We (all the residents on our street) have had an ongoing battle with a neighbor.

Since we live in a historical district, you are not allowed to post billboards on bordering walls.

Yet, this neighbor feels compelled to keep posting controversial material.

Every time something goes up on the wall, inevitably, someone comes by and tears it down.

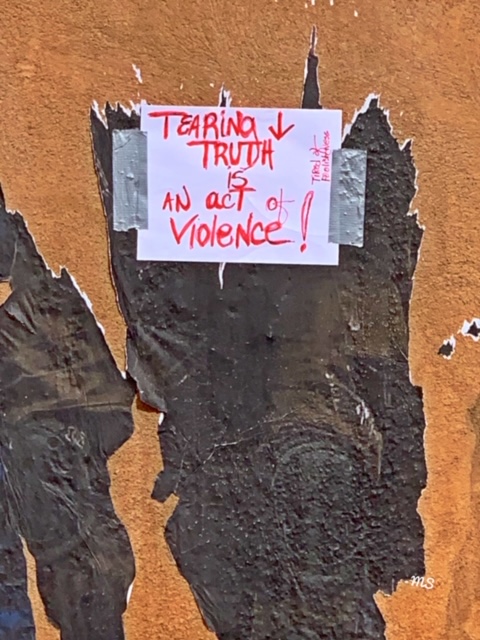

After the city got involved and ordered them to cease and desist, the neighbor posted this sign, “Tearing Truth Is An Act Of Violence.”

On the side of the sign it reads, “Tired of Foolishness.”

Emboldened by their own self-righteousness, the billboards (there are several) have not come down.

That started me thinking about truth, tearing of truth, self-righteousness, and foolishness and how they relate to the market.

First off, what is truth in the stock market?

Truth can be interpreted in many different ways.

One person’s truth is another person’s falsehood.

For instance, two of my Daily’s were dedicated to the Volatility Index and that after seeing a unique technical pattern, a big move (probably down) was coming.

That “truth” was met with sneers by those who wondered how I could question their truth-or the one that showed the S&P 500, NASDAQ 100 and the Dow making new all-time highs.

One lesson of trading, is that with truth open to interpretation, best to not violently (metamorphically speaking) tear down anyone else’s truth.

What is true one moment may not be true the next.

And this is where self-righteousness comes in.

The worst quality a trader can have is self-righteousness. Why?

Traders need to get used to being wrong, and changing their opinions on a dime. The market cares nothing about our truths or convictions.

In fact, I have seen so many traders confront me in a verbally violent way, only to see their confrontations turn into foolishness.

The Economic Modern Family is my truth. Price does not lie. They keep me from looking foolish.

The weekly charts, if you recall, showed two of the Family maintaining an inside trading week.

Transportation IYT and Retail XRT closed holding that inside week pattern.

That makes it easy.

If Monday begins with either or both breaking under 188.93 in IYT or 42.90 in XRT, that will be truth. At least until it’s not.

If they hold, considering that the rest of the Family is relatively far from breaking down (with the exception of Regional Banks KRE sitting on the 50 and 200-WMAs), then the other truth will be that this market remains robust and either sector is a low risk buy against the lows mentioned above.

Regardless, if you are tired of your own foolishness, then try not to get attached to any one truth.

I will be away from Monday through Thursday, back with you all on Valentine’s Day. Geoff will take over. Have a great weekend and week!

On July 12-13, 2020, I will be speaking/teaching at the Modern Traders Summit in Philadelphia. Only 5 speakers, which means attendees will get a lot of attention, I hope to meet many of you there-https://moderntraderssummit.com/2020-speakers/

S&P 500 (SPY) New all-time highs at 334.19. 332.90 pivotal. Support at 327.87

Russell 2000 (IWM) 165.56 pivotal as this held the 50-DMA at 164.68. If breaks there, see 163.50 next.

Dow (DIA) 294.14 the all-time high and 288 underlying support.

Nasdaq (QQQ) Made a new high and then closed lower. Must hold 228 then 224.00

KRE (Regional Banks) Confirmed caution phase-53.90 must hold support and back over 56 better.

SMH (Semiconductors) Unless this clears 147, see 141 next support.

IYT (Transportation) Confirmed caution phase. 193.70-195.33 the narrower range to watch first.

IBB (Biotechnology) 119.90 support and still one of the better looking sectors right now.

XRT (Retail) Watch that low 42.90 to hold and if can get back over 44.05 and hold, better.

Volatility Index (VXX) I would have like to see this close over 14.40-now pivotal.

Twitter: @marketminute

The author may have a position in the mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.