Hey all, just wanted to let you know that I will be joining MarketInflections.com and supporting there Research division. My company, Aether Analytics is also “Powered by Parallax” so there was a fit there. Along side the standard Market Infections Signal and Newsletter services, we will also look to add a community chat room for other parallax technology users. Today we want to provide a glimpse of our mid-year research report on stock market valuations. This will specifically look across U.S. market indices and sectors. Further below is a link to the entire research report.

You can learn more about our methodology on the site, but below you will find a brief recap of the high level U.S market findings. But note that the report also covers:

- A sector valuation analysis of four key global markets: US, Europe, China and Emerging Markets

- A review of two stocks which our software has identified as top long ideas

- A review of two stocks which our software has identified as top short ideas

Here is a summary of our finding on U.S. equity markets:

- US equity markets are approximately 13% overvalued

- Despite the rout in Chinese equities over the past year, they remain almost 50% overvalued

- Europe and Emerging Markets are 8% and 9% undervalued respectively

- Utilities and Telecommunications Services are the most undervalued sectors worldwide

- Industrials, Healthcare and Technology are the most overvalued sectors worldwide

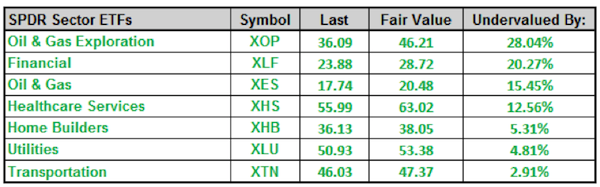

- Oil & Gas, Financials and Utilities are the most undervalued sectors in the US

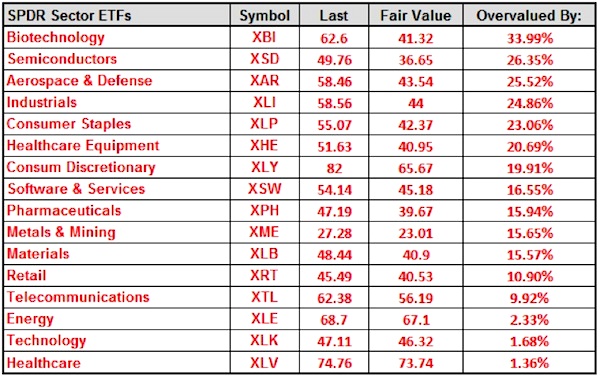

- Biotechnology, Semiconductors and Aerospace/Defense are the most overvalued sectors in the US

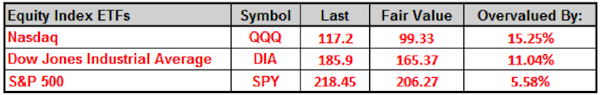

Using our methodology, we have US equity index ETFs currently overvalued by 5% to 15%. You can see the S&P 500 ETF (NYSEARCA:SPY) is overvalued by 5.5%, while the Nasdaq 100 ETF (NASDAQ:QQQ) is coming in at 15.25% overvalued.

Of the 23 Sector ETFs we track, only seven are undervalued. This list is lead by Oil & Gas Exploration (NYSEARCA:XOP) – undervalued by 28%.

The remaining 16 Sector ETFs are overvalued. This list is lead by Biotechnology Sector ETF (NYSEARCA:XBI) – overvalued by nearly 34%.

This report also analyzes valuation metrics of key industry sectors in four global markets: US, Europe, China and Emerging Markets as well as provides two new long ideas and two new short ideas.

Twitter: @interestratearb

The author may have positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.