in the last 40 years except 1987.

Cross Asset Correlations

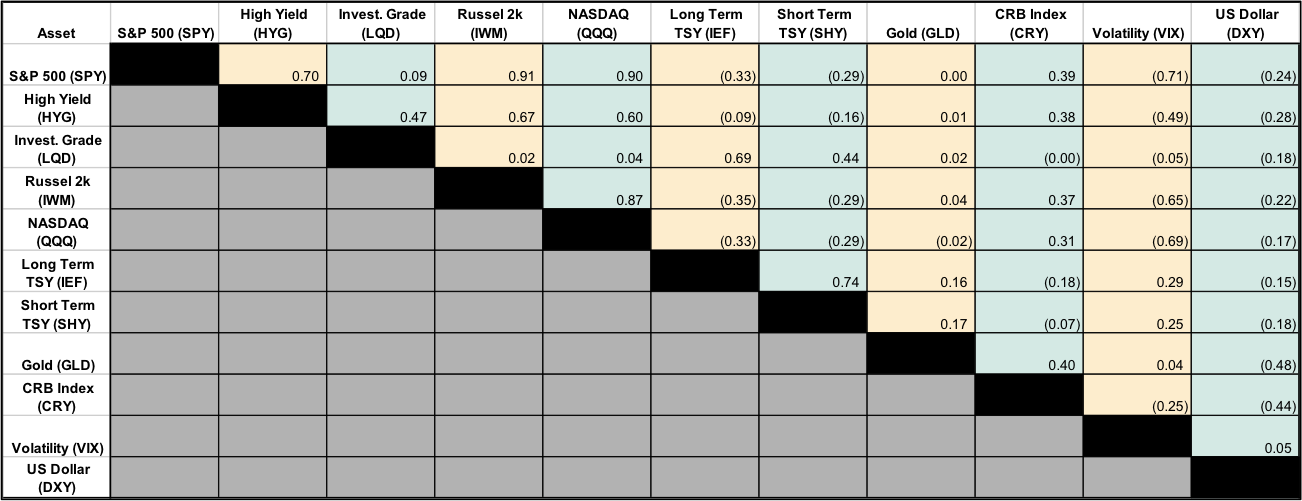

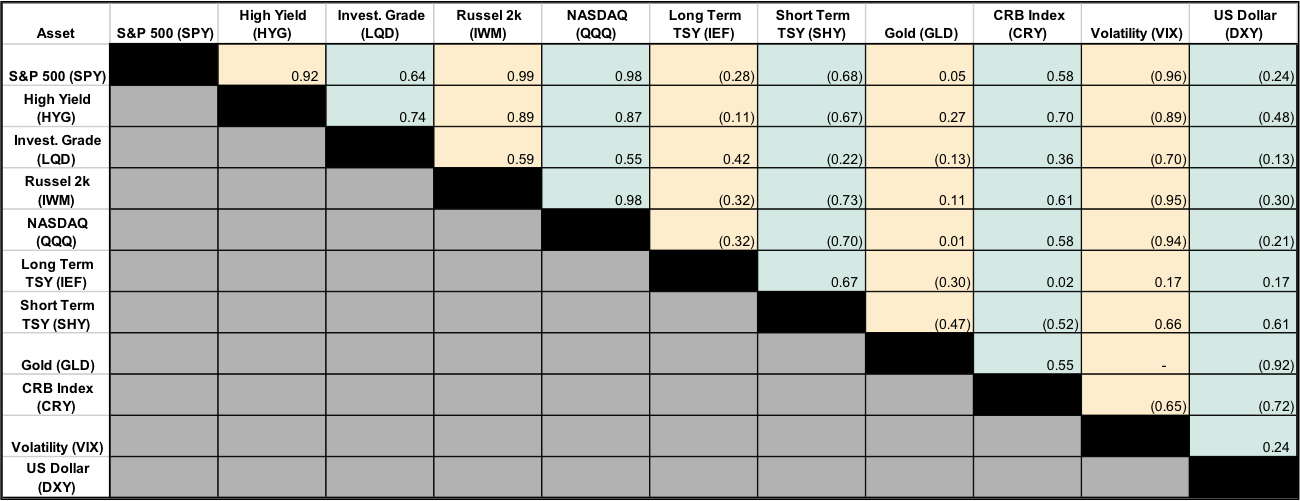

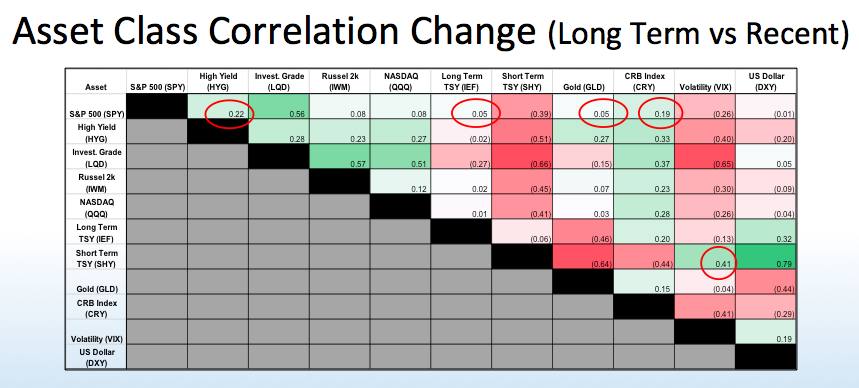

Asset Class Correlation (Long-Term vs Recent)

2003 to Current

1/26/18 to Current

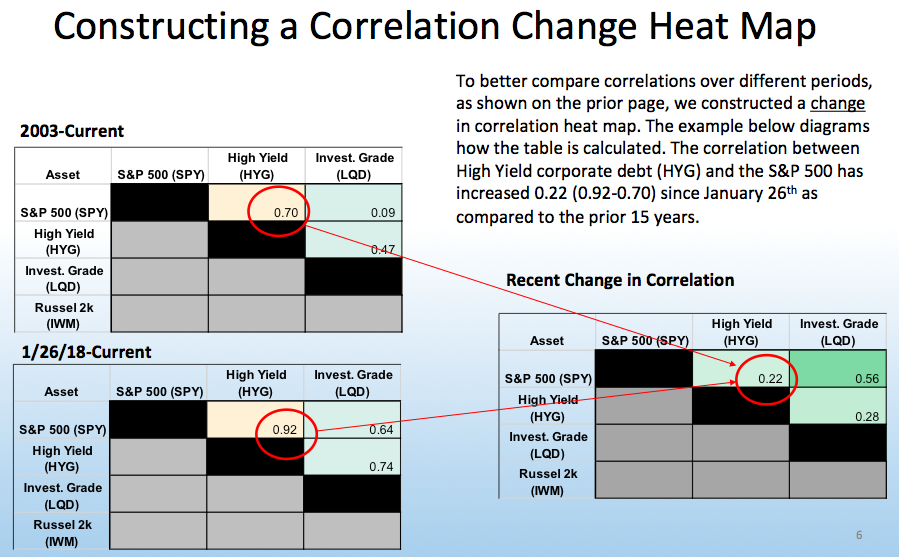

Asset Class Correlation Change (Long-Term vs Recent)

Takeaways

- The traditional equity market hedge, investment grade (LQD), has seen a marked increase in correlation to SPY +0.56 and reduced correlation to short term US Treasury Prices (SHY) -0.39 (Increased correlation to yields)

- Short-term Treasury yields (SHY) are being heavily influenced by expected Fed Funds rate hikes – current correlations less relevant

- The equity and commodity (CRB) relationship has increased

- Negative correlation of Gold (GLD) vs USD (DXY) increased sharply and is nearing -1.00 over the last two months

- VIX and SPY are more negatively correlated than in the past making VIX a good equity hedge thus far

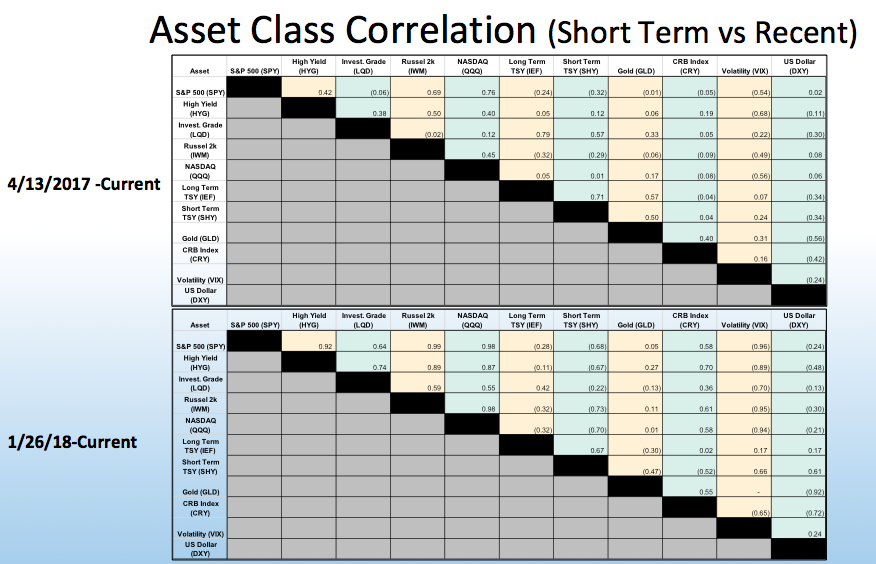

Takeaways

- Correlation between major equity indexes (SPY, IWM and QQQ) have increased sharply (+0.30 and +0.22) and are nearly 100%

- Negative correlation between volatility (VIX) and equities amplified (-0.54 to -0.96)

- Equities and Corporate bond prices are highly correlated in this recent downturn (SPY/LQD from -0.06 to +0.64) (SPY/HYG 0.42 to 0.92)

- Corporates (LQD and HYG) and Treasuries (IEF and SHY) are not as correlated as the prior year

- Volatility (VIX) has proven to be an effective hedge against Investment Grade and High Yield corporates

- Dollar (USD) / Gold (GLD) relationship has become significantly negatively correlated (-0.56 to -0.92)

- The relationship between USD (DXY) and short term rates (SHY -price) has become significant (-0.34 to +0.61) – Fed hikes should positive for USD!

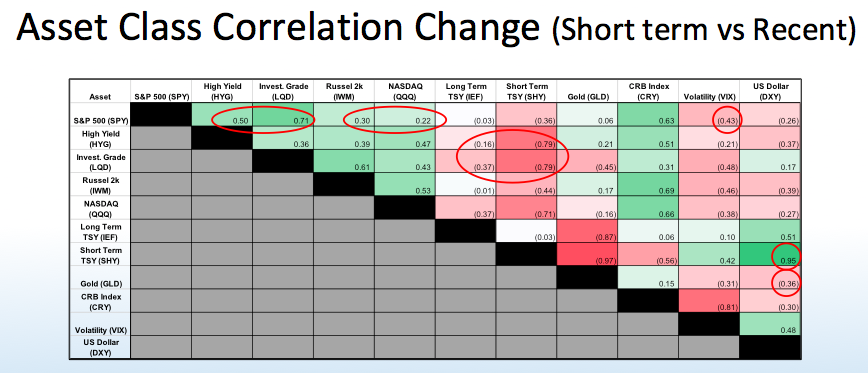

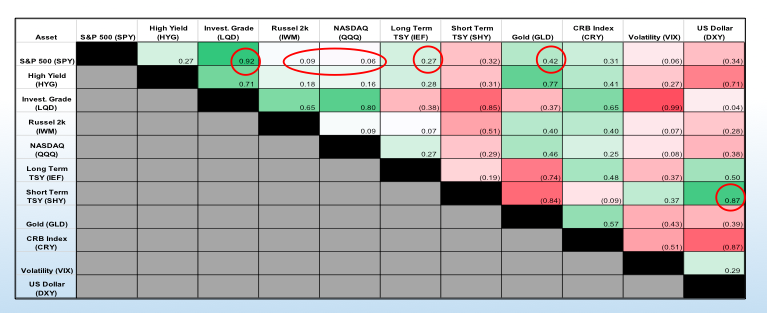

Asset Class Correlation Change (2008/2015/2016 vs Recent)

This table compares the past few months with three similar periods in which the S&P 500 fell 10-15%. Note the 2008 experience covers 10/2007 to 06/2008, the period before the market fell significantly.

Takeaways

- Correlation between major equity indexes (SPY, IWM and QQQ) is more pronounced than prior market declines

- The traditional equity market hedge, investment grade (LQD), has seen a marked increase in correlation to SPY (+0.92)

- Other traditional equity hedges (IEF and GLD) are not behaving as in prior sell offs

- The relationship between USD (DXY) and Fed rate hikes (SHY) has become significant (-0.26 to +0.61) – No flight to quality yet.

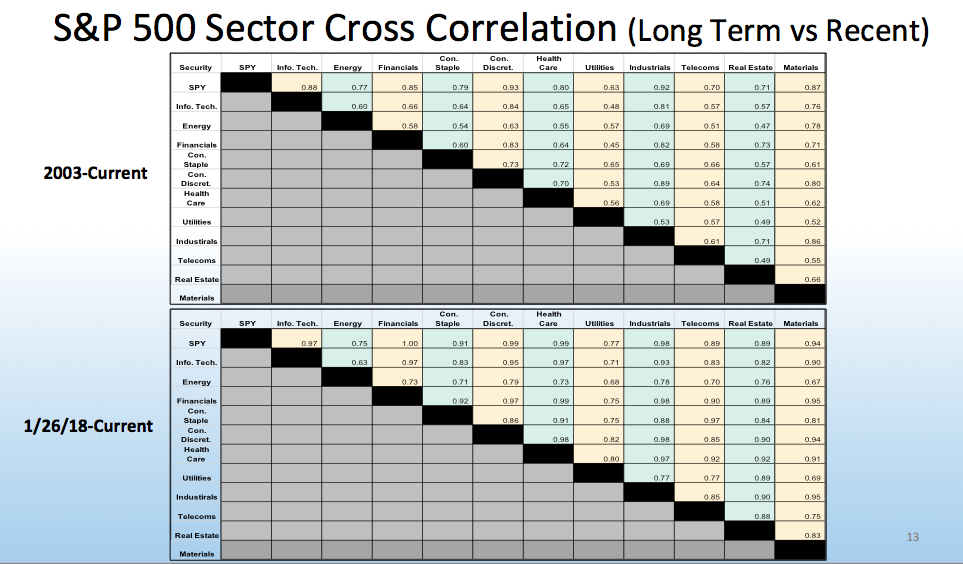

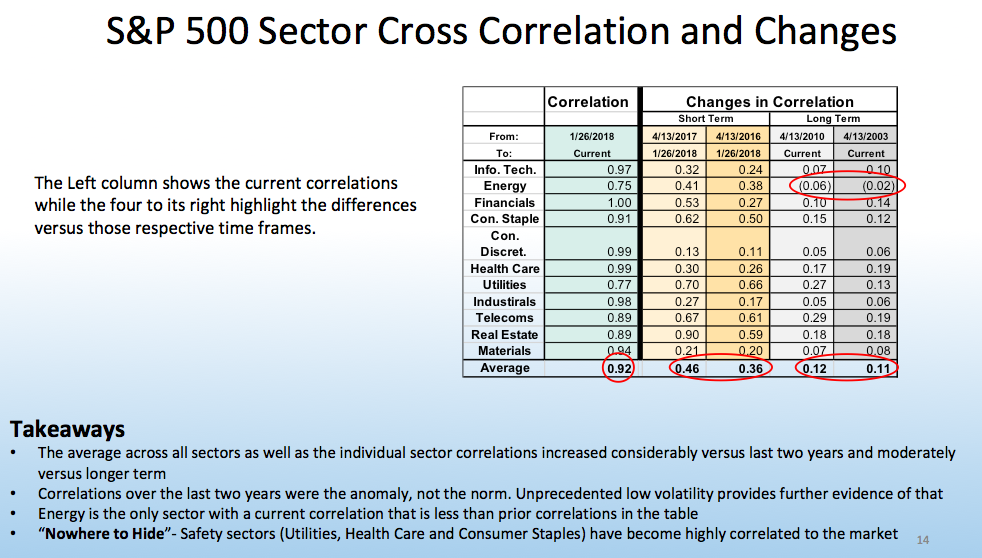

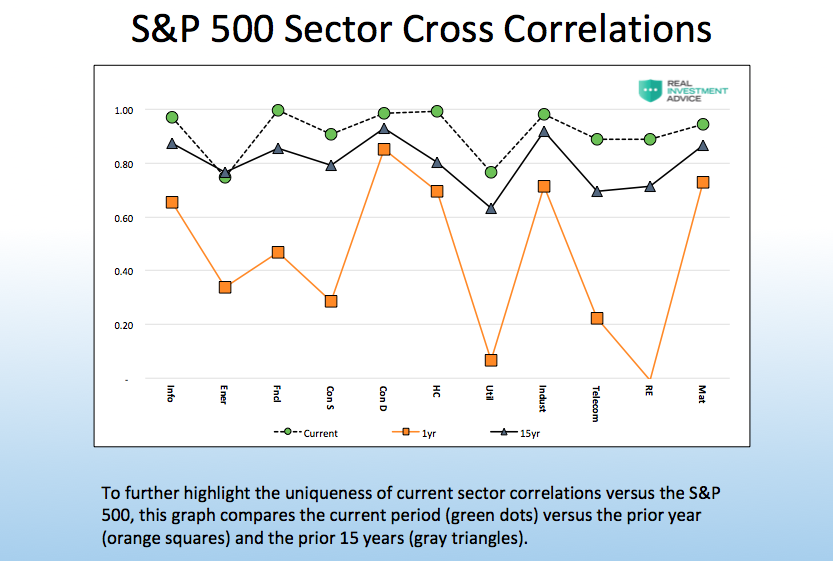

S&P 500 Sector Correlations

My Conclusions:

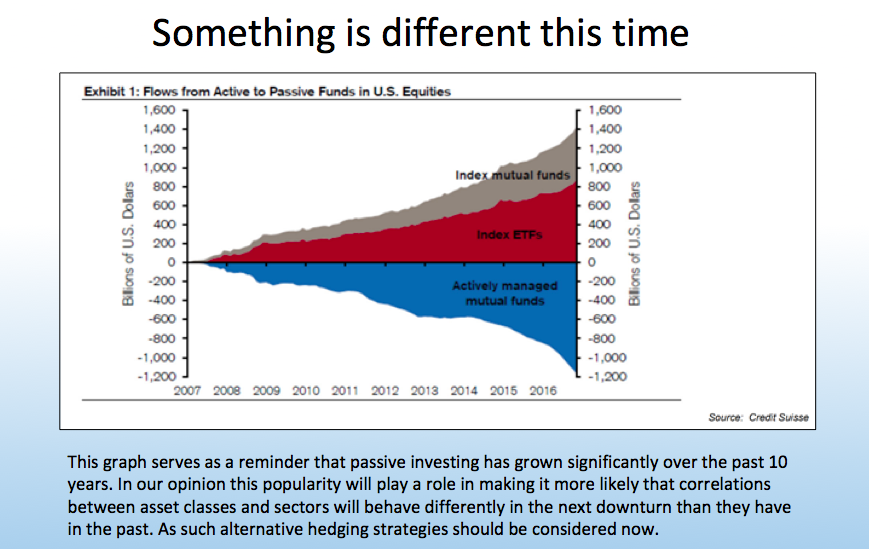

- Passive funds and strategies have increased the likelihood that future correlations between asset classes and the S&P 500 and its constituents are higher

- Equity and fixed income correlations have increased recently, rendering fixed income hedges for equities not as dependable

- Gold and commodities as measured by the CRB index have also not been as good an equity hedge as in the past

- Long equity volatility (VIX) has thus far proven a good ballast for stock and fixed income hedging

- Traditional safety, low beta, equity sectors have been well correlated to other sectors and the equity market as a whole

- Higher beta equity indexes (Russel 2k and the NASDAQ) have moved nearly perfectly in line with the S&P 500

- It is too early to tell if the market is topping or just taking a breather, but the signals discussed in this article and others we did not highlight, should be taken seriously

Thanks for reading.