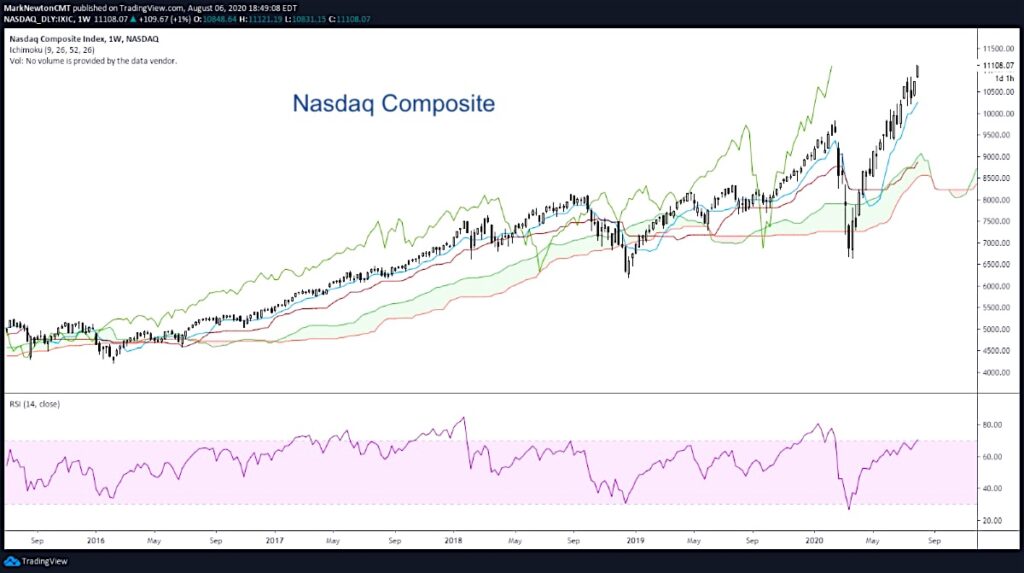

The NASDAQ Composite looks stretched here and a momentum divergence has definitely begun to resurface after its historic rise.

In January the weekly RSI showing a 78 reading. And now, after rallying 13% above these peaks, the RSI shows a reading of 70, which is well below.

Thus, momentum is now not able to keep up with this price rally, a historically negative sign when expecting a rally to have any longevity.

Overall, a pullback should begin within the next couple week into late September. That said, heading into next week, we still haven’t seen any evidence of trend deterioration (which we will be on guard for).

The negative breadth readings during a +1.4% XLK (Tech ETF) rally are notable and imply this cannot go on forever.

For now, within the top Tech growth stocks, additional strength looks likely into August expiration.

If you have an interest in seeing timely intra-day market updates on my private twitter feed, please follow @NewtonAdvisors. Also, feel free to send me an email at info@newtonadvisor.com regarding how my Technical work can add alpha to your portfolio management process.

Twitter: @MarkNewtonCMT

Author has positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.