Casino stocks have been some of the worst performers since the beginning of last year. Las Vegas Sands (LVS) has fallen 46% and Wynn Resorts (WYNN) has collapsed 74% from the 2014 highs. And as share prices tumble lower across much of the industry, it is not wise to try and catch a falling knife without fundamental and technical support backing your thesis (and a very patient careful plan).

Of the larger companies, I explain below why MGM Resorts International (MGM) could be one of the few worth considering as an investment.

On October 29th, MGM Resorts International reported Q3 earnings of $0.15 per share vs the $0.03 estimate on in-line revenue of $2.3B. Sales were down over 8% on a year over year basis, but given the overall sentiment of the industry the numbers weren’t as bad as some analyst’s expected. The $13B casino operator also said that domestic resorts revenue jumped 4% to $1.6B (China operations remaining the laggard) and REVPAR came in at +8% vs their own estimates of +6%.

But this wasn’t the last of the good news to come out of MGM resorts this fall. Activist investors, Land & Buildings, got an early Christmas present when MGM’s board of directors approved that they will form a real estate investment trust (REIT). L&B had been pushing for the shareholder friendly move since March. Their position in the company was worth about $80M (stock and call options) back on September 30th. It may not sound like a lot, but MGM is by far the largest holding in the hedge fund.

Earnings per share (EPS) estimates for next year are still on the rise and Wall Street is actually forecasting a return to top line growth in 2016. MGM trades at a forward P/E ratio of 34.61x, price to sales ratio of 1.44x, and a price to book ratio of 2.19x. On November 2nd, Susquehanna reiterated their positive rating and upped their price target to $31 from $25.

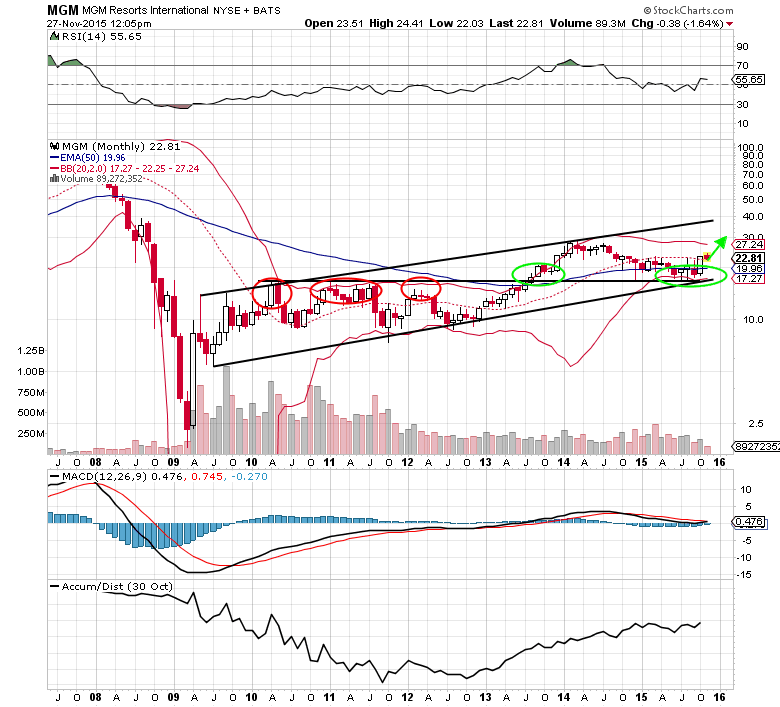

MGM Resorts International (MGM) Stock Chart – Technical Analysis

Looking at the monthly stock chart for MGM Resorts (above) we can see a few bullish signs. First, MGM Resorts has been trading in a well-defined uptrending channel since the 2009 stock price lows. It took several attempts to breakout above the $17 resistance level and once it did happen it triggered a massive rally to $28.75 in less than a year’s time.

As currency headwinds and diminishing international sales took it’s toll on the company, however, shares fell right back down to what is now major support at $17. MGM has traded sideways in consolidation recently and appears to have put in a successful test of the bottom of its stock price channel.

Given all of the positive developments we’re seeing out of the company and not to mention the bullish price action, it wouldn’t be much of a stretch to see MGM trading in the high $20’s to low $30’s by the end of the 2016.

MGM Resorts International Options Trade Idea

One could buy the Jan 2017 $25/$30 bull call spread for a $1.50 debit or better.

This entails buying the Jan 2017 $25 call and selling the Jan 2017 $30 call (all in one trade).

1st upside target- $3.00

2nd upside target- $4.50

Thanks for reading and have a great week.

Twitter: @MitchellKWarren

No position in any of the securities mentioned at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.