Monthly Catch (Micro View on Stocks)

March 22 was an important day.

It was when President Trump talked about putting all his eggs in one basket of healthcare reform and the market actually gave its first signs of doubt. Not only is the market doubting Trump and all he has promised but it’s also typical to see the market ‘mark-up’ prices in anticipation of an event and then sell into the event based on the expectation price reflects the new information.

That happened the week of March 12th with interest rates (TNX) and financials (XLF) and US Dollar (GLD GDX SLV) so next I think it moves into the indexes (SPY DIA QQQ) and in time with Volatility (VIX VXX UVXY).

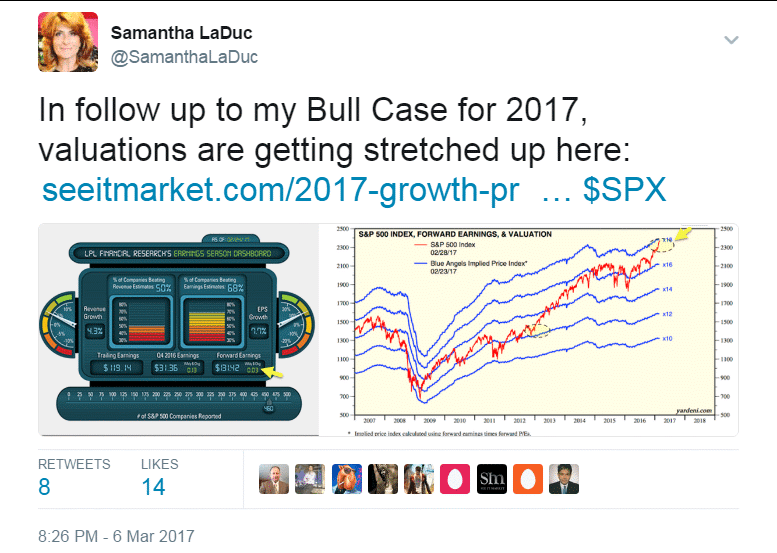

If you recall, my top thesis at the beginning of the month was that the ‘reflation’ trade had gone too far and rates were more than likely to pull back: buy the rumor, sell the news, or in this case 99% likelihood of FED raise would likely result in 99% likelihood they would talk it back. Both happened. US indices have fallen nearly every day since the FOMC raised the federal funds rate on March 15th. But at the end of the week (March 24), markets were still priced for perfection, despite a brief 1+% rug-pull in the S&P Tuesday and a 10% re-pricing in financials since March 15th.

I still like gold, silver and miners for more than a play on interest rate direction or hedge on inflation. It’s the only thing ‘certain’ to catch a bid when uncertainty rears its head, and with a Prez like Trump, what is certain? That’s not rhetorical. Also with VIX suppressed from delta-neutral hedging by the big boys or extreme complacency (read: bullishness) at these nose-bleed valuation levels, it seems another reason to buoy the metals and miners.

Top Call

Gold jumped on the Fed rate hike March 15 and Yellen’s more hawkish tone on inflation. My thesis going into it: If she’s right, gold goes higher. If she’s wrong, and the Fed rate raises don’t work (hiking when we don’t have sufficient growth or inflation), gold goes higher. Tweeted pre-FOMC and I still mean it:

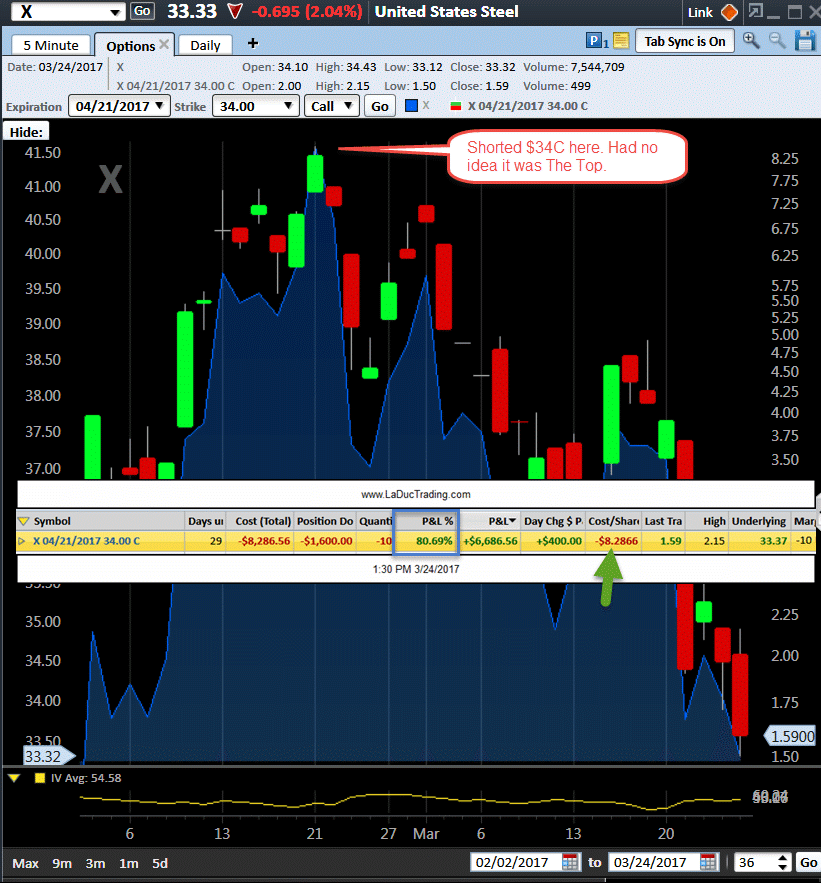

Top Trade

I started actively trading X short as a ‘deflation of the reflation” tell a few weeks ago. I probably traded this 15-20 times long and short but with this one particular trade I had no idea I had top-ticked and for that reason it wins Top Trade of the Month:

Top Tweet

Best timed anyway. Next day markets dumped and SPY finally had its first -1% day in 109 days.

Rising Tide Lifts All Boats (Macro View)

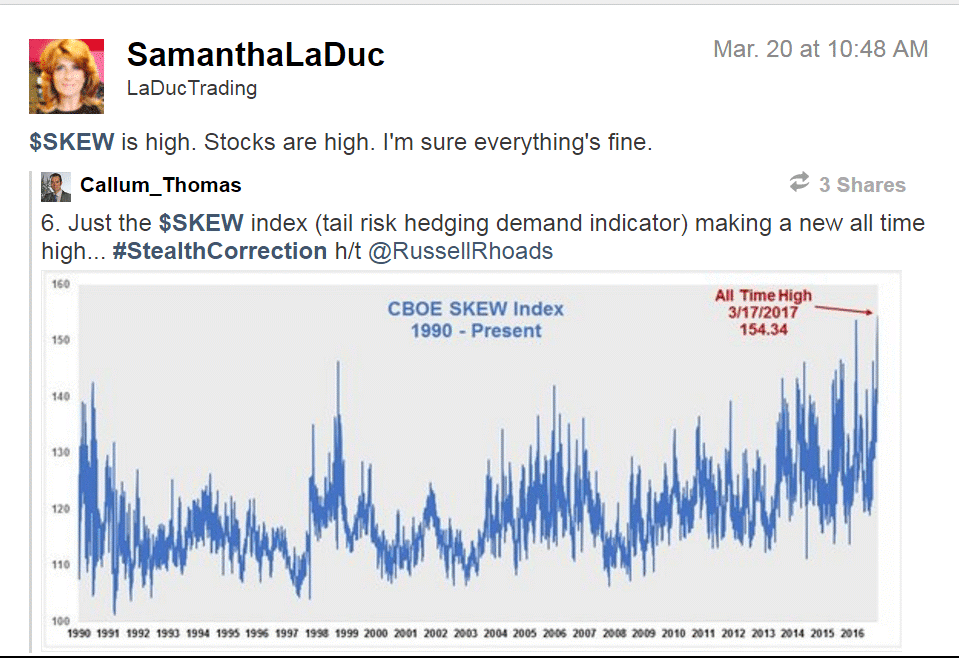

Both valuation and sentiment models are notoriously bad at timing market tops so when do valuations matter? When they get to extremes maybe?

Ben Carlson, writing at Bloomberg, highlighted research from Star Capital showing that markets go down a lot more when valuations are expensive than when they are cheap.

What about fundamentals? Based on Busigin’s analysis, the market is pricing in real EPS growth of 5%, which is roughly 75th percentile of historical experience. But real unit labor costs is in the 96th percentile. The Fed is about to embark on a rate hike cycle, something has to give.

As Humble Student points out, disparities between expectations and hard data have often been resolved with corrections, not bear markets. For a bear market to occur, the Fed has to tighten sufficiently to push the economy into recession.

So is Recession a likely thing, really?

The future of lending growth looks weak as reported loan demand leads C&I loan growth AND reported loan demand hit negative growth for the first time since the financial crisis. This is a signal recession risk is high.

Bank stocks have rallied, but the problem is there is actually less demand for loans. That normally leads to less lending. pic.twitter.com/X8yMOgqBqO

— VP Research (@VrntPerception) March 22, 2017

CONTINUE READING ON THE NEXT PAGE…