Nordstrom (NYSE: JWN) traded 10% higher on Friday morning, after posting earnings that beat analyst estimates.

The company reported earnings per share of $0.95 and total revenue of $4.1 billion, compared to Wall Street expectations of $0.84 and $4.0 billion.

Growth in same store sales came in 4%, more than 4 times the average estimate of 0.8%. Management raised its fiscal year guidance for earnings, revenue, and same store sales growth.

Also, “online traffic relative to our results is up. That’s where you’re seeing a lot of the growth,” explained Co-President Jamie Nordstrom. In fact, online growth was 23% higher, compared to 20% one year ago, and online represents 34% of sales, an increase of 5% from one year ago.

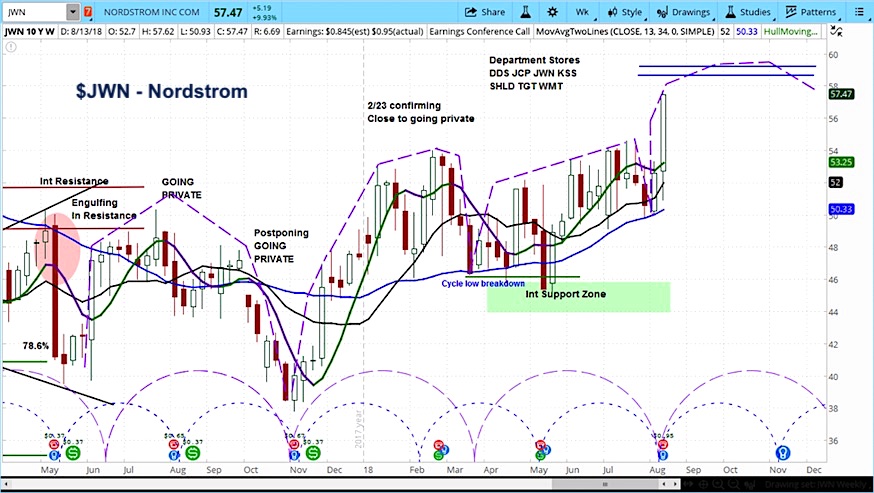

In analyzing the JWN market cycles, we can see that the stock recently started the rising phase of its current cycle.

Our timing on the current cycle was nearly perfect, which may have been due in part to a “nesting” effect, in which two different cycles ended at the same time.

As it is still early in this cycle, the stock may have more to go. Our target is $59, or possibly higher.

Nordstrom (JWN) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.