Netflix stock price (NFLX) traded nearly 4% higher on Thursday morning, after RBC Capital Markets raised its price target to $440.

RBC analyst Mark Mahaney reiterated his “outperform” rating on Netflix and raised his price target by $80 from $360 to $440.

This NFLX stock upgrade comes upon the release of a new RBC survey that indicated more people are using Netflix than before. Furthermore, nearly 70% are “very” or “extremely” satisfied with the service.

“We view Netflix as one of the best derivatives off the strong growth in online video viewing and in internet connected devices,” explained Mahaney.

However, Morgan Stanley highlighted on the previous day that Apple’s forthcoming video service could produce sales of as much as $4.4 billion by 2025. As such, Netflix will face new competition from Apple, in addition to its current competitors which include Amazon.

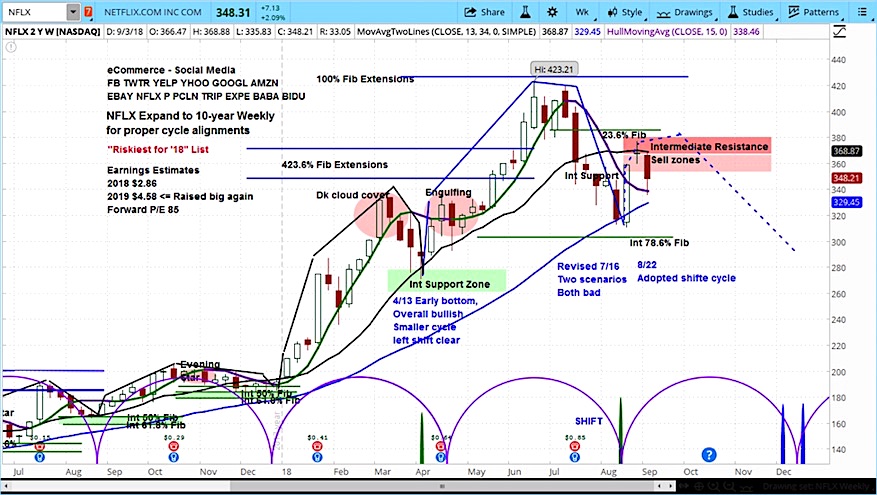

Looking at the market cycles for NFLX, we can see that the stock has benefited from the rising phase of its current cycle. While there may be a little more upside, we believe that NFLX is now stalling in resistance. With the current cycle set to end in December, our target is $300.

Netflix (NFLX) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.