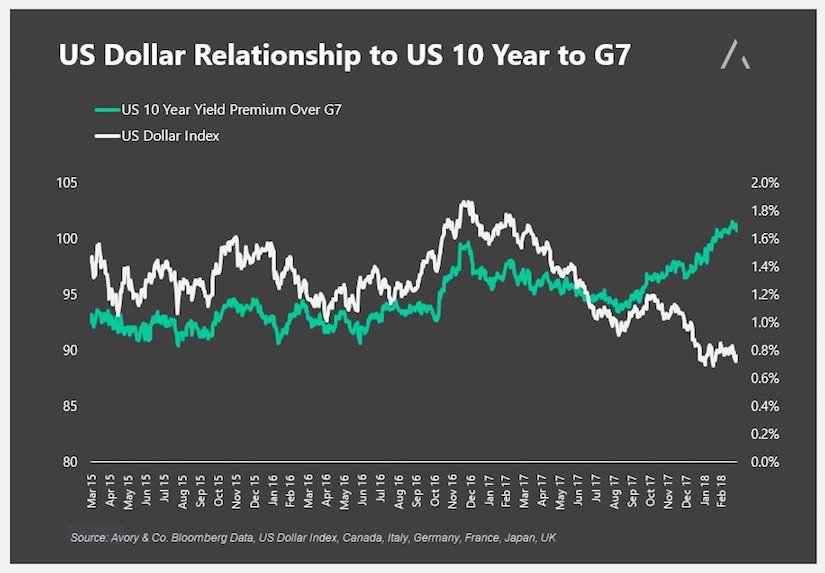

US yield gap continues to widen versus countries like Japan, Germany, and the rest of the G-7.

Over the last several years both the yield premium over G-7 and the US dollar have moved together.

Recently, the pair has diverged with the dollar declining and the pair widening. Assuming we don’t get runaway inflation, which may be a driver of the divergence, the relationship should somewhat normalize overtime.

If inflation begins to take hold, then this divergence will likely linger… if not, then look for a catch up or catch down scenario (mean reversion).

As it stands today, the US 10 year yield offers the highest yield of the group.

U.S. 10 Year yield Premium (to G7) vs U.S. Dollar Index

Twitter: @_SeanDavid

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.