Yesterday, I shared a series of charts looking at shorter-term US Treasury Yields and their reaction to the Federal Reserve statement. Most yields reacted lower, meaning bond prices went higher.

And since the stock market also went higher in response to the Fed, investors are left wondering with asset class is correct here.

I suppose both can continue higher, but when we consider that US treasuries are typically a safe haven, this bears more thought and analysis.

Enter the 20+ Year Treasury ETF ($TLT).

Investors often use the $TLT as a gauge of market fear, similar to the way that investors use the CBOE Volatility Index ($VIX) or equity put/call indicators. Likewise, they use it as an indicator for economic activity (or investors sentiment towards the economy).

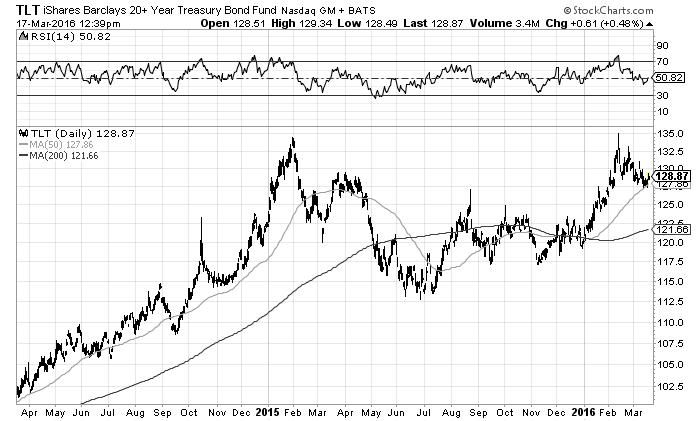

In the chart below, you can see that the popular treasury bond ETF is compressing and nearing a move. In short, there is a buildup of tension on the tape. This appears to be a bullish consolidation pattern, but one that has stretched out a bit longer than I’d like to see. It also includes a series of topping tales. Nonetheless, it comes at the 50 day moving average.

Price is compressing and this may lead to bigger move (in either direction).

This setup also coincides with a critical test of resistance on the S&P 500 Index ($SPX). Expect some turbulence as the market makes its next move.

20+ Year Treasury Bond ETF Chart ($TLT)

Zooming out a bit, we can see that the spike high on the treasury bond ETF ($TLT) in February matched that of last year. This raises the potential for a double top. If the $TLT has any shot at testing those highs/making new highs, it needs to breakout above the declining trend line in the chart above. Any move higher would likely coincide with some renewed pressure on stocks.

Thanks for reading.

Twitter: @andrewnyquist

The author does not have a position in any mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.