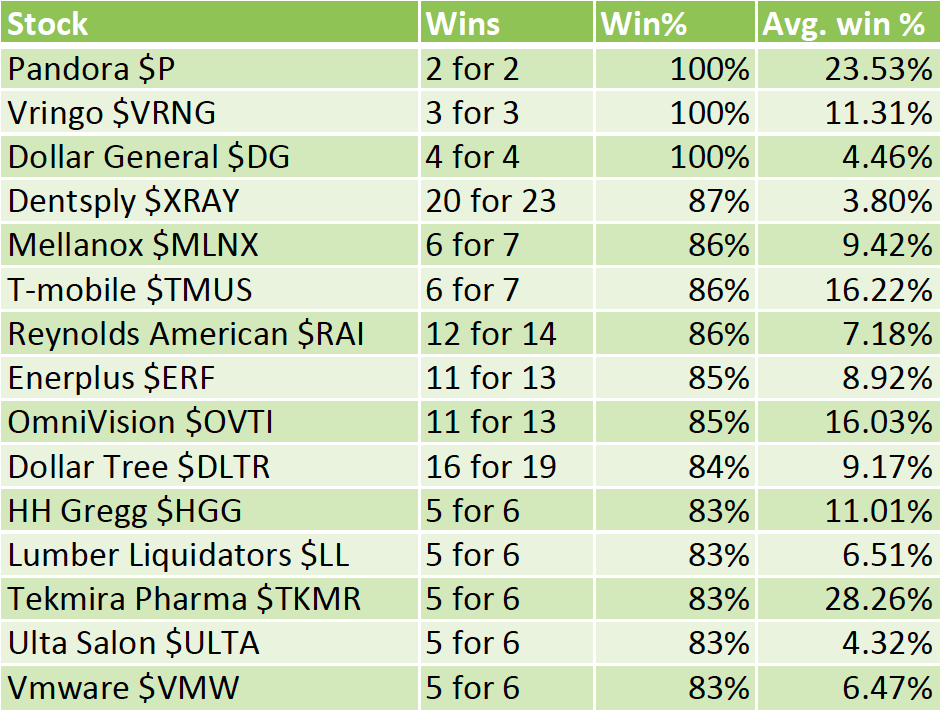

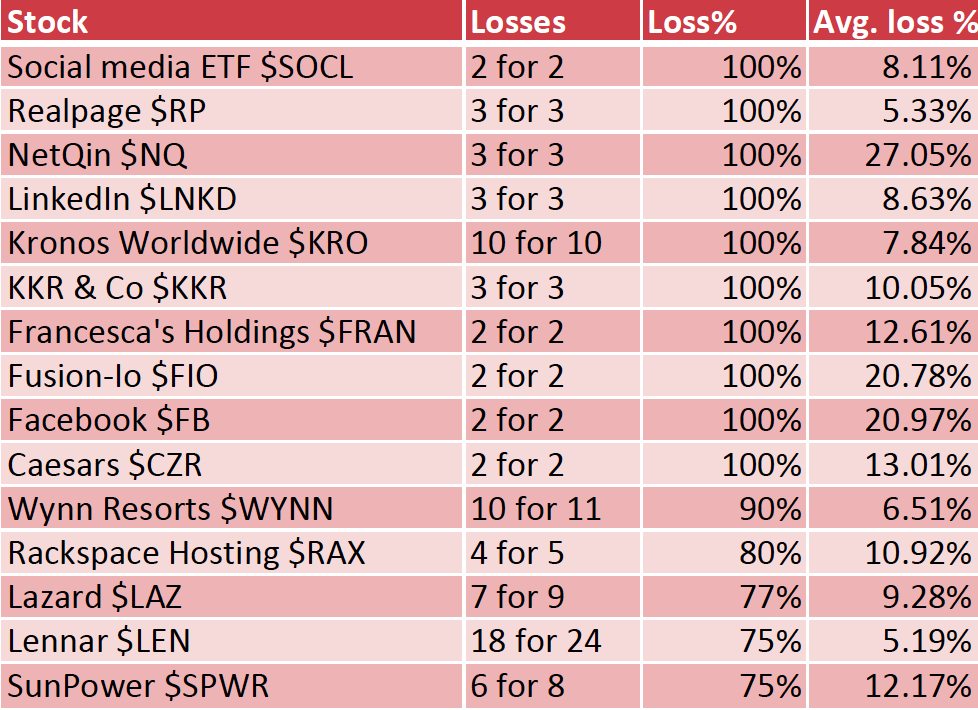

The month of May is typically a volatile month for the stock market. So the seasonality list for this month is very interesting. Let’s take a look at some of the stocks and ETFs that show strong and weak May seasonality trends. Check out the tables below.

The month of May is typically a volatile month for the stock market. So the seasonality list for this month is very interesting. Let’s take a look at some of the stocks and ETFs that show strong and weak May seasonality trends. Check out the tables below.

Strong May Seasonality — A couple of items worth noting: Stocks like OmniVision (OVTI) and Reynolds American (RAI) have tended to show strong May seasonality trends over the years. OmniVision (OVTI) has been higher on 11 of 13 occasions, with an avg. win % of 16.03%. Reynolds American (RAI) has been higher on 12 of 14 occasions with an avg. win% of 7.18%.

Weak May Seasonality — A couple of items worth noting: Kronos Worldwide (KRO) has never had a winning May in its history. It’s been lower on 10 of 10 occasions with an avg. loss % of -7.84%. Also, Wynn Resorts (WYNN) has shown consistent weak May seasonality trends over the years. It’s been lower on 10 of 11 occasions with an avg. loss % of 6.51%.

Data for tables from paststat.com

The past is not necessarily a predictor of the future, so there should definitely be more due diligence done. This post is simply intended to generate some trading ideas for further vetting for the month of May. Thanks for reading.

No positions in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.