Netflix (NFLX) reported Q4 quarterly earnings after the bell today.

The company posted an exceptional quarter led by their subscriber numbers. The following research and charts were compiled by myself and my firm, Avory & Co.

While looking at quarter to quarter, business conditions generally doesn’t influence long-term investors all that much. However, a stock like Netflix tends to be more sensitive due to it’s valuation of 6-7x revenue.

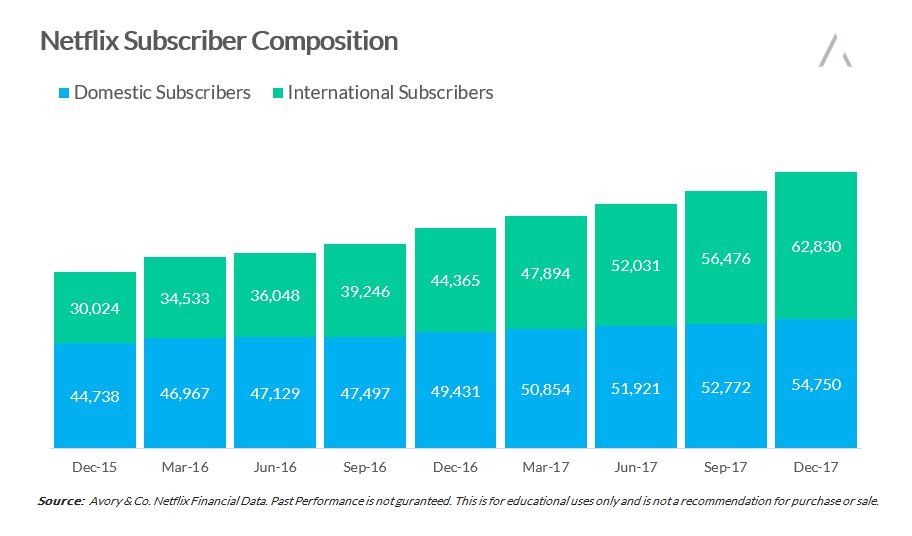

Netflix Subscriber Composition

The Netflix Q4 earnings release highlights continue to be dominated by their international base which now totals 62 million and growing at 41.6% year over year. Also, domestic subscribers are growing at 10.8% year over year, which is pretty good considering the competition is hitting the market.

Q3 was the first quarter where the international business was more significant than the domestic business and that gap seems to be widening.

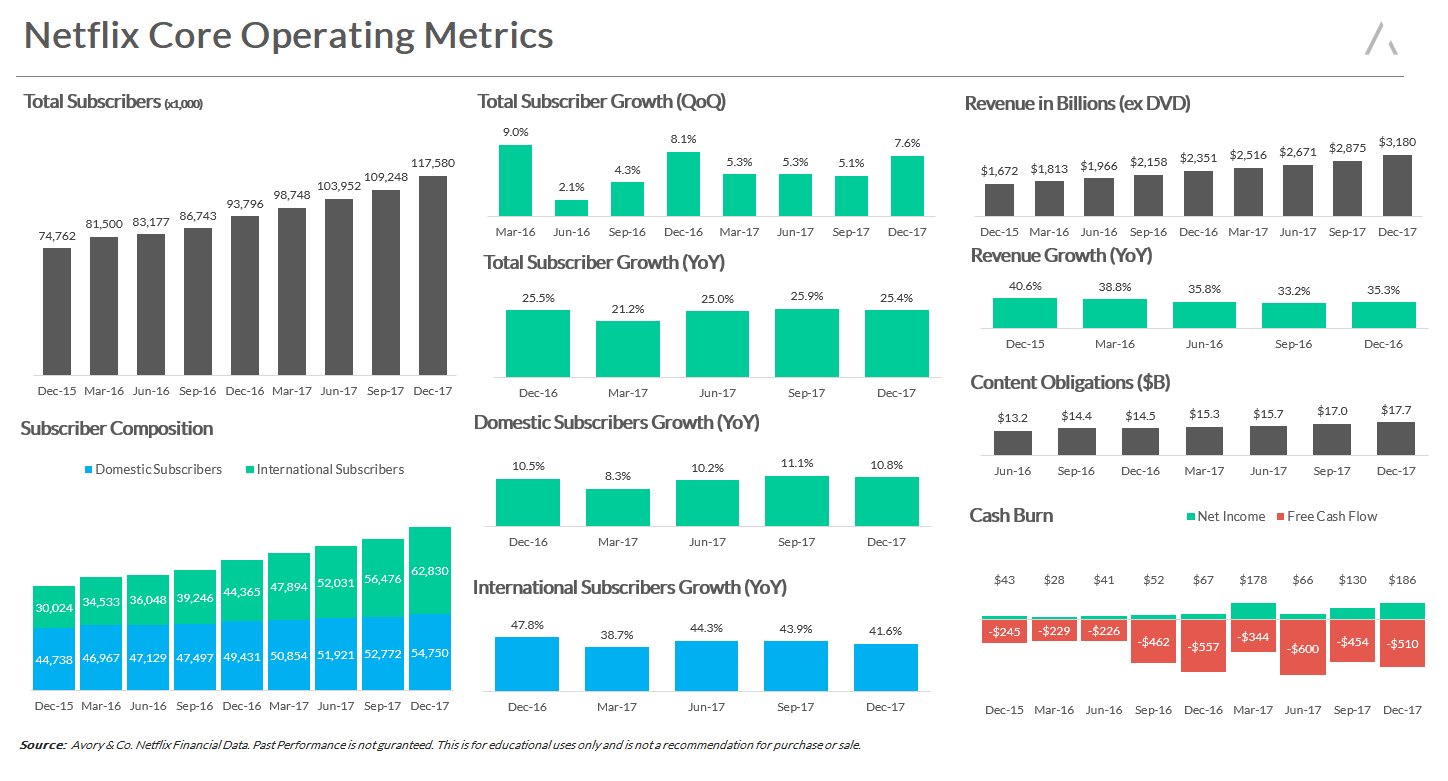

Netflix Core Operating Metrics

Revenue growth ex-DVD came in at 35.3% year over year which is higher than their total subscriber growth. This is a positive and proves their ability to scale up pricing despite the competitive market forces.

The next important area was their cash burn, along with the overall content budget. Their -$510 cash burn was slightly better than last year, but this figure includes $44.8m of stock-based comp add backs, which was $28.9m more than a year ago. Stripping out stock-based comp add backs in Q4 of 2017 and Q4 of 2016, the overall cash burn would have been worse than a year ago. Bulls will point to revenue growth, which I must admit solves many short-term issues. They are likely to have the ability to continue price increases while also adding subscribers. The combination is a powerful force in investing.

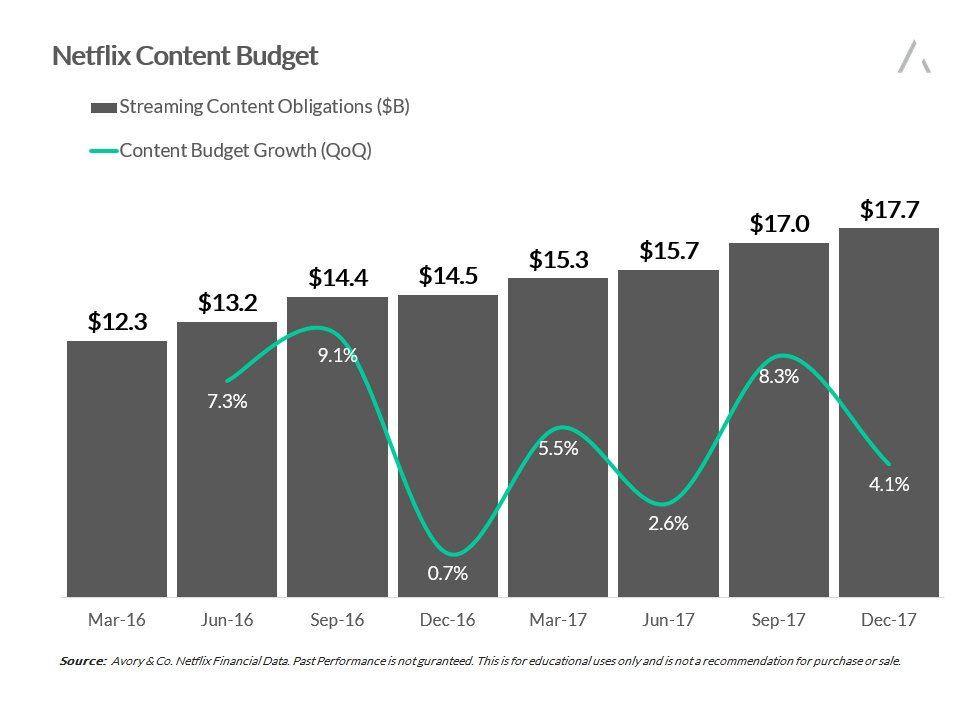

Netflix Content Budget

Another concern is content budgets which have to rise in the future with the amount of capital from cash-rich companies coming for streaming. This quarter Netflix was able to keep the content obligations in check at $17.7B from $17B, but look for this to rise in the future. Either way, this is a massive number which many bond analyst can’t stand.

To wrap it up: Good quarter regarding growth metrics. Slightly misleading cash burn metrics and some stability in content obligations.

Disclaimer from author: THIS IS NOT A RECOMMENDATION FOR PURCHASE OR SALE OF ANY SECURITIES. AVORY & CO. IS A REGISTERED INVESTMENT ADVISER. INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS, OR INVESTMENT STRATEGIES. INVESTMENTS INVOLVE RISK AND UNLESS OTHERWISE STATED, ARE NOT GUARANTEED. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.