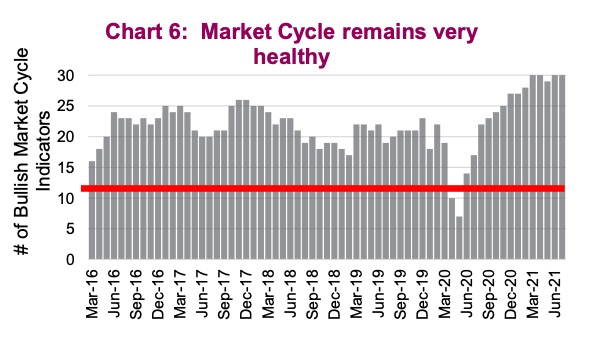

With the global economy on the up-trend, it is not surprising that market cycle indicators remain healthy and elevated.

Leading indicators are rising at a healthy pace, with transports from rail to trucking seeing solid increases. We are also seeing strength in manufacturing data from the Purchasers Managers Index (PMI) and chemical activities are at or near record highs for increases.

Global market cycle indicators from oil to copper are appreciating and ocean shipping rates are up. Global PMI data is also strong, and Korea (its equity market is very sensitive to global trade) and emerging markets are on the rise.

Stock market valuations remain elevated (i.e. they are high), however. Global equities, including all developed markets, are trading at about 19x forward earnings. Geographically, valuations are highest in the U.S. (22.4) while lower in Europe (16.3) and Canada (15.9). Note that relatively lower valuations does not equal cheap.

On a positive note, earnings growth for global equities is forecast at about 10% in each of the next couple years. That certainly helps somewhat with the elevated valuations and if the economic growth does come in above forecasts, earnings may follow suit. Still, not cheap out there.

The only other blemish among the market cycle indicators is the yield curve. While still positively sloped (a good sign) it flattened significantly during the past month. Three-month T-bill yields picked up a bit, mainly due to some central bank engineering with the repo market (a much longer story), while the bigger mover was drop in the 10-year yield. A drop of 1.62% to 1.45% over the past few months isn’t a huge move but it is a little surprising given the pace of the economic recovery and elevated inflation data. I believe this is a consolidation phase following a rise in yields from last summer, with the next move being to the upside.

As we move into the 2nd half of 2021, we remain roughly equal weight in equities with holding a bit of extra cash (dry powder) at the expense of bonds. While the economy is on a clear healthy path, we believe a move up in treasury yields will trigger a consolidation or period of weakness. This should be viewed as a buying opportunity, hence the elevated cash level.

We continue to be overweight international equities. Valuations are more attractive (albeit not cheap). More importantly, the leverage to improving global growth is better outside the U.S. market. Within U.S equities, we remain tilted to a more value bent along with dividends.

Fixed income is underweight with lower duration. Credit spreads are very narrow but given the economic backdrop we continue to remain comfortable with credit exposure.

Overall, we remain constructive on markets looking out a few quarters with a current elevated correction risk.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.