The equity markets turned higher last week with most of the popular stock market averages showing gains of less than 0.5%. A single stock, Apple (NASDAQ:AAPL), accounted for most of the gains in the large-cap indices as the broad market showed more stocks down than up for the five-day period.

Although longer-term market breadth indicators remain positive, short-term breadth and momentum have turned down.

The past two weeks downside volume has exceeded upside volume by a ratio of more than 10 to 1 on two occasions. We would need to see at least one session where upside volume exceeds downside momentum by a like amount to feel confident that the downside momentum has been broken.

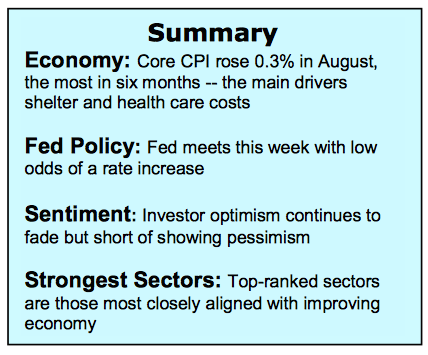

Entering the new week, the focus will once again be on global central banks. The Federal Reserve is meeting on Tuesday and Wednesday (and don’t forget about the Bank of Japan announcement early on Wednesday). The fed funds futures market has seen the potential for a rate increase drop from 24% to just 15%. Except for the strength in the labor markets, the latest economic data including retail sales and industrial production have been soft. Typically, the Federal Reserve raises interest rates when the economy is overheating, which is not the case in the present example. Given the uncertainty over the path of interest rates, the election, and seasonal tendencies for stocks to trade defensively in the September/October time frame a continuation of the current trading range is expected. Support for the S&P 500 (INDEXSP:.INX) is 2080 to 2120 with resistance considered to be in the vicinity of 2160 to 2180.

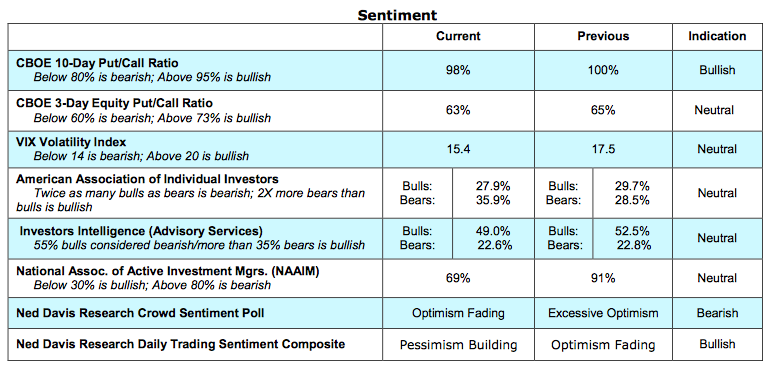

The technical condition of the market showed modest improvement last week but short of suggesting a breakout from the recent trading range is imminent. We continue to be concerned about some divergences that persist including the fact that the Dow Transports remain a distance from the previous high scored in 2014. Investor optimism, that turned problematic three weeks ago, has improved with many of the sentiment indicators now neutral. Given the widespread and excessive optimism that was present at the August stock market peak, a further buildup in pessimism is likely necessary before getting an all-clear from a sentiment perspective.

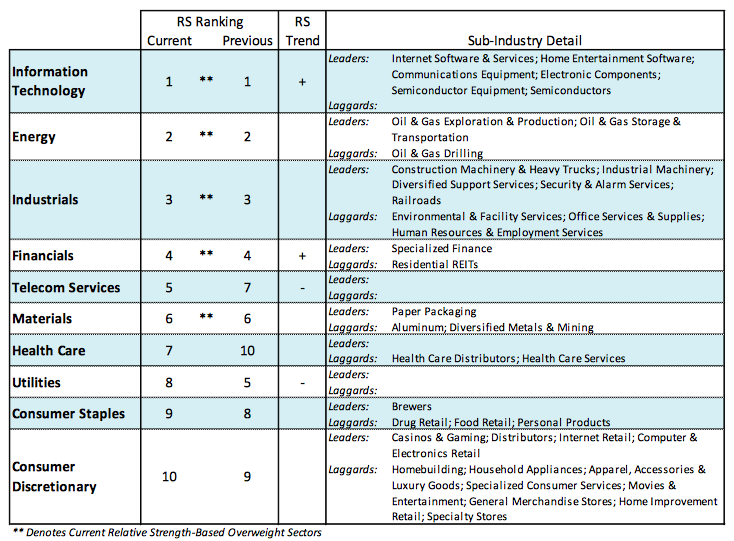

Active investment managers reduced their equity exposure last week, as the NAAIM Exposure Index fell from 91% to 69%, the lowest level in 10 weeks. A drop toward 30% would provide evidence of pessimism among active investors. The CBOE Volatility Index (INDEXCBOE:VIX) fell to 15 (a reading above 20 would argue that fear has entered and a market low is close). While longer- term breadth trends do remain favorable, the short-term has deteriorated with the number of stocks making new highs contracting as the new low list has expanded. The strongest areas of the market include technology, industrials and the financials that recently climbed in the relative strength rankings.

Thanks for reading.

Twitter: @WillieDelwiche

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.