Market Overview:

Frustration is a common feeling to experience in trading. Shorter term traders can experience it on an intraday basis and for slightly longer term traders it can take days or weeks to play out. This year the S&P 500 Index fell around 11% and has nearly recovered that move in the past few weeks.

Feelings of frustration usually come out of trying to understand “why” the market is doing something, getting attached to an opinion, and struggling to adapt when the market changes. While it’s good to recognize change, it’s hard to believe that the market environment has changed significantly in the past few weeks despite the fast move higher for stocks.

Over time, longer term themes will either resume or the stock market will reverse. It’s too early to say that the longer term themes have reversed despite the sharp rally and “hope” coming back into the stock market. That hope is represented by an uptick in investor sentiment from poor to neutral.

The market is frequently presented as being either bullish or bearish over some period of time. In reality, the market isn’t always trending and directional calls tend to oversimplify price action and lack context. Right now, it seems like the market is in a wide range distribution that looks bullish if you’re talking to a television camera.

Negative investor sentiment has also provided good fuel for the recent rally and I suspect that many traders did not participate on the long side. Despite the early strength we saw in February, many people wanted to believe that the stock market was overbought and had “gone too far.” Shorts seemed to get squeezed the whole way up and, in some cases, are probably still getting squeezed. When everyone hates a market move it’s usually a good time to be on board. So investor sentiment is an important indicator to be aware of.

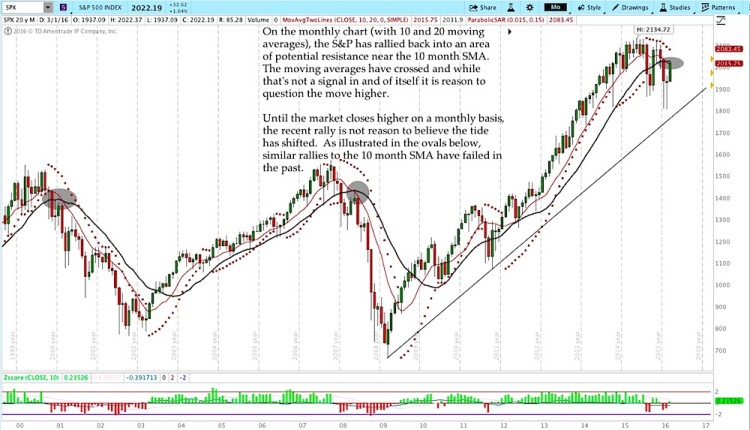

While the short and intermediate term trends are positive, the longer term picture is still negative. We all know that the market has been able to demonstrate some great strength over the past few weeks. At the same time, when we step back to the longer term timeframes, the picture hasn’t changed. If anything, the market could potentially be setting up for a great short on the longer term timeframe.

The chart below is a monthly chart of the S&P 500 Index ($SPX):

Gold is another market that is worth mentioning in the context of sentiment. The media seems intent on pointing out that too many people are long Gold. The obvious implication is that Gold prices have no reason to go up.

To help the media, the market is stretched to the upside on a short term basis so it’s easy to build up fear about buying the market. Fortunately for Gold and Gold bulls, those themes could suggest a shift in trend. The monthly chart below shows the recent move in the Gold ETF ($GLD).

Despite the media story, on a price basis, Gold had a monthly breakout in February and depending on your timeframe it might actually be a favorable time to buy Gold for a long term trade. The fact that the media does not want you to buy Gold is another favorable sign. Note that this is not a recommendation to buy Gold; it’s just an example of a potential shift in trend accompanied by negative sentiment.

It’s easy to get caught up in the fast moves on shorter term and even daily and weekly timeframes because those moves have the potential to cause great short term pain. At the same time, it’s important to recognize longer term themes and what might play out in the coming weeks and months. There’s reason for caution when the sentiment begins to shift from bearish to bullish and the longer terms charts are still broken.

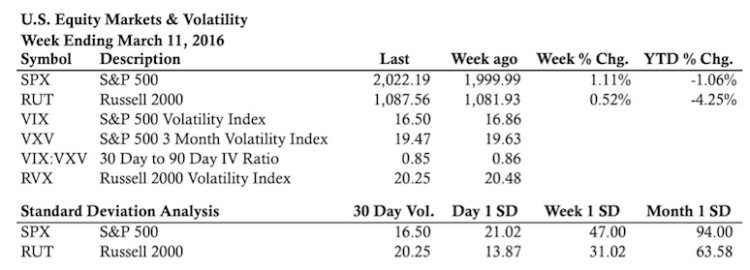

Market Stats:

Looking Ahead:

Even though we’ve seen a strong move higher over the past few weeks, I don’t trust it. The longer term picture has been and remains bearish and at some point the market has the potential to reverse lower. That scenario may take some time to play out, but it’s something worth keeping in the back of our minds. If the market does continue higher over the month of March and stage a positive close around or above the 2015 area, I’ll begin to question my longer term bearish sentiment. Fortunately, we’re a few weeks from that possibility.

The moves out there have been big and fast. Stay safe.

Twitter: @ThetaTrend

The author does not hold a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.