Netflix (NASDAQ: NFLX) is trading higher by nearly 5 percent on Wednesday afternoon, after posting earnings that beat Wall Street expectations. Note that the stock was up over 10 percent initially in morning trade.

The media services company reported earnings per share of $0.89 and total revenue of $4 billion, compared to analyst estimates of $0.68 and $4 billion.

For the closely watched metric of subscriber growth, Netflix added over 1 million domestic subscribers and nearly 6 million internationally, both of which handily beat consensus estimates.

While Netflix CEO Reed Hastings forecast continued strong growth, he also pointed to increased entry into the online entertainment space, “There are so many competitors. Disney is going to enter, AT&T is going to expand HBO, and YouTube is just on fire.”

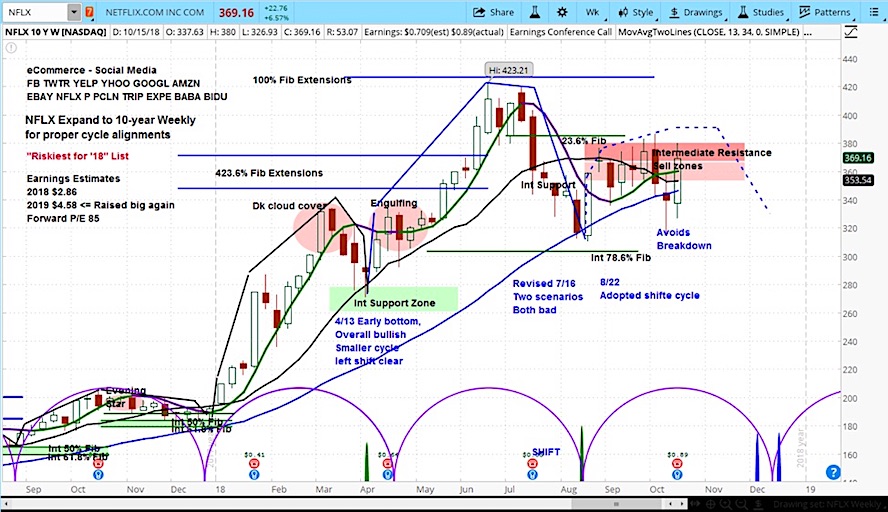

With regard to market cycles for Netflix stock (NFLX), it appears that the stock price is cresting its current cycle, perhaps heading towards a declining phase. Netflix has avoided a cycle breakdown for the time being, but this may be the best it can do for a while.

Our expectation is for a test by December of its recent lows near $320.

Netflix (NFLX) Stock Chart with Weekly Bars

For more from Slim, or to learn about cycle analysis, check out the askSlim Market Week show every Friday on our YouTube channel.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.