by Raj Dhaliwal The word “leverage”, more now than even before the 2007 -2008 financial crisis, has a worse reputation than practically anything I hear in the financial media or social finance spaces. Perhaps it’s because investment leverage is blamed for the financial crisis and constantly vilified across our financial media. No word or phrase evokes more hate than when you start talking about the use of investment leverage. From the lay person on the street to the investors on the front lines “leverage” has become an evil word.

by Raj Dhaliwal The word “leverage”, more now than even before the 2007 -2008 financial crisis, has a worse reputation than practically anything I hear in the financial media or social finance spaces. Perhaps it’s because investment leverage is blamed for the financial crisis and constantly vilified across our financial media. No word or phrase evokes more hate than when you start talking about the use of investment leverage. From the lay person on the street to the investors on the front lines “leverage” has become an evil word.

However, like many things in life, it’s not always as it seems. Before you stop reading here and say Raj has fallen off his rocker, please let me take you through a case where investment leverage is not only beneficial but less risky than your traditional investor and institutional portfolio (when used with discipline).

In the markets there are two ways you can make a positive return: 1) by taking a risk you get paid for (“beta”), or 2) by being smarter than another investor (“alpha”). And further, the simple way to boost your returns is to increase the amount of riskier assets in your portfolio, while the more complex but, in my opinion, better way is to use leverage.

In short, buying the riskiest assets of an asset class almost always gives worse long-term gains than if you were to lever up lower volatility assets in that same class. I believe investors across asset classes can reduce their portfolio volatility and improve their risk-adjusted returns by using moderate investment leverage. The key word here is moderate. Levering your portfolio up 3-5X will, over a long enough duration, practically always lead to disaster. However, utilizing leverage moderately can greatly improve your long term returns. Let’s take a deeper dive into why.

Many retail investors have portfolios that are poorly diversified and often consist of only a few stocks. Surprisingly, institutional portfolios are also poorly diversified, but for another reason. Institutional portfolios using a typical 60/40 stock/bond allocation end up having a large amount of their portfolio volatility coming from the equity portion of their portfolio. Typically the 60/40 portfolio has 95% of the portfolio volatility coming from the equity portion. This level of concentrated risk is not optimal in terms of risk adjusted returns. When using the Sharpe ratio* (SR) which tells us whether a portfolio’s returns are due to smart investment decisions or a result of excess risk, investment leverage can be used to improve the SR of these portfolios. This is done by levering up the bond portion to an equal volatility level similar to that of the equity portion. This approach was coined “risk parity” investing by Bridgewater Associates.

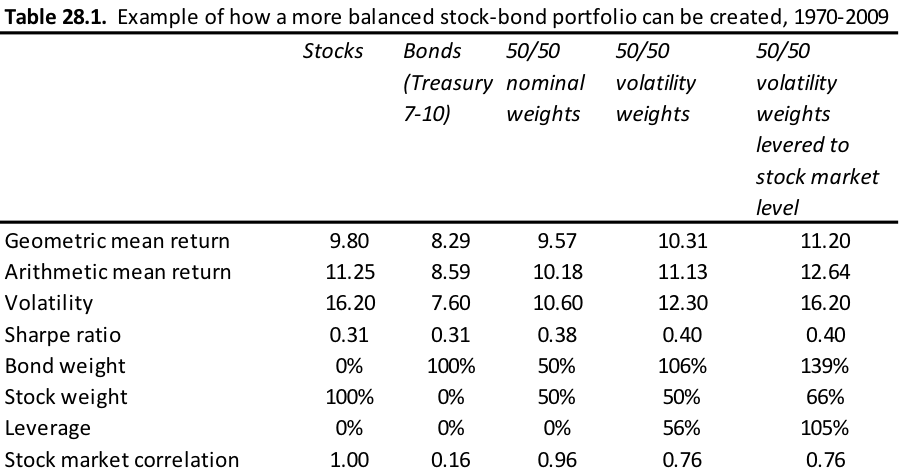

The table below taken from the risk section of “Expected Returns” by Antti Ilmanen drives home this point. Table 28.1 shows that a 50/50 volatility weighted portfolio had a slightly higher SR and a much lower correlation to the market than the equal nominal 50/50 weighted portfolio. Adding further leverage (last column in table) investors can get a higher return for equity-like volatility.

Sources: Bloomberg, Citigroup, calculations by Antti Ilmanen

Moderate use of leverage thus can be used to increase risk-adjusted returns by shifting into a lower volatility asset and changing the higher portfolio Sharpe ratio into a higher portfolio return. The use of leverage is one reason hedge funds can outperform long-only investors. Their willingness and capacity to lever up many standalone positions opportunistically has been a factor in their outsized returns.

Is the use of investment leverage for everyone?

No. Investors who are not seeking or mandated for high raw returns do not need the use of leverage. Broadly diversified leveraged portfolios can experience sharper losses in times of correlation spikes than a simple concentrated equity portfolio. In general, the use of leverage to capitalize on the diversification gains via leverage will fail in bad times. With that said, as with most things in life, nothing is black or white. Often it’s the grey area where we find the optimal solution. So goes it with the use of investment leverage. Used in the right context, it can lower volatility and risk compared to the average retail and institutional portfolio.

*The Sharpe ratio is calculated by subtracting the risk-free rate – such as that of the 10-year U.S. Treasury bond – from the rate of return for a portfolio and dividing the result by the standard deviation of the portfolio returns.

About Raj Dhaliwal: Raj is a scientist who moonlights in finance. He has been actively investing for several years and works as a Long/Short PM for a small family office. You can follow Raj on Twitter and StockTwits at @RSDtrading.

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.