The New Zealand Dollar currency is still navigating its way through some general weakness.

Today we look at Elliott wave analysis on some currency pairs with the New Zealand Dollar (Kiwi).

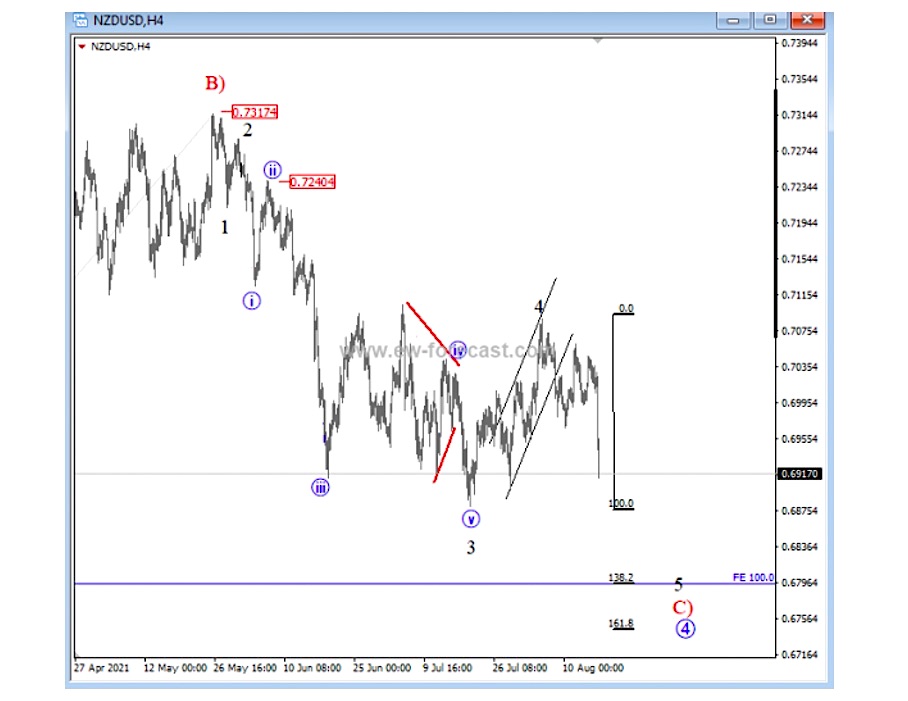

Looking at the New Zealand Dollar / US Dollar currency pair (NZDUSD), we can see that it has made a three-wave corrective recovery only. This looks like wave 4 within the downtrend, so be aware of a retest of the lows for the final wave 5 of an overall wave C). Bulls won’t show up until wave C is complete.

NZDUSD 4h Elliott Wave Analysis Chart

Looking at the New Zealand Dollar / Japanese Yen currency pair (NZDJPY), seems like it’s now looking for a deeper A-B-C correction within a higher degree wave 4. This could send the price back to the former wave 4 and 73.50 support level. We will see if there will be any strong rebound off those lower levels.

NZDJPY Daily Elliott Wave Analysis Chart

The Aussie / New Zealand Dollar currency pair (AUDNZD) has been trading sideways since August 2020. AUDNZD remains in the middle of a bullish sequence as current consolidation can be a triangle or maybe even a flat. With the recent retest of yearly lows combined with the current bounce higher, AUDNZD could have found support… but to confirm a bullish reversal, we need to see it trading back above the 1.0812 level.

AUDNZD Daily Elliott Wave Analysis Chart

Twitter: @GregaHorvatFX

The authors may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.