When I am asked to do an interview on the media, the producer(s) ask for my notes on market conditions.

As I will appear at 9 PM ET on CNBC Asia First in Singapore, here are the comments I sent them earlier today.

As the S&P 500 etf (SPY) corrects a bit from the recent run up to all-time highs, we still have keen eyes on other sectors.

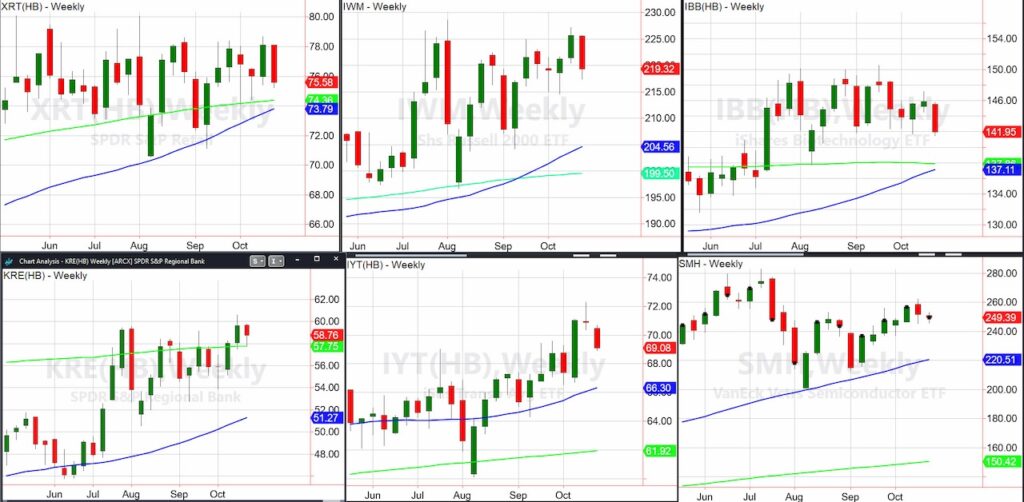

Looking at four areas of the Economic Modern Family:

Retail XRT, Small Caps IWM, Regional Banks KRE, Biotechnology IBB, are all up big since last October and are paused for a breakout over recent highs if

- The yields soften from here

- The dollar DXY breaks down back under 103.70 area

Thus far, the narrative remains more soft landing than anything else, while gold remains the mirror reflecting potential cracks

Hence, for equities we are recommending more patience especially ahead of the election.

The market is choppy and volatile

And we still see commonalities among the 2 Presidential candidates

- Pro bitcoin-which looks also ready to break out of its consolidation

- Not dealing with soaring debt and rising government spending

- In favor of defense spending and reshoring goods to US

Elsewhere,

Good news on Tesla yet a run to resistance unless clears 260

Gold taking a pause but remains resilient

Silver big breakout over 32.50 now support

Palladium just had a huge run

Oil holding $70

Natural Gas looking better-watch the chart of LNG

Inflation is not going down, but not rising as of yet-it could but until it does, we believe that outside of current positions in gold and silver, commodity investing is also a bit premature

We have eyes on China.

After a huge run, many names like Alibaba, are on pause awaiting softer US dollar and election results.

Tariffs are a concern; hence BRICS has moved forward but not yet impacting US markets.

While our models remain long the indices, we are advising our clients to sit back and wait.

Our current positions have protective stops in place while we wait in case the market has a more serious correction

Plus, I am advising clients to watch the ETFs (XRT IWM IBB KRE) rather than individual names for the next investments once the trading ranges are reconciled.

There will be no weekend Daily. Look for the weekly Outlook published on Sunday.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.