By Andrew Nyquist

By Andrew Nyquist

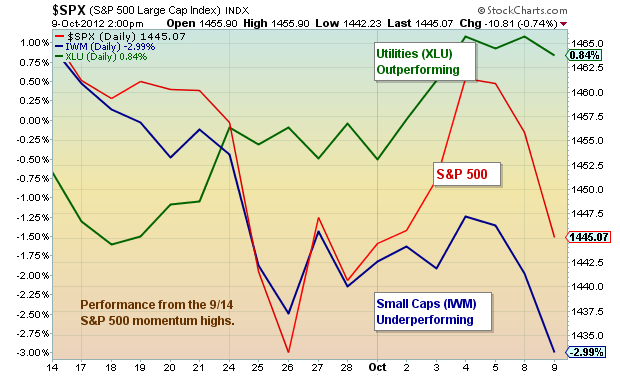

Last week I posted a chartology of the Utilities Sector (XLU) projecting a path higher and stating that outperformance by defensive sectors ” is not typically a bullish near term indicator for the equity markets.” In translation: Be Careful.

Well, a little less than a week later we are seeing continued outperformance by defensive sectors such as Utilities, while equities pull back. In the chart below, I have plotted price from the 9/14 S&P 500 highs for the Utilities, Small Caps (IWM), and S&P 500. It is clear that deterioration began last week and followed through this week. Just look at the drop and underperformance of the high beta/risk small caps.

Using the S&P 500 to gauge the broader market, I am seeing initial technical support at 1440, then 1430. But those are the obvious traditional lateral supports. I’m also seeing the potential for an A-B-C measured move to 1420ish (the initial breakout area). A sustained move under 1420 would likely cause technical damage that would need some time to repair.

Trade safe, trade disciplined.

———————————————————

Twitter: @andrewnyquist and @seeitmarket Facebook: See It Market

No position in any of the securities mentioned at the time of publication.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of his employer or any other person or entity.