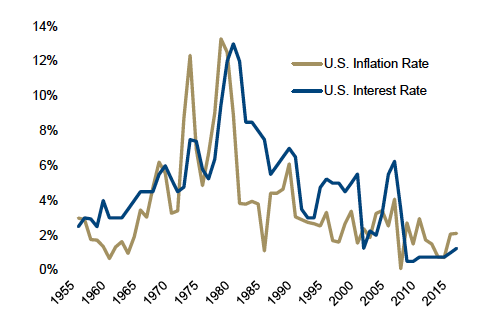

The U.S. Federal Reserve has a dual mandate of targeting 2% inflation and maximum employment. They are doing a great job of achieving their employment goal with only 4.1% of Americans looking for a job and not being able to find one.

However, targeting 2% inflation has been elusive.

Stephen Poloz and the Bank of Canada have half as much to worry about as they only target inflation. Up until recently, fears have been of deflation (where aggregate prices trend lower). Sentiment has pivoted lately with U.S. wage growth accelerating quicker than expected and inflation exceeding expectations. Some even blame the recent market sell-off on this concern over inflation, which would lead many to think inflation is a bad thing. That is not necessarily the case, as moderate inflation can be beneficial to the economy.

The reason why this moderate increase in aggregate prices is viewed with caution is because if inflation moves above and beyond the FED’s target their best tool for reining it in is by hiking short term rates. A rapid increase in rates makes it more expensive to borrow, disincentivizing companies to invest and hire. It lowers the future value of cash flows (a higher discount rate lowers the present value of future earnings) which is negative for equities because the multiple paid for those cash flows will be lower, which decreases the price investors are willing to pay for a stock. And of course higher short term rates is negative for bonds.

So what would cause the FED to accelerate the pace of rate hikes?

The simple answer, inflation. Chicago FED President Charles Evans said earlier this month “Suppose inflation picks up more assuredly, as many expect. Then, we still could easily raise rates three or even four times in 2018 if that were necessary…. and I would support such a faster pace if the data point convincingly in that direction.”

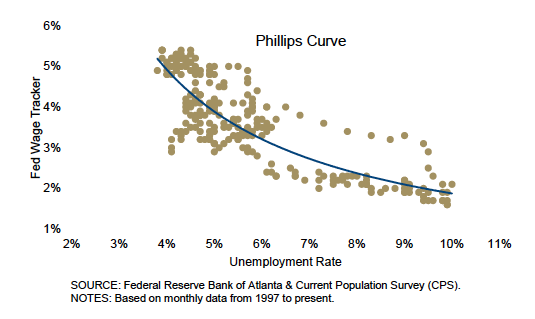

One of the easiest ways for inflation to accelerate is wage growth. Labour costs dominate input cost in many industries, labour scarcity will eventually drive up prices. The Phillips curve, an economic model developed in the middle of the last century, shows the historical relationship between changes in wages and the unemployment rate. Some have attested the Phillips curve is dead as we had unemployment falling for so long before wages started to rise. However, it seems we may be entering the steeper part of the curve, where now even small changes in unemployment may lead to bigger changes in wages.

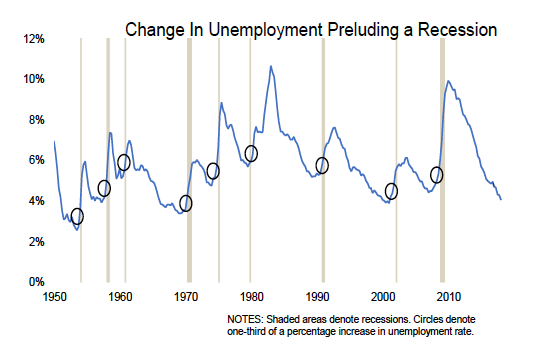

The FED has had low inflation as the backstop to gradually raise rates. If that changes and they accelerate the pace of rate hikes, that could cool growth and at some point reverse employment growth. Which could be a big problem, looking back at previous cycles there has not been a point in time where unemployment raised by more than 30bps, which was not followed by a recession. Albeit wage growth is accelerating, it is still not at a level that precedes a major pullback, looking at the past three recessions.

Much of the emphasis of this report and our research is on the U.S. but the stark reality is any major economic concerns for our neighbours to the south will adversely impact our economy as well. Additionally, the economic backdrop is much the same in Canada, making many of the arguments outlined applicable in Canada as well.

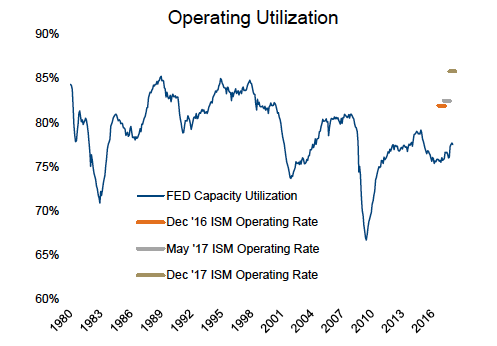

The Bank of Canada quarterly Business Outlook Survey highlighted that “capacity and labor pressures are becoming more apparent and are stimulating firms’ employment and investment plans”. Firms reporting capacity pressure moved to the highest level since 2007, right before the recession. The other main points they highlighted in the subsequent press conference, were that they see signs of strength in investment plans and strength in hiring.

Why has inflation been so low until now?

Excess capacity

The Great Recession left North America with swells of excess capacity. The anemic economic growth over the recovery has meant that sopping up that capacity has been a slow process. But now, nine years later much of that capacity has been soaked up. The FED has its own methodology for measuring manufacturing capacity which is not overly encouraging. However, the ISM manufacturing operating rate paints a different picture. The FED model asks companies to assess their capacity regardless of bottlenecks for feedstock or labour that are causing friction. The ISM, on the other hand, takes those constraints into consideration and that is why we think if we do see an acceleration in operating utilization, it could lead to further upward pressure on wages and inflation.

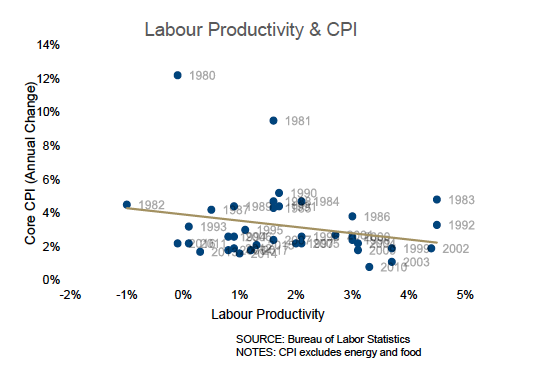

Productivity through technology

Another likely cause of this period of subdued inflation can be attributable to labour productivity. Quoting former FED Chairman Alan Greenspan, “innovations that spawned new computer, telecommunications, and networking technologies, which, especially in the United States, have elevated the growth of productivity, suppressed unit labor costs, and helped to contain inflationary pressures.” That quote dates back to 2005 from a guy with a pretty good beat on the inflation rate. Today, thirteen years later, that statement is still true.

As an example think about the “sharing economy” Uber has had a deflationary impact on taxi prices, Airbnb has done the same for hotel rates, particularly in smaller markets with less business travelers. They have done this by utilizing otherwise idle or underutilized assets. Technological advancements in hard goods have had a deflationary impact as well. With the camera in your smartphone being better than a professional camera from just a few years back, camera makers have had to drastically lower prices to defend unit sales. A similar analogy can be made for TV prices. The prices of TV and photographic equipment have fallen 73% and 24% respectively since 2010, according to the U.S. Bureau of Labor Statistics.

Conclusion

The secular shift, which now seems underway, from deflation to inflation still does not appear to be fully priced in and we expect it to cause bond yields to creep higher. Not only is this a negative for bond prices but also for interest rate sensitive equities and equity multiples because as the discount rate rises, future cash flows are worth less. This will place further emphasis in stock selection and sector allocation. Should this play out the active managers may come back in to vogue after years of aggregate underperformance to their passive foes.

Charts are sourced to Bloomberg unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.