Entertainment company Netflix (NFLX) is up over 10% today after posting Q4 earnings per share of 41 cents and revenue of $3.29 billion versus expectations of 41 cents and $3.28 billion.

One figure that is closely watched by NFLX investors is their net subscribers, which grew by 8.33 million, compared to an expectation of 6.37 million. This may have caused the stock to move higher.

However, Netflix management also noted rising marketing costs due to increasing competition from the likes of Apple (AAPL), Google (GOOG), Amazon (ANZN), and Disney (DIS).

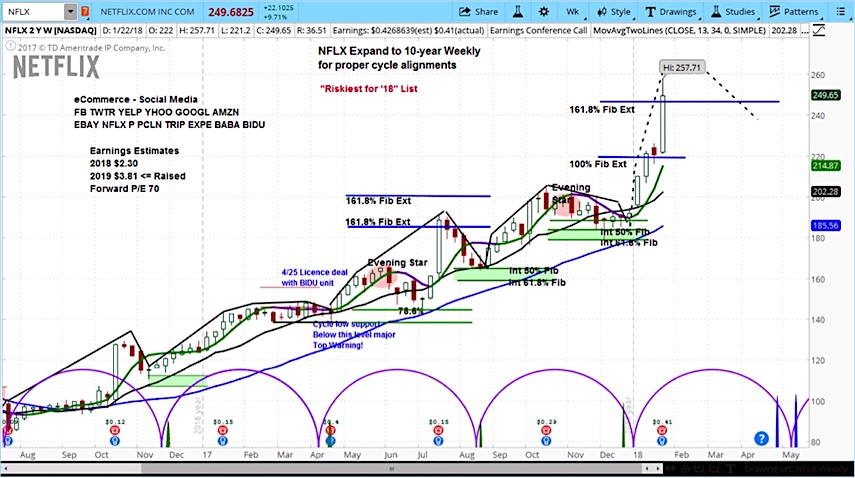

We put NFLX on our “Riskiest for 2018” list in our New Year’s 2018 show, as it may be overvalued with a Price to Earnings ratio over 250 for the trailing 12 months.

So far it has moved through our projected resistance, but we expect a correction by midyear.

For more on our 2018 predictions, check out our New Year’s show.

NFLX Stock Chart with Weekly Bars

Visit our site for more on our approach to using market cycles to analyze stocks.

Twitter: @askslim

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.