A new month is here, so it’s time to take a look at some stocks and ETFs that show strong and weak seasonality trends for the month of November. Let’s look at the data tables below and provide some November seasonality stats and insights.

A new month is here, so it’s time to take a look at some stocks and ETFs that show strong and weak seasonality trends for the month of November. Let’s look at the data tables below and provide some November seasonality stats and insights.

Strong November Seasonality

United Parcel Service (UPS) and McDonalds (MCD) have shown strong November seasonality trends over the years. UPS has been higher on 13 out of 14 occurrences, with an average win percentage of 4.89%. MCD has been higher on 21 out of 23 occurrences, with an average win percentage of 5.28%.

Other noteworthy names include Monsanto (MON) was up 11 out of 13 and Tesla (TSLA) up 3 out of 3.

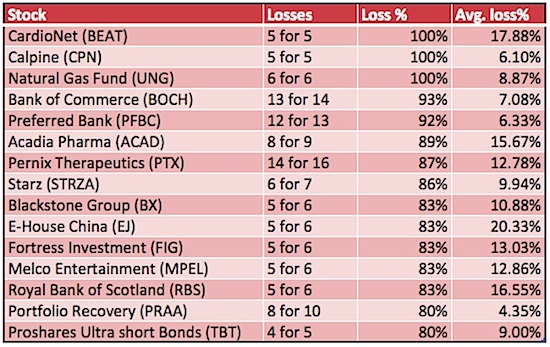

Weak November Seasonality

Bank of Commerce (BOCH) and Portfolio Recovery (PRAA) have shown weak November seasonality trends over the years. BOCH has been lower on 13 out of 14 occurrences, with an average loss percentage of 7.08%. PRAA has been lower on 8 out of 10 occurrences, with an average loss percentage of 4.35%.

The past is not necessarily a predictor of the future, so there should definitely be more due diligence done. This post is simply intended to highlight November seasonality trends and generate some trading ideas for further vetting for the month of November. Thanks for reading.

Follow Rob on Twitter: @TraderRL23

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.