It’s been a volatile week for the markets. After opening the week higher, the S&P 500 reversed course and headed lower on Tuesday and Wednesday seeing a peak to trough drop of 2120 to 2067 (roughly 2.5 percent). Today was better, closing up 0.38 percent. However, the overall action has been choppy and uncertain. And all of this as we head into Friday’s Jobs Report.

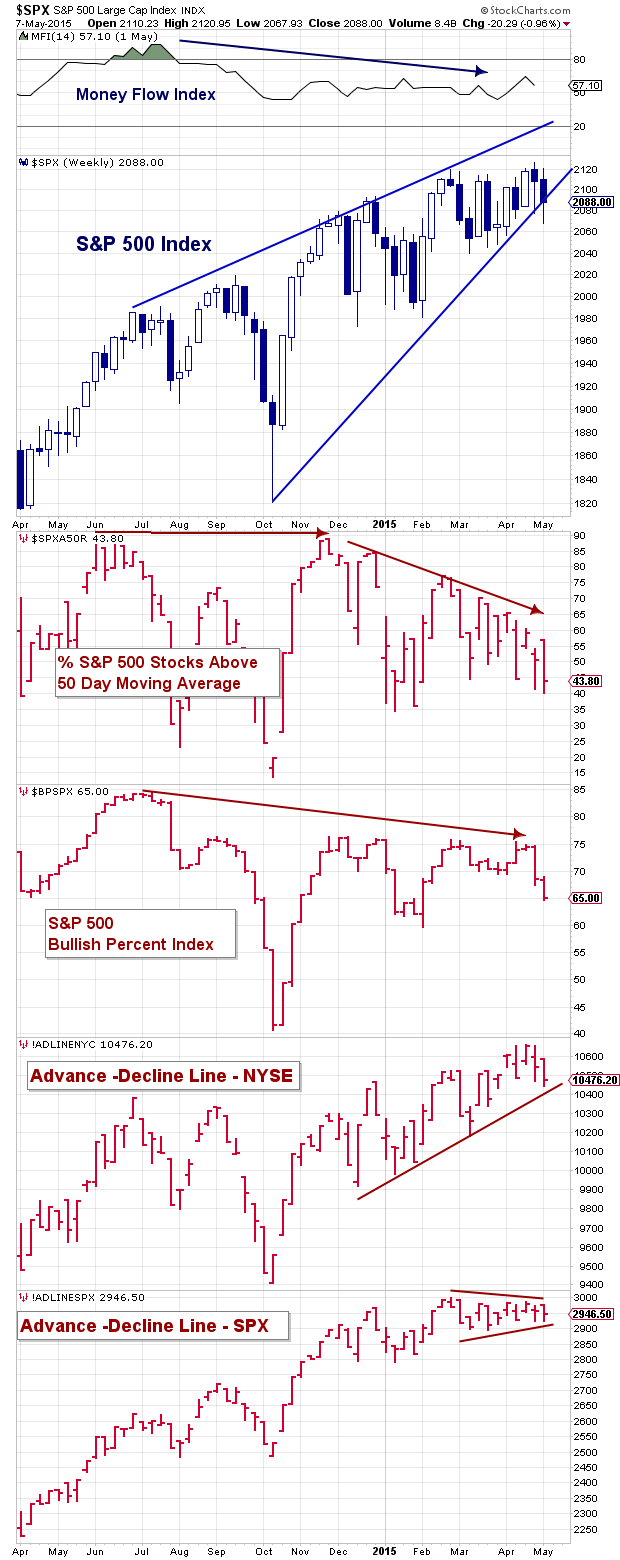

Yesterday, I posted about the deteriorating market breadth across the S&P 500 (and NYSE). It’s not extreme, but definitely a sign that the market is in flux. And you can tell by the price action. Yesterday, as the market pressed lower, so did the US Dollar, the 20+ Year Treasury Bond ETF (TLT), and Silver (SLV). Talk about some odd action. Below is an updated look at market breadth:

And this action implies that traders are uncertain about Friday’s Jobs Report. And for good cause – the Federal Reserve has been talking out of both sides of its mouth regarding economic growth and rates for much of 2015. But more recently, they have been talking down expectations for a rate cut (and the economy).

But at the same time, investors aren’t sure what the narrative is. Silver is down implying deflation concerns, while bond yields trade higher and the Dollar lower?

So, how do investors attack the report. If the number is bad, will the market rally on the possibility of prolonged low rates? Or if it’s really good, will it sell off on expectations for a rate increase. Then, of course, some are hoping for Goldilocks.

The point is that certainty (or the thought of it) helps.

But it is what it is right now. And I expect some sort of volatile move(s). Last month’s Jobs number (for March) showed weakness, adding 126,000 jobs to payrolls. But the market didn’t care as it reduced the odds for a rate hike. Friday’s Jobs Report comes with expectations for roughly 225,000 jobs to be added to payrolls.

The bulls and bears are now laying out their cases at a fever pitch levels. This noise often means that it may take some time to sort out the markets intentions. That’s okay with me, as I often like to play small ball until the dust settles.

Time does a great job of sorting these things out. And sometimes investors have to remain patient. Thanks for reading.

Twitter: @andrewnyquist

The author has exposure to both long and short S&P 500 related securities at the time of publication. Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.