McDonald’s Fourth Quarter Earnings Analysis

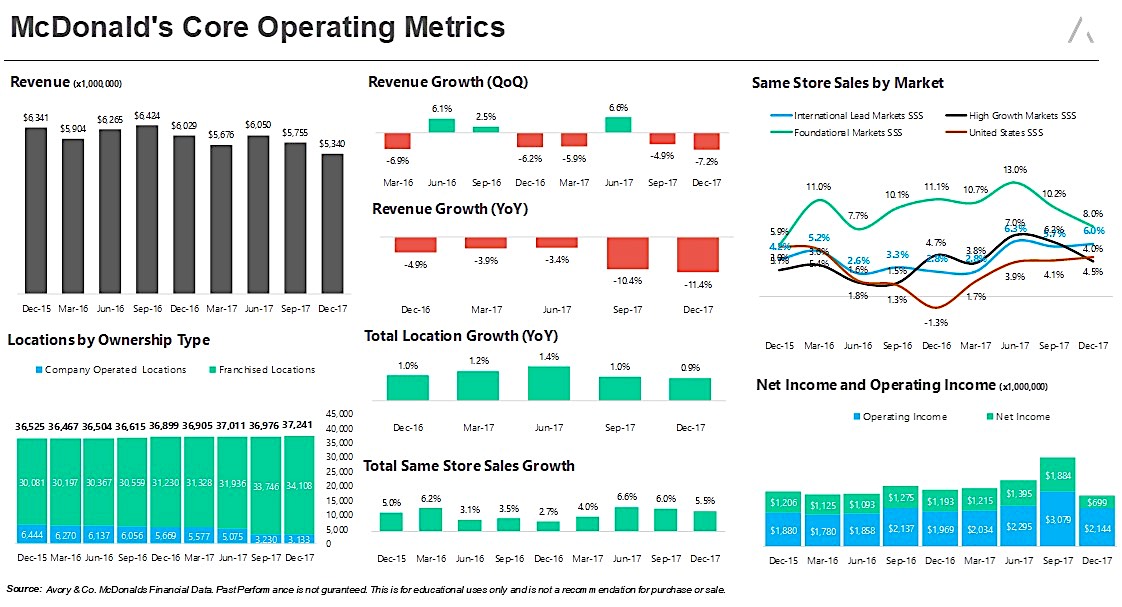

Overall, McDonald’s (MCD) report is fairly strong with same store sales up 5.5% globally.

McDonald’s overall revenues declined by 11% and 15% when adjusting for neutral currency. The downshift in revenue is from the refranchising of company owned stores. So less revenue up front however a leaner higher margin operation.

There are now only 8.4% of stores which are company owned compared to 37,241 stores in total.

The shift to franchise has provided a lift to margins as shown by the decline in revenue and pickup in operating and net income.

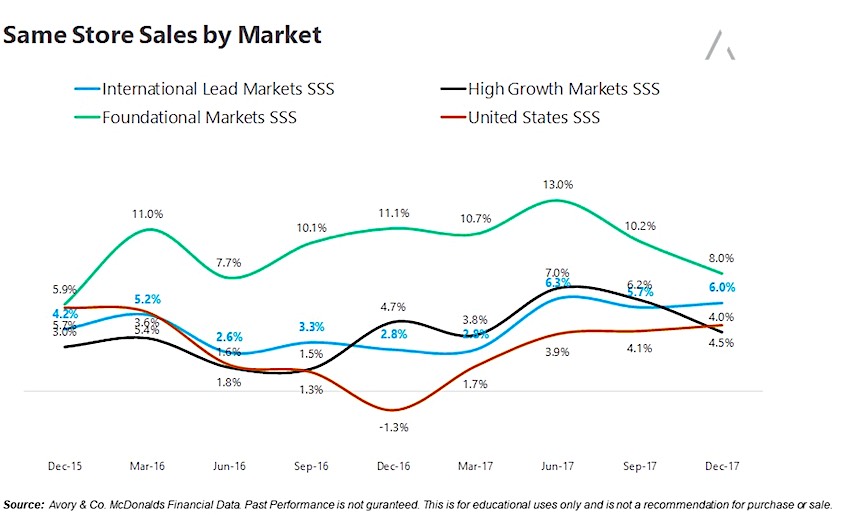

Here’s a glance at same store sales by category. Management did acknowledge that the lift in traffic and sales was driven by the dollar menu. We think this is good for consumers but will likely spark a price war in the future as it did year back.

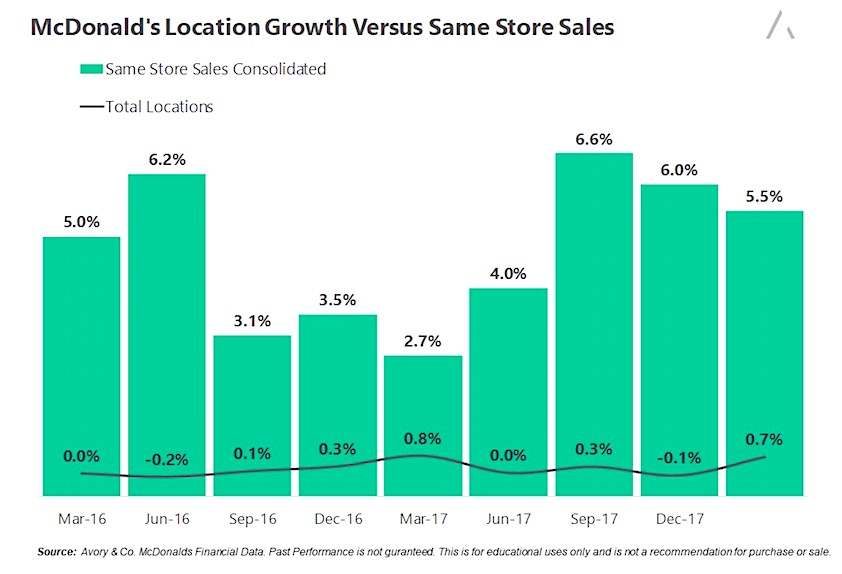

Lastly, here’s the combination of location growth and global same store sales. It’s always good to see more stores, more traffic and higher margins as the compounding effect is material.

Overall company operations remain firm however as we have expressed recently there’s a significant amount of optimism on a valuation basis here given the forward growth profile.

Disclaimer from author: THIS IS NOT A RECOMMENDATION FOR PURCHASE OR SALE OF ANY SECURITIES. AVORY & CO. IS A REGISTERED INVESTMENT ADVISER. INFORMATION PRESENTED IS FOR EDUCATIONAL PURPOSES ONLY AND DOES NOT INTEND TO MAKE AN OFFER OR SOLICITATION FOR THE SALE OR PURCHASE OF ANY SPECIFIC SECURITIES, INVESTMENTS, OR INVESTMENT STRATEGIES. INVESTMENTS INVOLVE RISK AND UNLESS OTHERWISE STATED, ARE NOT GUARANTEED. BE SURE TO FIRST CONSULT WITH A QUALIFIED FINANCIAL ADVISER AND/OR TAX PROFESSIONAL BEFORE IMPLEMENTING ANY STRATEGY DISCUSSED HEREIN.

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.