From a markets’ perspective, in normal times, good news is good and bad news is bad. Who doesn’t like getting some surprisingly good news? A positive surprise on the health of the economy, implying prospects for improving corporate earnings growth, is welcomed and has a positive influence on stock prices. Disappointing data is the opposite. But sometimes, the markets appear to enter a phase that literally sees the opposite relationship. Bad news can elicit a positive market response and good news weakness. This may very well be the situation today as a confluence of factors has created this kind of upside-down market:

Prices are down: The speed and magnitude of the market declines this year have created ‘oversold’ technical conditions. Given how much negative news the markets have absorbed so far this year, even bad news that is just ‘less bad’ would likely contribute to a relief rally.

Inflation: High inflation has remained one of the biggest concerns and continues to embolden central banks to tighten monetary policy faster in response. This also lifts yields higher. Higher yields means higher discount rates, meaning valuations have to come down for equities and bonds. Hence, prices are down.

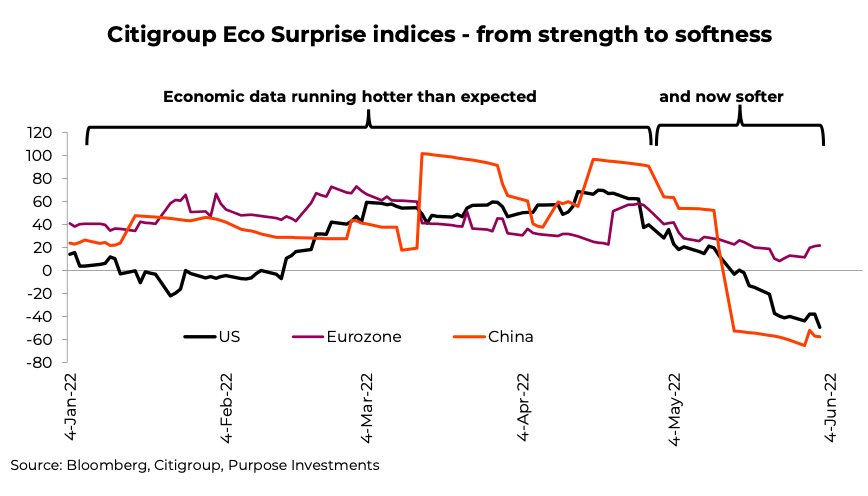

Softening economic data: Normally, softer economic data would raise concerns for slowing corporate earnings growth, which leads to lower equity prices. But today, softening economic data also implies less inflationary pressures, which means central banks may not be as aggressive in their tightening of financial conditions. That means the rising discount rate may not rise as far and that equals a move up in markets, especially since they are starting from oversold territory.

This may create a bit of a sweet spot for the markets. Softer data, leading to less inflationary pressures, may slow or cap the rise in yields and soften expectations for the path of central bank rate hikes. This is clearly the glass half full perspective. The negative implications of slowing economic growth more than offset the positive implications of the resultant slowing inflationary pressures.

So if bad economic news is now good for the market, what if the economic data were to improve? Well, we certainly can’t have it both ways. If we were to experience a sudden run of improving economic data, yields would likely rise faster and that would not be welcome for equity markets. Plus, that would not help alleviate any of the inflation pressures. While this is possible, the current trend in the data is to weakening.

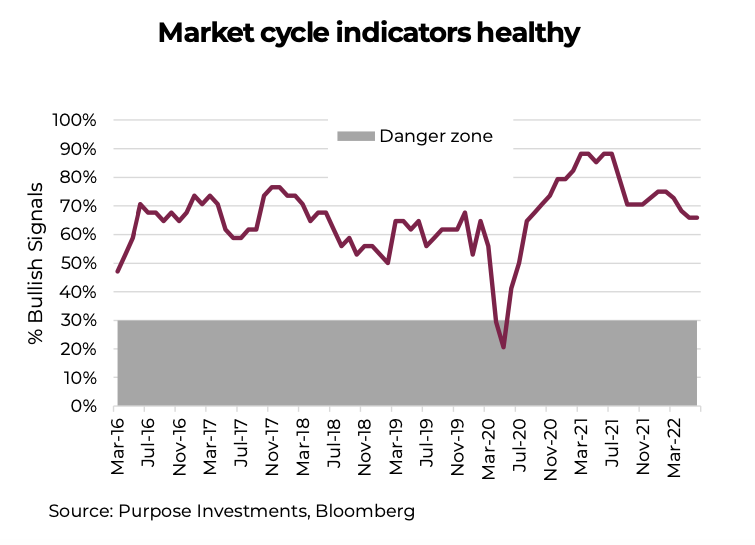

This trend has been evident in our Market Cycle framework which has seen a steady decline in bullish signals. Still well above the danger zone which warns of a high likelihood of recession of end of a market cycle.

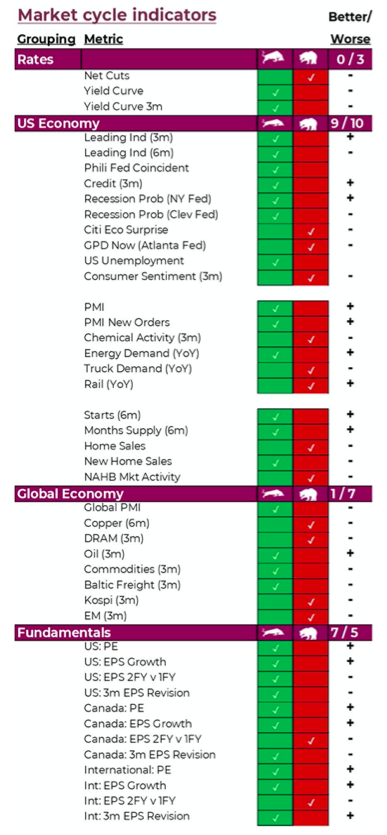

Among The Indicators:

Interest Rates – clearly central bank rate hikes are a negative, and this one should carry a larger weight. Yield curve remains positively sloped but has been flattening.

US Economy – Leading indicators, recession probabilities and employment remains supportive. As does manufacturing, which is still playing a degree of catch up given past supply and fulfillment issues. Housing is starting to wobble a bit, likely due to higher mortgage rates.

Global Economy – The story does grow a bit more worrisome outside North America. While the signals are evenly mixed, there has been a deterioration across almost all the signals during the past month [the ‘Better / Worse’ column is whether the indicator got better or worse during the past month].

Fundamentals – These are encouraging given valuations have fallen and margins remain healthy despite rising cost inputs. However, the longer forecasts are starting to show slowing earnings growth.

You can have too much of a good thing.

Slowing economic momentum may be a positive today, but just like most things in life, too much can quickly become a negative.

So far much of the weakening economic data has been in the ‘soft categories’. Soft economic data is typically populated with surveys, anecdotal indicators, less direct measurements of the actual economy. For instance consumer confidence is a survey where people are asked about their spending patterns and intentions. It can be a good indicator but it does not necessarily reflect what people are actually doing. It has been in the dumps for a couple years now, yet the consumer has been spending away. Sometimes people say one thing and do another.

Hard economic data is actual measurements of economic activity, such as GDP, employment, industrial activity. Perhaps more reliable but it does suffer from a longer lag times in reporting and is often revised after being reported. Yes, economics is a bit more of art than a science. An art with a good dose of math.

If the weaker data continues and spreads to the harder data, the noise around recession will start to grow louder. This may build as the year progresses and potentially become a bigger issue than inflation fears later this year. Plus, we believe margin pressure and slowing earning growth may become an issue later this year. For now, we are in opposite land. This softening economic data trend should start to alleviate some of the inflation and rate-hiking fears in the market, opening the door for a potential summer rebound in risk assets.

Source: Charts are sourced to Bloomberg L.P., Purpose Investments Inc., and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.