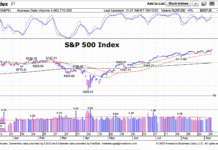

The S&P 500 closed Friday at an all-time high of 1900.53. It was the only one of the four major indexes to close at an all-time high.

The S&P 500 closed Friday at an all-time high of 1900.53. It was the only one of the four major indexes to close at an all-time high.

For those keeping score, here are the returns YTD:

Dow Jones Industrial Average +0.18%

S&P 500 +2.82%

NASDAQ Composite +0.22%

Russell 2000 -3.28%

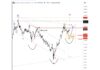

And looking at my Trending Indicators, here’s what I see:

US Stock Market Trending Down

Canadian Stk Mkt Trending Up

US Bond Market Yields Trending Down

So, what does all this mean? Is there a new rally underway? Should we be aggressively buying stocks? Great questions! In order to put the markets in context there are several issues that may assist in providing perspective:

- Volume: In a healthy market, new all-time highs are achieved on higher than normal volume. That signifies that there is more money moving into the markets and that there is an underlying conviction that the economy is growing and profits will be increasing. That’s what we saw in 2013. Now, though, we are seeing news highs established on anemic volume. For instance, Friday’s SPY all-time high was set on volume that was 23% below the 1-month average volume and 41% below the 3-month average volume.

- Short Covering: So if it wasn’t investors buying based on a growing economy, what was it? Short covering. There are almost 9,000 hedge funds that manage close to $2.7 Trillion. Many of those hedge funds are short the S&P 500 based on the CFTC net position of -114,248 contracts. Let me put that in context—that’s an increase in their net short position by almost 60% in the last week. One year ago these Hedge Funds had a LONG position of 62,224 contracts. Remember, they buy these contracts on margin so when things start going the wrong way for them they have to take action. Friday, as the markets started to move, those Hedge Funds had to buy to stop losses on their ‘shorts’.

- The Russell 2000 (representative indicator of the broad market and a growth-oriented index) was up 1.9% last week, but is still down 3.28% year-to-date and is down 7% from its March high.

The underlying fundamentals haven’t changed so there has not been any dramatic changes in the way I’ve been managing the accounts. I have been moving more money into the stock market—but in Canada, not the U.S. The Canadian TSX is up 5.56% YTD and their fundamentals appear much better than ours. I also continue to own bonds with PONDX +5.3% and OSTIX up 2.53%. And several of the US-oriented strategies continue to be in cash awaiting the signal of a new uptrend that may be coming soon. Until then, I remain defensive and focus more on preservation than growth.

Thanks for reading.

Author holds positions in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.