There’s a lot to unpack in the growing instability of the markets right now so I’m going to resort to equal parts summarizing with granularity.

Banks– All four Big Banks have reported – C, BAC, JPM, WFC – and all delivered positive earnings surprises with an average EPS growth of 21% (for the group).

Did any catch/keep a bid despite a 21% YOY EPS growth? Now I’m not going to unpack consumer biz from trading or loan growth or the like to defend bull or bear case for banks, as that’s not what I do. I am going to comment on the obvious: Banks beat big but market ignored. Bond yields bounced (following strong CPI data out Friday) but banks didn’t catch a decent or sustainable bid. I said in my trading room: “That’s a Tell”, a worrisome one. I also said I would stay away from playing banks through EPS and I’m glad I did.

Small Caps – I had a cheeky trade long IWM for a run to $158 trend-line resistance. Silly.

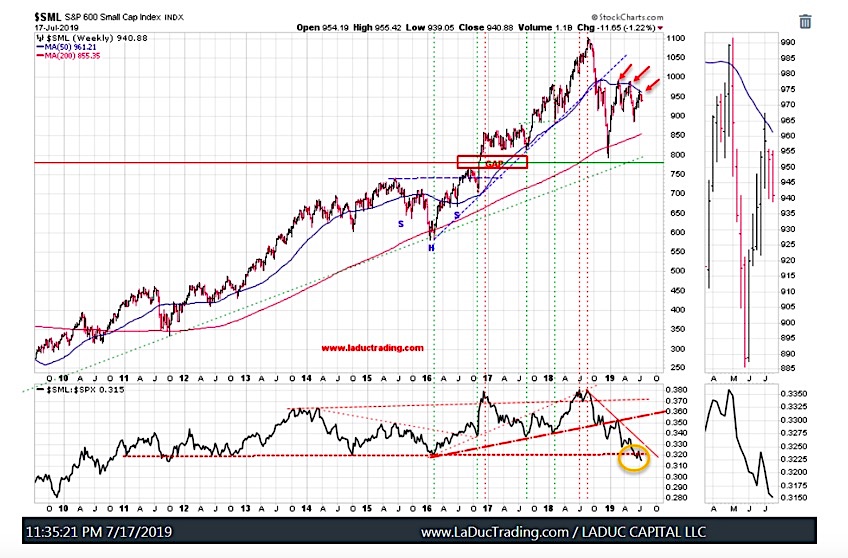

I’ve repeatedly warned about how weak small caps are relative to SPX (see chart below). I’ve talked about how the safe trade is to wait to go long when SML price action is ABOVE its 50W. I’ve talked about how my Intermarket Analysis work portends a break of support (bottom panel) that goes back to 2011. I’ve talked about a gap-fill quite a ways down that WILL be filled. I’ve written and talked about how the weakness in small caps and transports (pulling down Industrials) are at critical inflection points, representing not only this year’s weakest stocks but also a danger to the Bull’s thesis of economic and market recovery.

The WSJ notes that while the S&P 500, Dow Industrials, and Nasdaq Composite all made new highs, the small-cap Russell 2000 has been lagging badly. Since 1979, this has only happened in January and April of 1999. @sentimentrader

I’m really going to take my own advice now.

While surveying the market landscape, I am actively looking for new momentum and value trades for my Live Trading Room and some may even make it into my Live Portfolio, Brokerage-Triggered, Trade Alerts!. Check them out!

Netflix NFLX – Another silly – for not playing – as NFLX reversed 7 months of gains in one evening. Ironically, I’ve been shorting NFLX based on both fundamental and technical reasons in the recent past and expected a poor EPS just from shear quantity of competition, customer complaints of diminishing content and general growth malaise… But I didn’t play it directly much to my regret. I shorted DIS instead as I figured either way, DIS would get nicked. (ROKU would have been the better horse, however.) Anyway, for a great recap of their Earnings, check out @_SeanDavid as he does a great job. But @eddiemac3356 summed it up best:

When you’ve got a negative working capital deficit, gargantuan long-term liabilities, negative free cash flow, better capitalized oncoming competition that owns their content, and an outrageous valuation you better not miss subscriber numbers…

Volatility – At least THIS I got right. Not only did I close several profitable Chase long positions Tuesday, but I added VXX. And then I added more this morning. I have FIVE excellent shorting indicators – two I built myself, the others I interpret – and I smelled we are close. This was before NFLX. I have also half-jokingly said that “Gold and Silver are the new VIX!” Well, both moved in parabolic fashion of late and due a pause. My point: Pretty clear that bonds and precious metals/miners smell Volatility to.

The positions I left open were primarily green today: SLV, CGC, NVDA. Lucky? Nah, I was going with ‘oversold’ thesis so they go ‘down less’ when market pulls back. I spied the SLV trade last Thursday and mentioned it had yet to catch up to GLD. Oversold Pot and select Semi plays looked ready to bounce. So really, we can move higher or lower and I will trade what I see for rotation plays, but I will admit I am unconvinced this is “THE top” let along “A top”. I have ‘feelings’ but I NEED confirmation.

With that, I have not moved into Big Bear territory to start really positioning short. I have interest in MSFT short …. yes, the Godzilla of Tech… but I will put on a Sept financed put spread sprinkled with Aug puts as I do not think MSFT is ready to really roll, like NFLX just did. I am more inclined to see MSFT as a ‘buy the rumor, sell the JEDI contract”, which should be announced within the month. Wait, so we have FOMC, Debt Ceiling and MSFT/AMZN $10B cloud business announcement same time? Nature can be cruel.

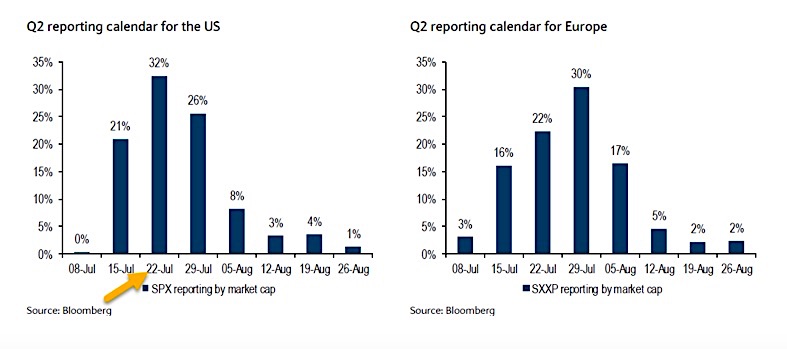

Earnings – Thus far the few that have reported have beaten on the bottom line (low bar so not hard) but failed miserably on the top. Like 70% – have failed the top line. It’s usually the other way around: 70% beat!! Just a theme I am spying with not a lot of data yet but signifies that stock picking matters. Speaking of data, we are going to get a lot of it:

Twitter: @SamanthaLaDuc @LaDucTrading

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.