The following is from LaDuc Trading’s premium newsletter (sent out on March 26) – The Monthly Fishing Report & Weather Forecast.

Either way, the rumor of pro-growth fiscal policies, which has fueled our market’s advance since Donald Trump took power, has met with the reality that the Market is Priced For Perfection with no room for White House policy missteps.

Well, the health care bill was DOA Friday. Of course, I fully expect all Trump Tweets to redirect attention to promised Tax Reform, but with every speech and tweet filled with policy superlatives but empty on details, I find a market that is finally rethinking its trust in a man who is not trustworthy.

It is a tale. Told by an idiot, full of sound and fury, Signifying nothing. Macbeth Act 5 …

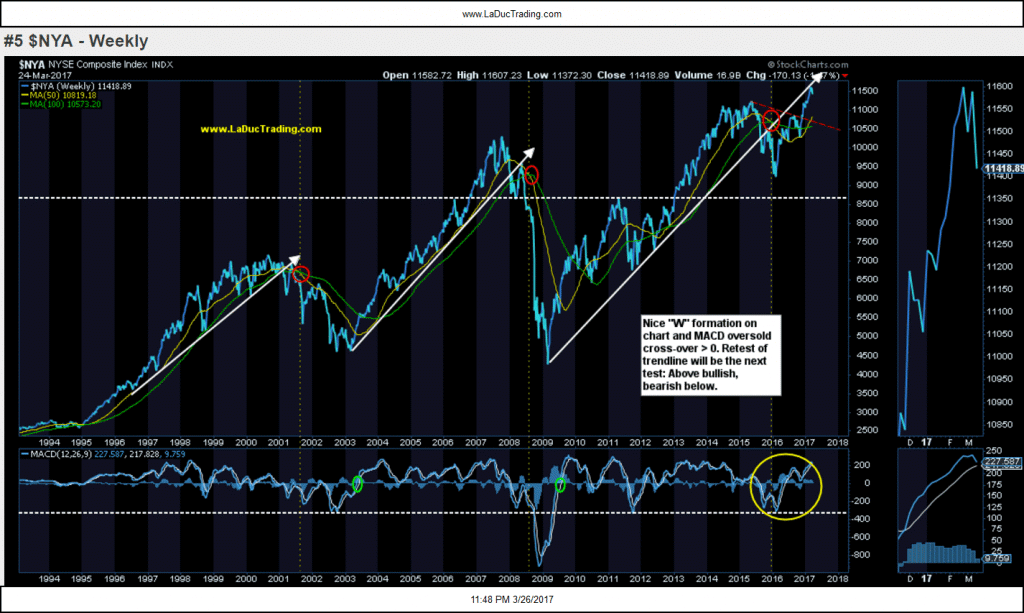

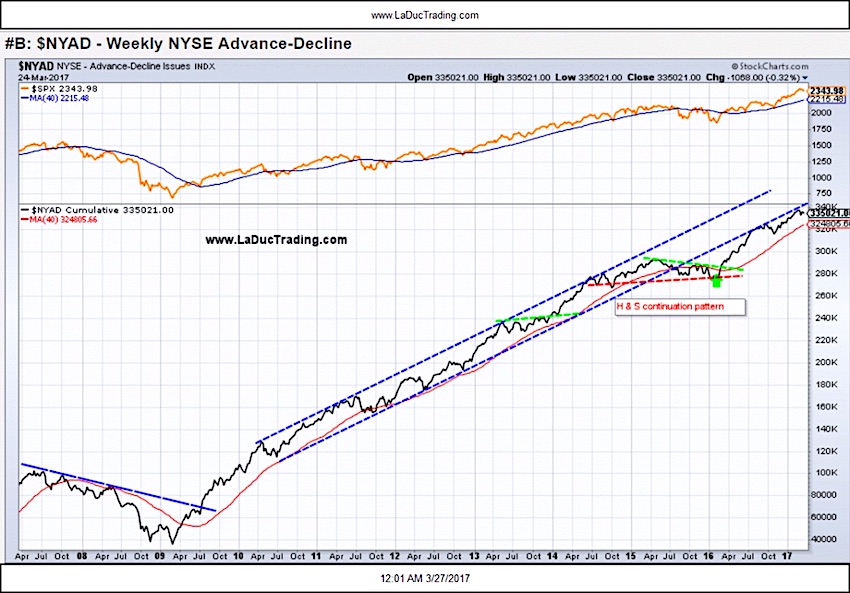

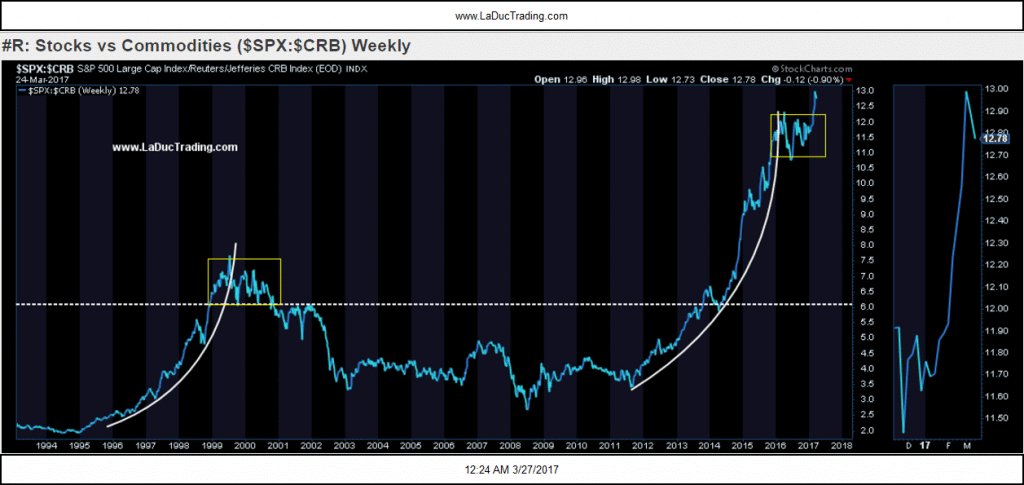

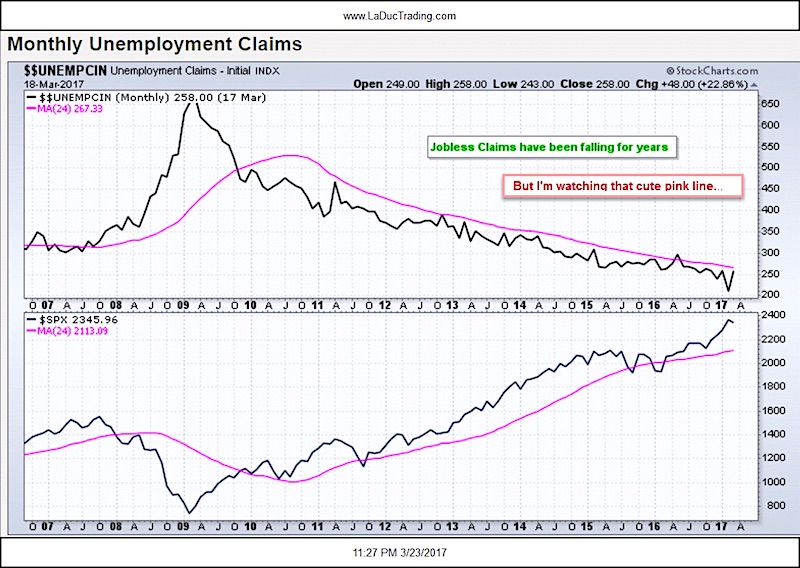

Rethinking is often followed by Repricing. The much exalted “reflation trade” has been tested first in commodities (Big Tell for me was steel…then oil—short both), then interest rates (financials…dollar—short both) and now the market is showing signs of rethinking the upside of Washington policy’s impact with repricing of indexes (and with that long volatility and gold/silver/miners).

Watch for the generals that led the advance to start to retreat a bit while they wait for their soldiers to catch up: AAPL, BA, IBM, and HD as just these four stocks added $77 or 654 points to the Dow–more than half of the index’s 1150-point rally post election.

Potential Upcoming Market-Moving Events

Most Notable: End of Quarter ‘window dressing’ or ‘Mutual Fund’ mark-up should showcase the last week of March, so this will help relieve any serious downside from occurring this week. Wednesday, the UK may trigger Article 50 but it won’t even register. Various Fed speakers throughout the week may telegraph or talk back more hikes in 2017 as they attempt to balance their balance sheet, but it won’t even register. It will be curious how Friday fares with important economic data on US personal income/spending/PCE and Chicago PMI (predictor of ISM coming later), but it won’t likely register.

Another bullish spot could be OPEC recommending extended cuts by another six months but the reality is we are in a supply glut of oil and futures speculators are wrong-sided and the only way out is liquidation. But with EIA reporting Wednesday, expect an oversold relief bounce. As for Europe, a small feather in the Euro cap is that Merkel’s party won support this weekend and will live to fight another day, specifically Sept 24 election, which helps the stability of the Euro. At least until the French elections (April 23rd with run off May 17), then all bets are off.

Fish Are Jumping (Sector Rotation)

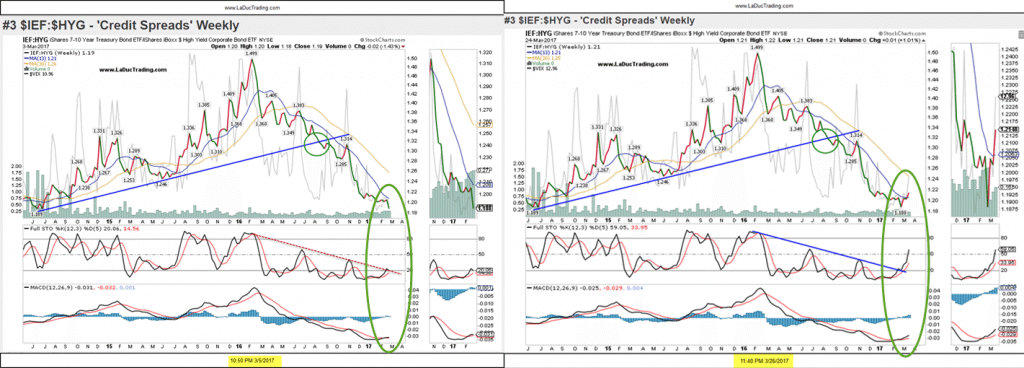

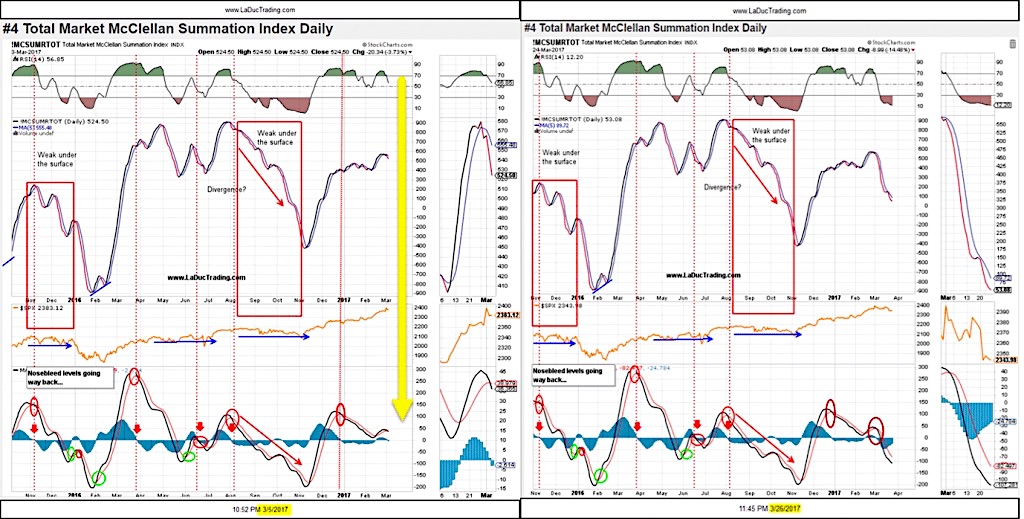

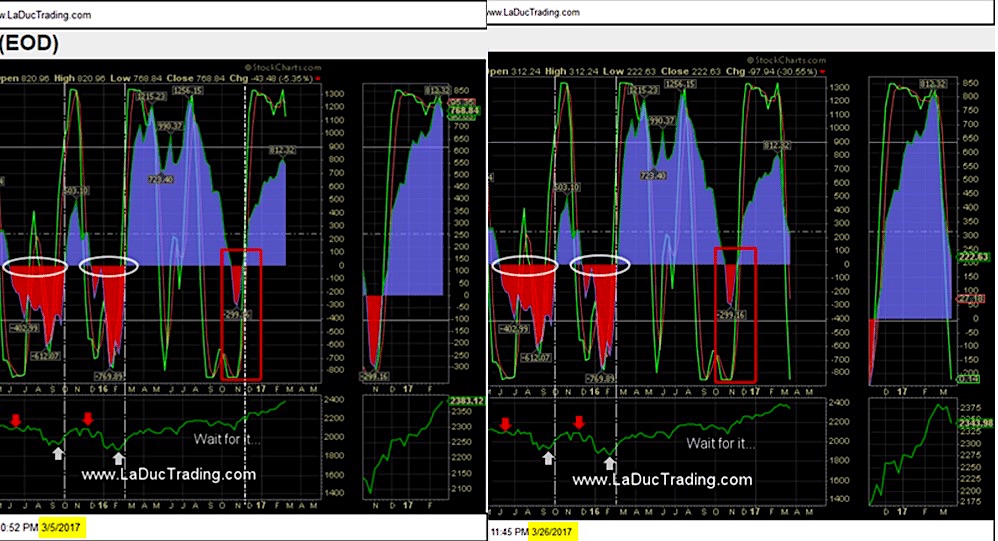

Here are the charts that formed my bearish thesis that March would introduce lots of shorting opportunities:

CONTINUE READING ON THE NEXT PAGE…