Economic and corporate uncertainties are elevated as we progress through the first quarter.

There’s no getting around it, tariffs are the headliner no matter where you go. Immediate financial impacts are on goods imported from China, but President Trump’s orders have also pressured the economies of Canada, Mexico, Colombia, and the Euro Area during the first month of his second term.

There is a knock-on effect, though. Services companies, namely many firms in the Information Technology sector, have felt unease given their relatively high share of revenue generated from overseas.

Euro Gems

Ironically, the European bourses, such as the German DAX 30, France’s CAC 40, and the UK’s FTSE 100 have surprised many investors with strong early-year returns. Across-the-pond alpha coincides with a, we’ll call it, “wobbly” US dollar. The EUR/USD currency pair keeps defending parity after impressive strength in the greenback throughout the fourth quarter.

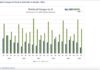

The macro scene drives so many market narratives today, but at the industry level and when scanning profit reports among individual companies, the story is pretty good. Consider that the S&P 500 paces for a mid-teens Q4 EPS growth rate with more than two-thirds of reports released, according to FactSet.

Eye on Monetary Policy…

What’s more, consumer spending is healthy after a downright jaw-dropping holiday shopping season. January inflation gauges were worrisome at first glance last week, but Treasury yields have merely trodden water since the December Fed meeting; it now appears that the FOMC may be done cutting rates. With the All-Country World Index reaching an all-time high last week, equities seem just fine with that reality.

…But Fiscal Policy Clarity Needed

Stocks have ascended even with the occasional volatility spike so far in Q1. What has been missing are those animal spirits talking heads chirped about last year. Dealmaking has been tepid through mid-February and the IPO market remains on ice.

Perhaps it all comes back to policies in Washington—clarity on tariffs, what taxes will look like in 2026, how supposed deregulation unfolds, and changes to immigration. We will learn where CEOs across sectors stand over the coming weeks considering a busy conference slate.

Here are the headline gatherings:

Information Technology & Communication Services

February 26: Bernstein 3rd Annual Tech, Media & Telecom Forum

February 26: Wolfe March Madness Software Conference

February 27: Susquehanna 14th Annual Technology Conference

March 3: Morgan Stanley Technology, Media, and Telecom (TMT) Conference

March 10: Deutsche Bank 33rd Annual Media, Internet & Telecom Conference

March 17: NVIDIA GTC AI Conference

April 1: Evercore ISI 2nd Annual Cybersecurity Summit

Health Care

February 27: Citi Medtech and Life Sciences Access Day

March 3: TD Cowen 45th Annual Healthcare Conference

March 11: Barclays 27th Annual Global Healthcare Conference

March 11: Jefferies Biotech on the Bay Summit

March 11: Carnegie Healthcare Seminar

March 17: Oppenheimer 35th Annual Healthcare MedTech and Services Conference (virtual)

March 18: KeyBanc Capital Markets Annual Health Care Forum (virtual)

March 26: Nordic-American Healthcare Conference

Consumer Discretionary & Consumer Staples

February 26: TD Cowen Glowing Ahead: Beauty & Wellness Summit

March 5: Evercore ISI 9th Annual Housing and Building Products Symposium

March 10: Citi Consumer Conference

March 11: Bank of America Securities Consumer and Retail Conference

March 12: UBS Annual Global Consumer and Retail Conference

April 2: J.P. Morgan Retail Round Up

Financials & Real Estate

February 19: Morgan Stanley 8th Annual CRE Conference

February 26: ING Real Estate Conference

March 2: Citi Global Real Estate Property CEO Conference

March 4: RBC Capital Markets Global Financial Institutions Conference

March 11: Wolfe Research Fintech Forum

Industrials

February 19: Barclays 42nd Annual Industrial Select Conference

March 3: Evercore ISI 17th Annual Industrial Conference

March 4: Deutsche Bank 12th Annual Shipping Summit (virtual)

March 6: Barclays Select Series: Industrial Energy & Infrastructure Corporate Access Day

March 11: JP Morgan Industrials Conference

March 18: Bank of America Global Industrials Conference

Energy, Utilities, Climate

February 26: Canaccord Genuity Sustainability Summit (virtual)

March 3: Morgan Stanley Global Energy & Power Conference

March 4: Jefferies Power, Utilities and Clean Energy Conference

March 6: UBS Nuclear Conference (virtual)

March 10: CERAWeek

March 12: BNP Paribas Consumer Ingredients and Chemical Conference

March 26: UBS Global Energy and Utilities Conference

March 28: Jefferies Virtual Cleantech and Utility Equipment Conference

Materials & Crypto

February 23: BMO Capital Markets 33rd Global Metals, Mining & Critical Minerals Conference

February 24: Bitcoin Investor Week

February 25: Bank of America Global Agriculture and Materials Conference

March 5: Bitcoin Ski Summit

Regional

February 24: JP Morgan Global Emerging Markets FI Conference

February 25: Goldman Sachs European Technology Conference

March 3: Morgan Stanley European Healthcare Conference

March 3: Morgan Stanley`s London EU MedTech Conference

March 4: UBS European Healthcare Conference

March 12: UBS Technology, Media and Internet London Conference

March 12: Citi European TMT Conference

March 12: JP Morgan European Opportunities Forum

March 18: Bank of America Asia Pacific APAC Telecom, Media & Technology TMT Conference

March 18: Morgan Stanley European Financials Conference

Investor Specific & Multi-Sector

February 24: JP Morgan Global High Yield & Leveraged Finance Conference

February 25: Oppenheimer 10th Annual Emerging Growth Conference (virtual)

March 11: Evercore ISI 2nd Annual Private Markets Forum

March 18: Exane BNP Paribas Transforming Industrials, Materials and Energy Conference

March 25: HSBC Global Investment Summit

March 26: JP Morgan Public Finance Transportation & Utility Investor Forum

Twitter: @ChristineLShort

The author may hold positions in mentioned securities. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.