Staples Making Moves

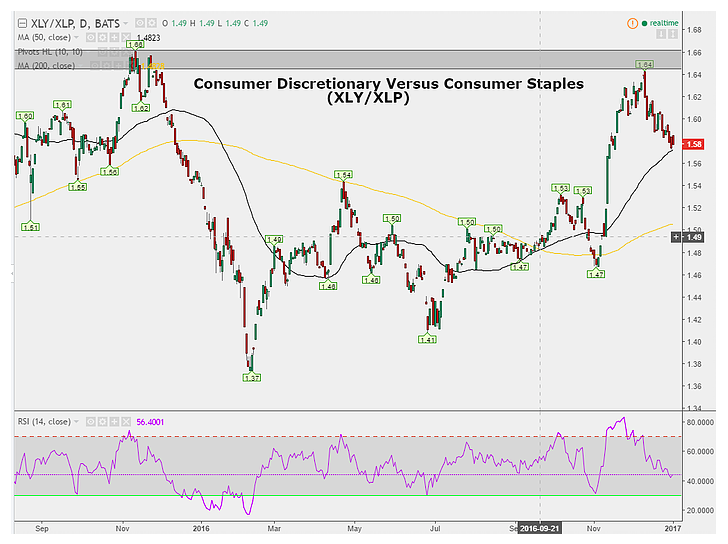

Another chart we are looking at is the discretionary versus staples relationship. Since the Trump victory, discretionary stocks took off against staples, however this took a drastic turn in mid December. This turnaround took place at the November 2015 highs, and could be an early signal for risk asset weakness in the markets.

How About Apple Though

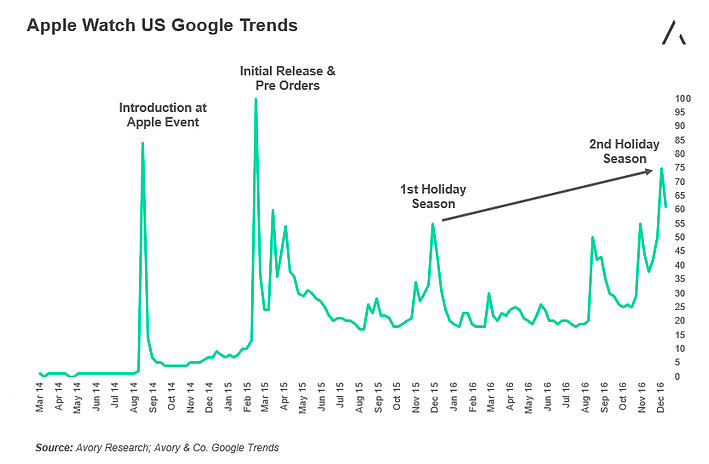

Holiday season just passed and our early indicators for the AppleWatch are strong. We have multiple internal readings, with one we want to share with you. Google trends for the AppleWatch are roughly 46% above holiday season 2015. Apple sold about 17-20 million units in its first 12 months, with about 50% coming in the December quarter. These early readings could imply 9-10 million units sold in the December 2016 quarter alone, and an annual run rate of roughly 26-30 million units for 2016. These figures combined with an average selling price of $350-400 would imply a $10-12 billion revenue stream for the company in 2016-2017. Not to mention the ecosystem effect at play. More watches means more people tied to their iPhones.

Sentiment Sending Valuations Higher

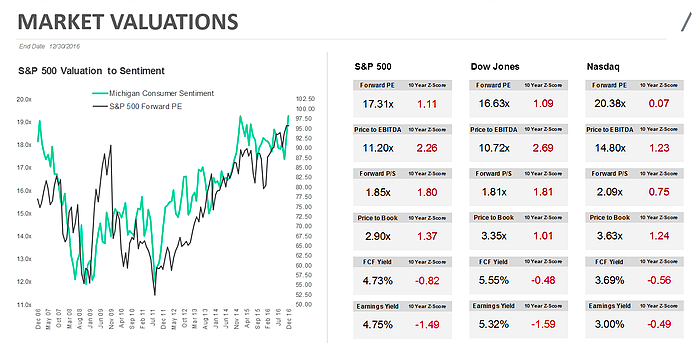

Another area I continue to look at is the Trump effect on consumer sentiment and how that is relating to market valuations. On the left you can see that there is a strong relationship between consumer sentiment and forward P/E levels. Currently sentiment moved to highs last seen in 2004. On the right you can see how valuations are all above their 10 year averages. So right now, the market is signaling that the economy and companies are going to produce. Will they, we will just have to wait and see.

Themes for 2017 and beyond

Our annual letter at Avory was considered the “Call of the Day” by MarketWatch. This was a good way for us to start 2017. Here are the themes which were referenced.

1) Software companies that are vital to a business’s daily operations. Think payroll services, insurance products, financial services solutions and website creation that involves confidential information and in-depth training to use — i.e. investment that sticks around.

2) Shift from physical to digital. The digital revolution is taking place across video games , advertising and publishing — we are focused on the first.

3) Companies moving horizontally across industries. Think Google GOOGL , which now has self-driving cars, and Facebook , moving into messaging and machine learning. Apple, and Amazon , are also players here.

4) Shift to a cashless society. With the bulk of global consumer transactions still done in cash, this theme is a long-term play, but one that’s here to stay, says Emory.

5) From the thirst for material items to experiences. Think millennials who want to spend money on travel, and niche travel and online travel agencies who are getting this. Avory says they’re looking for undervalued companies that “either offer these experiences directly or are mediums to offer experiences.”

Market Vibe:

So here is my overall market vibe on what is going on today. I continue to think the move in bonds is providing intermediate investors a decent entry point, with a clear stop level at $117 on TLT. Bonds have been positive for back to back weeks now, which may be the first step in calming the fixed income market. Equity indicators on the other hand are sending mixed signals, which vary largely in both directions. These signals are coming from the relationship between discretionary versus staple stocks, the RSI on the Vix, and strong indications from the US economic surprise index. Either way, we are mainly single security investors, and we think this environment of mixed broad market indicators is perfect for us.

Moving on to investor sentiment. Sentiment is elevated, mainly due to optimism from a new regime in the white house, along with stronger economic data. This is leading to higher valuations across the board. Even though valuations are high broadly, it is going to take industries and companies to prove their value. If you are looking at companies or themes, I left you with 5 themes in focus for us, and healthy AppleWatch (which I own) indicators. That is how I see everything right now.

Thanks for reading.

Twitter: @_SeanDavid

Read more from Sean on his blog, the Market Meter.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.