I am often asked what is the best market to create intraday trading strategies.

There are maybe literally one million factors – both market related and personal – to answer that question, but one way to try and attack this question is to look at the amount of money each market moves per day and use it as a gauge of what kind of opportunity exists in each market.

I, as well as many before me, have stated that a trading system should match your personality to some extent and more specifically match your risk tolerance. Some traders can stomach more volatility while others prefer more “consistent” or subdued markets.

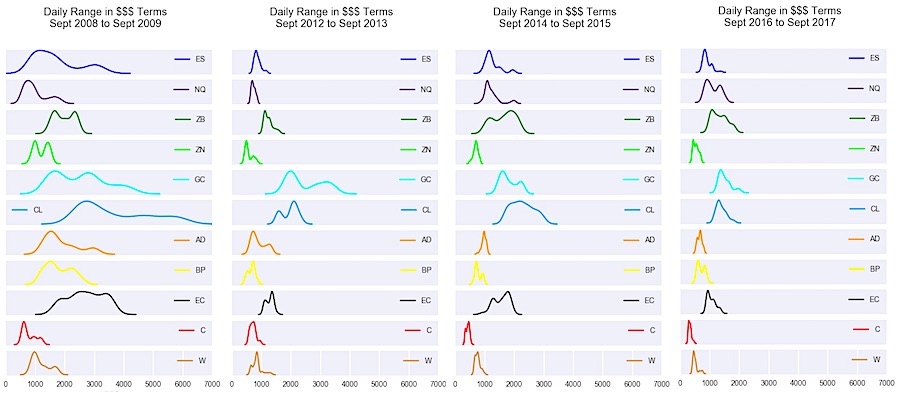

In this post, I’ve decided to show visuals of one year of daily ranges (expressed in dollar terms) for some major futures markets. It is amazing how these distributions change over time (importance of having robust and dynamic systems) but their relative relationships remain pretty similar. Probably something I will blog about in the future.

Note: I could have normalized further by taking range as a percent of the closing price or something else but hopefully you get the main point. Results were not very different.

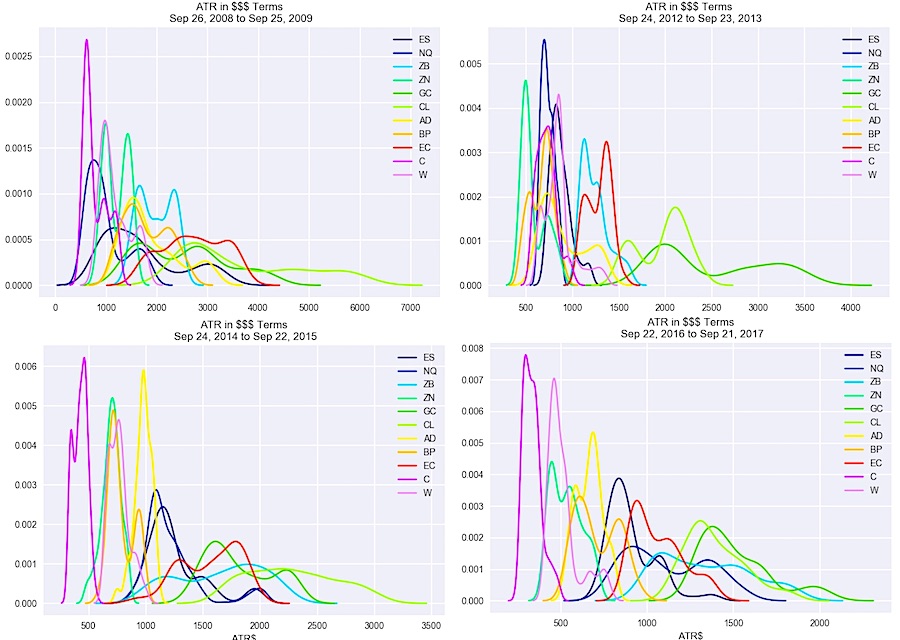

Back to the matching a trading style with your personality point… the more risk seeking trader or shorter time frame trader would tend to prefer markets like Gold and Oil who show more platykurtic distributions (fatter tails). On the other hand, traders looking to avoid big one day swings or large spikes might tend to prefer Corn or equity indexes as they’ve shown more leptokurtic distributions.

Another (unrelated) point… where has all the volatility gone? Suppressed because of the Fed or the market becoming more efficient/democratized, etc.? You can fit your own narrative but for most short-term traders it’s anything but an ideal day trading environment! The point is, when building trading systems (or trading in general) it is important to know what markets offer what types of opportunities.

I have also created the same visual above but in one chart. I think it might be helpful to view it both ways.

Over at Build Alpha, we have tools that can help anyone, even those with no programming capabilities to do simple and complex testing. Thanks for reading.

Twitter: @DBurgh

No position in any of the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.