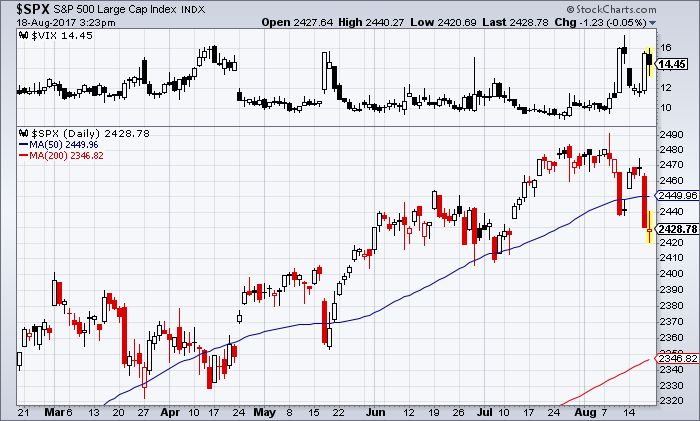

While the noise of the political environment can be deafening to the point of distraction, the uptick in stock market volatility (INDEXCBOE:VIX) over the past week comes after a period of remarkable calm.

By some measures the S&P 500 (INDEXSP:.INX) has recently completed the calmest three weeks in its history (closing within 0.3% of the previous day’s close for 15 consecutive days). The summer-time trading lull can be better characterized as a 2017 year-long lull as volatility has been notably absent for much of the year. With yesterday’s decline, there have now been seven daily changes (up or down) in the S&P 500 in excess of 1% in 2017, with three of those coming over the past six trading days. For perspective, there were 48 1% moves in 2016 and 72 such moves in 2015.

While headline writers can attribute this uptick in volatility to any number of geo-political uncertainties, this after-the-fact attribution looks past the evidence that has been accumulating beneath the surface of the stock market.

Our weight of evidence indicators turned neutral in late July as we saw evidence of excessive optimism building in the sentiment data. While optimism is now ebbing and some shorter-term indicators point to some degree of pessimism, sentiment overall remains a headwind for stocks. On top of this, seasonal patterns have become more challenging (after providing tailwinds in the first half of the year, seasonals now are neutral at best) and market breadth, particularly on a shorter-term basis, has started to deteriorate. Longer-term breadth trends do remain positive at this point, but with the list of new lows expanding and a decreasing percentage of stocks trading above their 50-day averages, the risk of the first meaningful pullback in stocks in over a year is on the rise.

Importantly, the longer-term backdrop remains largely supportive. Bond yields remain relatively low and industrial metals breaking out to new multi-year highs (Copper and Aluminum are near their highest levels since 2014, Zinc is at its highest level since 2008) suggest that the global economic recovery remains intact. While stocks may well be overdue for a correction (the current stretch without a 5% pullback is the longest in more than 20 years), there is little evidence at this point that the cyclical bull market that emerged in early 2016 has run its course.

The BottomLine: After a period of remarkable calm, investors are being confronted with an uptick in volatility. News headlines remain a distraction, but weight of evidence argues for continued caution.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.