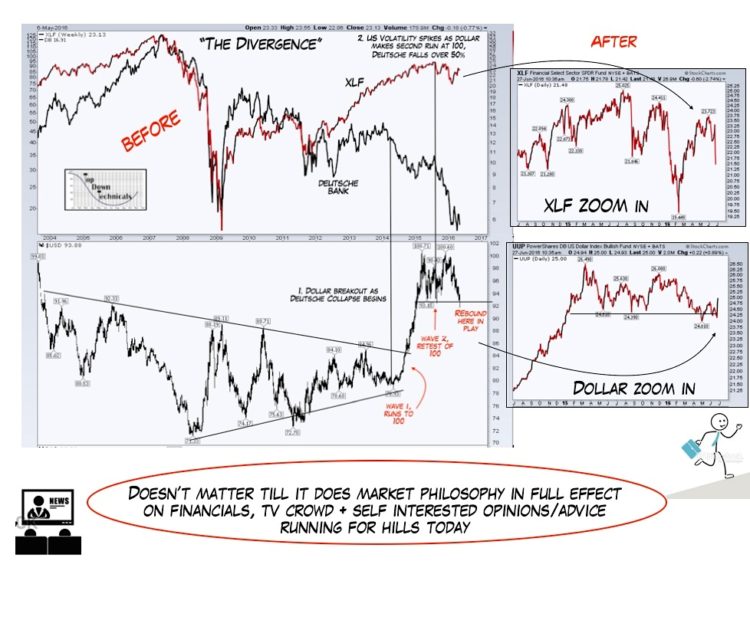

In May, Arun Chopra, CFA, CMT and I noted the following market divergence between U.S. bank stocks (XLF) and Deutsche Bank (DB).

We were concerned that U.S. bank stocks may get pulled down by fellow European banks such as Deutsche Bank.

Here’s the chart from May:

In May, we asked “It doesn’t matter until it does”?

Consider the following points:

- Deutsche Bank (DB) began a precipitous decline as the U.S. dollar broke out towards 100 in 2014.

- U.S. bank stocks (financials) peaked and rolled as the U.S. dollar made its second run at 100 in 2015.

- Deutsche Bank total assets ~ Wells Fargo’s and DB leverage back to crisis levels.

Below is another chart looking at the before/after (including the U.S. Dollar). Note that U.S. bank stocks are now “catching down” to their European banking brethren as dollar strengthens and interest rates plunge.

Thanks for reading.

Further Reading: 3 Reasons The Tesla-SolarCity Deal Looks Fugly

Twitter: @JBL73

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.

![Key Insights On Consumer Strength, Tariffs, and the AI Revolution [Investor Calendar]](https://www.seeitmarket.com/wp-content/uploads/2025/03/consumer-weakness-218x150.png)

![Key Insights On Consumer Strength, Tariffs, and the AI Revolution [Investor Calendar]](https://www.seeitmarket.com/wp-content/uploads/2025/03/consumer-weakness-100x70.png)