The economic data is certainly starting to normalize, which was largely expected and will continue.

From an economic perspective the last 24 months have seen many unprecedented impacts, initially largely negative and more recently largely positive. And while the economy is dynamic and adjusts, reverberations will continue for years given the size of these shocks.

The good news is that we are currently in the sweet spot. Aggregate demand has been rising for the past year as economies re-open. Also contributing has been changing consumption behaviors, more housing demand, durable goods, technology and fewer services. The former has a more dramatic impact on economic data and equity markets. Mr. Economy would prefer you buy a laptop instead of spending money enjoying a few pints on a patio.

The changes in consumption and quick resumption of demand has put a lot of strain on the supply chains while lingering impacts of the pandemic had already slowed capacity responses. These factors are largely driving the inflationary impulse we are currently experiencing.

But investing is more about what happens next. The supply/demand imbalances are already starting to resolve. Behavioral consumption patterns are starting to gradually get back to normal. The bond and commodity markets have priced in this normalization, though perhaps not as much in the equity markets.

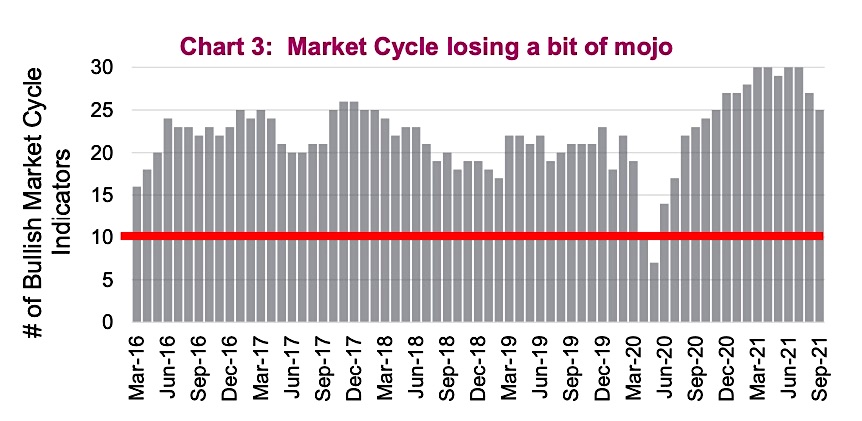

This slowing may trigger the long-awaited period of market weakness. The good news is even if this transpires in the coming months, the market cycle remains very healthy. While we have seen some normalizing in our bullish signals, the framework continues to favor risk assets.

This would have us more overweight equities were it not for valuations and such a high degree of optimism priced into the market. As a result, we are slightly overweight, with a greater focus on international markets. Within equities we continue to favor more of a value tilt and less exposure to the mega-caps.

The biggest change from last month is in our currency view. While we have a positive view on the Canadian dollar relative to the U.S. dollar longer term, we are now neutral shorter term. Essentially, 78-82 cents is our rough fair value that makes us indifferent towards hedging or changing currency exposures. Outside this range, our view likely changes.

We continue to favor a higher cash balance allowing us to be opportunistic when the next period of market weakness materializes.

Source: Charts are sourced to Bloomberg L.P. and Richardson Wealth unless otherwise noted.

Twitter: @ConnectedWealth

Any opinions expressed herein are solely those of the authors, and do not in any way represent the views or opinions of any other person or entity.