Stock market observers often wonder how index A can be up significantly on a particular day while index B can’t gain any ground at all. While the circumstances are obviously unique to each occasion, the answer very often is as simple as — index B had no more room to go.

A case in point: how could the Dow Jones Industrial Average close up 155 points and the Russell 2000 gain 1.5% today while the Nasdaq 100 actually lost 4 points?

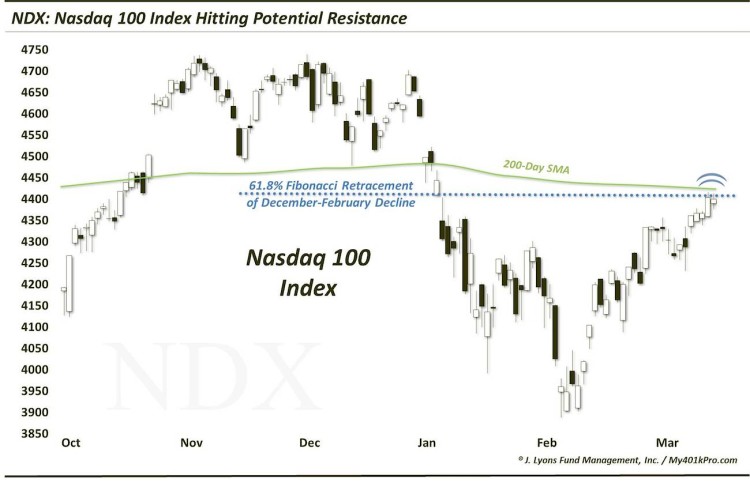

Simple — the Nasdaq 100 (NDX) was already hitting resistance in the following forms and thus had no more room to run:

- The 61.8% Fibonacci Retracement of the December-February decline

- The 200-Day Simple Moving Average

Now perhaps the NDX blasts through this area today, or in the days ahead, but that resistance was enough to prevent the index from gaining any ground yesterday, even while most of the rest of the market was strong.

Nasdaq 100 (NDX) Chart

Have a great Friday!

Twitter: @JLyonsFundMgmt

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.