Technical indicators continue to point to further gains in the stock market. The Dow Transports recently hit a new high confirming the record high by the Dow Jones Industrials (INDEXDJX:.DJI) – a Dow Theory signal.

In addition, the S&P 500 Index (INDEXSP:.INX) and NYSE Composite Index (INDEXNYSEGIS:NYA) are are reaching new high ground.

The fact that 2200 issues comprise the NYSE Composite provides a good argument that the rally is broadening out. The improvement in market breadth is also seen in a jump in the weekly new high list from 229 issues last week to 323 this week. Disappointing in the breadth analysis is the failure of the percentage of S&P 500 industry groups in defined uptrends to expand. Last week 72% of the groups within the S&P were in uptrends as opposed to 76% three weeks ago. We would need to see, however, the groups in uptrends drop below 60% before this valuable indicator would turn negative.

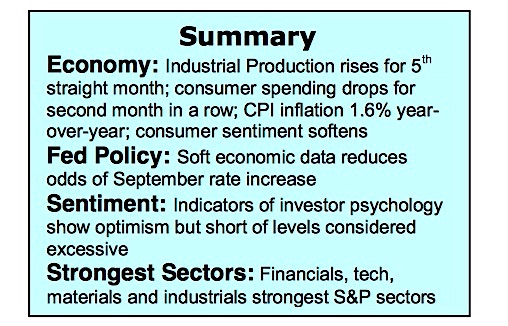

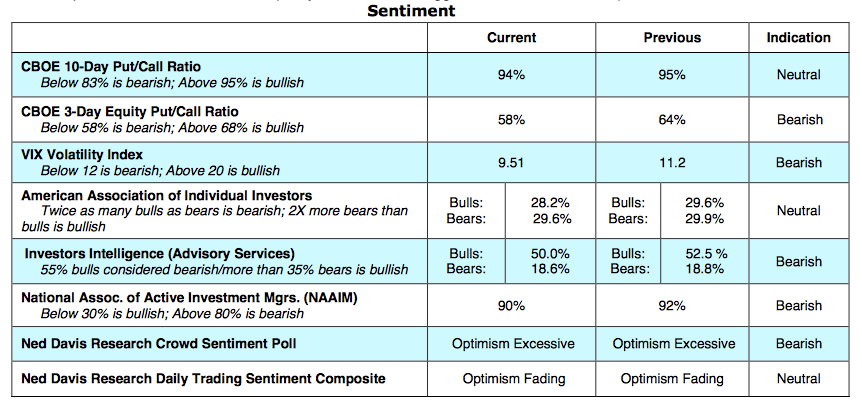

Most encouraging that the rally has legs is the absence of investor enthusiasm despite the record close on Friday. The weekly survey from the American Association of Individual Investors (AAII), the data from Investors Intelligence (II) and the report from the National Association of Active Investment Managers (NAAIM) all show a drop in bullish sentiment last week. Historically, prior to an important peak optimism is widespread, deeply seated and excessive. Since there is an inverse relationship between sentiment and liquidity, the recent surveys would argue there is sufficient cash to push stocks higher.

Many point to the low readings for the CBOE Volatility Index (INDEXCBOE:VIX) that a top is near. But the VIX can stay low for very long periods of time and is not as reliable for signaling market tops as it is at forecasting a market bottom.

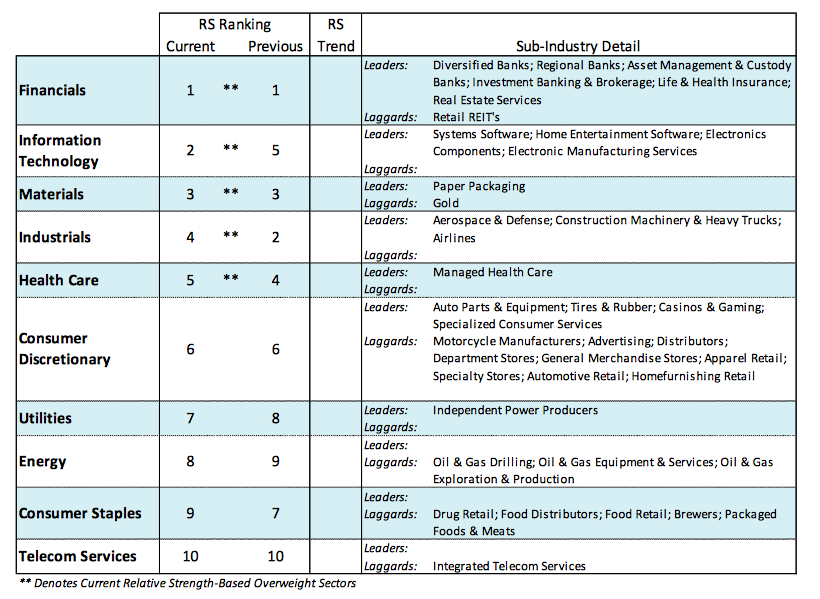

At the beginning of the year it was widely believed that the U.S. economy would break out of the 2.00% GDP growth pattern that persisted over the past eight years. Many economists believed that inflation would rise causing the yield on the benchmark 10-year Treasury to climb to 3.00% or more triggering a sharp rise in the dollar. It was broadly felt that this sequence of events would serve as a headwind for stocks in the second half of the year. As we enter the third quarter, evidence is mounting that contradicts earlier forecasts as inflation remains dormant, the yield on the benchmark 10-year Treasury is unchanged from January and the U.S. dollar is in a slow but persistent slide south. Although the U.S. economy continues to move slowly ahead, the fact that wages have not advanced helps keep corporate profit margins high and a weak dollar allows U.S. multinationals to enjoy the benefits of the global economic expansion. This resulted in a surge to record highs by the Dow Industrials, Dow Transports and S&P 500 Index. While high valuation levels remain a concern as well as the longevity of the bull market, this is offset by the fact that corporate earnings have recovered from the slump two years ago and the rally to new highs this year has been slow and measured absent of a blow-off phase that typically accompanies a market peak. The path of least resistance is expected to remain to the upside until either central bank policy becomes more aggressive and/or investor optimism becomes extreme.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.