It would appear the bark was worse than the bite. After months and months of tough talk, name-calling and threats of walking away from any trade deal, the U.S. and Canada (plus Mexico) have agreed to a new NAFTA deal called the United States-Mexico- Canada Agreement (USMCA).

We would say this resolution is a positive surprise for Canada.

Yes, concessions were given on the Dairy front, opening up more of our market to the U.S. but most other key friction points were muted or went to Canada.

The New NAFTA deal (USMCA) is set to last for 16 years, which is a good thing. That helps remove uncertainty and allow businesses to make longer-term decision. Canada won again on keeping the dispute settlement mechanism.

The new terms on autos and auto parts appear largely positive for Canada. Online shoppers should welcome the move to allow purchases below $150 to be duty free, which may hurt some Canadian retailers.

As mentioned the biggest concession of the new NAFTA deal was allowing access to 3.5% of Canada’s dairy market, slightly higher than the 3.25% Trans-Pacific Partnership level. Perhaps the price of cheese will fall, but the government plans to compensate dairy farmers, so higher taxes may offset the consumer gain.

There was much speculation that the hard line talk taken by the U.S. was largely policitally motivated. Lots of tough talk sound bites for politicians ahead of the mid-term elections, and a win in the form of a better deal ahead of going to the polls. We would expect this new NAFTA deal to be marketed as a win by U.S. congress members vying for re- election.

Let’s look at the implications of the USMCA deal.

Implications

This is good news for the Canadian economy. A big harsh overhang has been removed, that while it had a low probability of occurrence, would certainly have caused a big economic hit. We would not be surprised to see the consensus of 2.0% GDP growth for next year to move marginally higher.

This deal also makes rate hikes by the Bank of Canada more likely. In their latest statement, the BoC specifically highlighted trade uncertainty as a contributing factor to their decisions. Now with this removed, it is more about the economic data and the data has been good.

This brings us to the loonie. The trade deal obviously removes a big overhang from the loonie and there was a move higher. However this move has not impressed most and we left wondering, can it get any better for the loonie?

Canadian Dollar – where to from here?

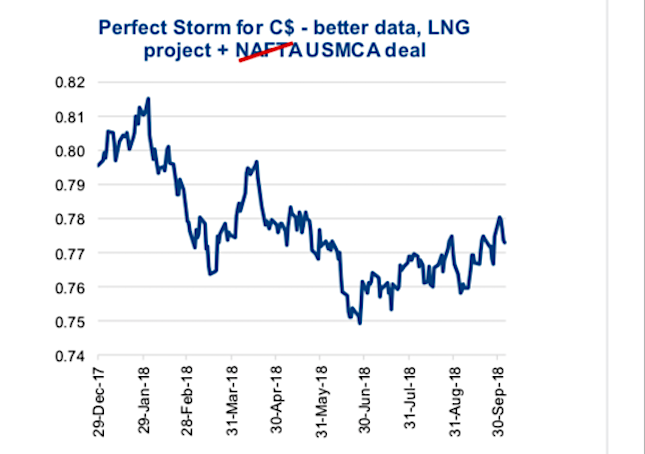

Ok, one would have thought that, given the strong Canadian economic GDP print on September 28, oil trading into the mid $70s, the good news of a multi billion dollar investment into LNG capacity AND the new NAFTA deal (USMCA) the loonie would have rallied more.

The Canadian Dollar strengthened by 1% on Friday, thanks to the economic data and 0.73% on Monday with all the other good news. But since then it has given back about half those gains with the market moving into more of a risk-off environment.

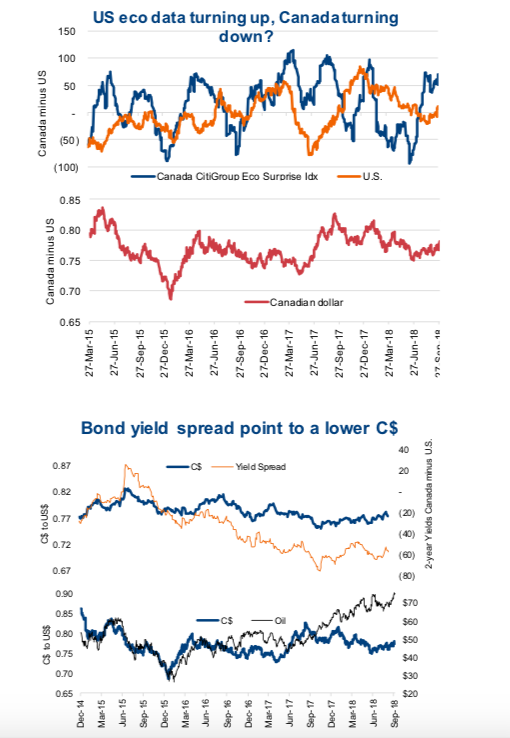

This brings us to the economic data. The U.S. data has been failing to impress expectations since the beginning of the year as made evident in the declining yellow line in the first chart below, top panel. The yellow line is the Citigroup Economic Surprise Index for the U.S. with the blue line the same for Canada. We would note the Canadian Dollar (first chart below, bottom pane) failed to rally much when the Canadian data was surprising to the upside.

However now, the U.S. data appears to be turning more positive. This has been a seasonal trend evident over the past seven years that has seen soft U.S. data in the first half of the year and stronger data in the back half. Meanwhile Canada appears to be starting to soften. This week’s employment data from Canada was very strong but the vast majority of new jobs were part time with full time actually shedding jobs.

If these reverse course and we transition to a market with better U.S. data and softer Canadian, we would bet the Canadian Dollar would soften.

Care for some more support that the Canadian Dollar should weaken? Yield spreads, based on 2- year maturities certainly favor a lower Canadian Dollar relative to the U.S. (Chart 2 above). Yields in the U.S. continue to be much more attractive than in Canada, plus they appear to have inflation and an economy firing on more cylinders than ours.

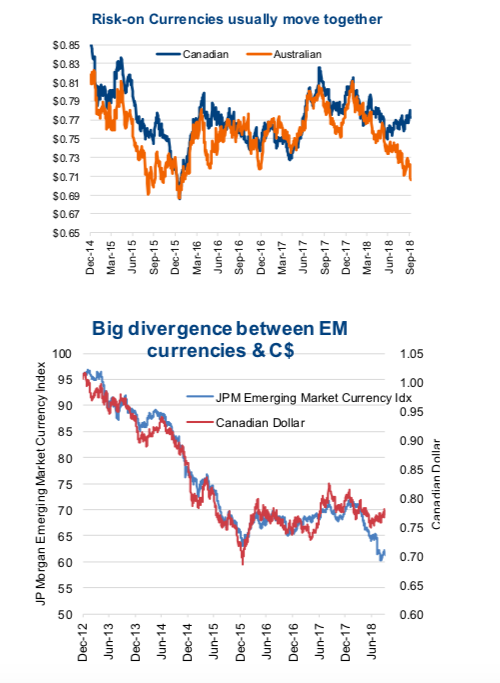

Risk-on currencies, which includes the Canadian Dollar and Australian dollar (AUD) usually trade together. But not recently as the AUD has been declining while ours has held up (top chart below). While we could argue the AUD is more levered to China which is in a bear market and their housing industry appears to be in some trouble, if this relationship reasserts, there is an air pocket under the Canadian Dollar.

There is also an air pocket under the Canadian Dollar if you look at emerging market currencies. Now we are not saying the Canadian Dollar is an emerging market currency, but there has been a long strong relationship over the years and currently there is a big divergence (see bottom chart above).

There are some counterarguments to a weaker Canadian Dollar. Oil in the mid $70s is certainly a strong one. Plus from a valuation perspective the Canadian Dollar is about 5% undervalued vs. the US Dollar. The US Dollar may also be starting to top out as global yields rise, playing some catch up to the U.S. Still, when a big pile of bullish Canadian Dollar news hits and the result is tepid, the market is telling you something. Likely the path of least resistance for the Canadian Dollar may be to the downside for now.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @sobata416 @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.